Market Data

July 10, 2016

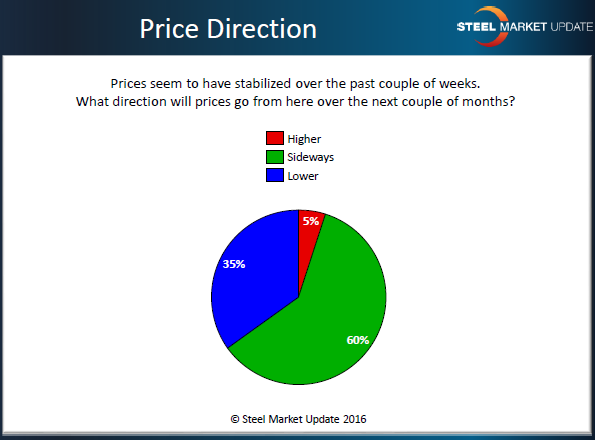

SMU Survey Results: Flat Rolled Steel Price Direction

Written by John Packard

Buyers and sellers of flat rolled steel are not believers that the next move will be for higher flat rolled steel prices over the next couple of months. At least that is what the respondents to our most recent flat rolled steel questionnaire believe.

Based on the analysis of last week’s survey, 60 percent of those responding believe prices would go sideways from here. Another 35 percent thought prices would move lower while 5 percent were of the opinion that prices would go higher.

We did have a number of comments left from those responding to this question:

“If they continue to move up the drop could be greater. They should let the market catch up and pause for a month.” Trading company

“HR will lower. CR and Coated will stay sideways.” Service center

“Dramatic change over the last 6-8 weeks with allocations in the rear view mirror. No question in my mind that we will see some price erosion the only issue is how much.” Service center

“Prices should move down in the 4th qtr.” Manufacturing company

“They are already wanting to deal to lock down 4th Qtr orders. I don’t believe it will come down a lot though.” Service center

“Imports will put a cap on pricing… The Domestics have until September/October to hold pricing.” Service center

“Sideways through the summer and perhaps, maybe a little correction of too much too fast.” Service center