Prices

June 30, 2016

Hot Rolled Futures: Brexit the Latest Excuse

Written by Jack Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall and Jack Marshall of Crunch Risk LLC. Here is how they saw trading over the past week:

Financial Markets

Brexit serves in some people’s minds as the beginning of the end, the unraveling of the European Monetary Union and the beginning of further turmoil and the deterioration of the globe’s economic livelihood. I find Brexit simply the latest in a long line of justifications for a gloomy forecast mentality about the globe’s economic future, a mentality that has gripped the media and thus the mind of most of its readers the world over. In the end, Brexit probably won’t be a smart move for the U.K., or is it England now, or is it Britain now? Not sure they even know now yet.

And in the end, Britain’s exit probably won’t matter much long term to the rest of the Union assuming there are no further defections. Britain and the Union most certainly will continue to trade with each other, they have no choice, too inter-dependent. Britain had never adopted the Euro so it will be an easier official separation, if there ever is one. Even on an exit, Britain itself will likely remain the financial center and real estate center of the world, for some very obvious reasons. It’s London, just like New York is New York. You might recall they doomed NYC to the waste bin of has-been financial centers when the ’09 crisis hit. Wall Street is still there and plenty strong. For the financial markets, Brexit was the excuse the longs needed to finally sell the market, and they did so with aplomb, in a wide range of red ink, 2.5% down for some equities to 20% down for the Sterling, which hit lows not seen since 1985. It was a great opportunity to buy if you had the foresight and stomach to do so.

Despite all the World ending panic, the financial markets have pretty much written this Brexit chapter off already, maybe as not that important?, or maybe as not-in-the-end-gonna-happen?! The markets have since recovered almost all of their losses from this event. The S+P Sep future is last 2087 when the level was 2096 just before Brexit. We have rallied from the lows of 1982 on Monday, or 5.13%. On a chart basis, this a complete rejection of the downward correction and the market will now want to go test the highs at 2134, and likely set new highs.

In industrial commodities, they have been less affected by this Brexit turmoil. Copper has been in recovery mode since June 6th having climbed from $2.035/lb on the Sep. future to approx. $2.20/lb. today, and Crude continues its upward correction trend started in late January with the Aug. future last $48.40/bbl. up from the $33.90/bbl . low in January. We have been higher since in Crude, i.e. $51.84/bbl. high on June 8th, but it’s fairly normal to have market fluctuations in a trend, and the support line has remained intact. In fact, the Monday Brexit fallout pushed Crude right to its support trend line at $46.33/bbl. where it held. On a chart basis, all indicators are that Crude will want to push higher as technically it looks strong.

To the U.S. steel community, I would put forth this. This nearby period, the 3rd Quarter anyway, could be your Brexit! Lots of reasons to sell (hold off buying) and be a doubter (lead times changes, imports, BRZ, scrap), but emotional headlines, as we see, aren’t realities. Realities are imports aren’t gonna hit in Q3, as no one pulled the lever back when, and Granite isn’t coming back up that we can tell, and neither is Ashland likely, and there is no sign of BRS running anytime soon as we don’t see them in the scrap market yet, and MSCI inventories are low, and lead times are still 4-6 weeks on HR and 6-8 weeks on finished, and obsolete scrap has been dropping, but prime hasn’t, and obsolete is now again in the too low to collect territory again. Hmm!

Hot Rolled Coil (HRC)

Spot HR continues to hover around the $630/ST. With HR spot reported flat and the June HR future settling at $631. We have seen some buying interests return to the market which was particularly quiet to start the week.

Exchange reported HR volume of 6,950 ST. Activity has been focused primarily on the 2H’16, especially the nearby months. The steep discount between Spot and Q3’16 has come in from $48 to $35 based on this week’s trades. Yesterday we saw Jul’16 trade at $618/ST which was $18 above the previous day’s settlement and Aug’16 trade at $595/ST which was $15 above the previous day’s settlement. On the other hand Q4’16 traded today at $543/ST which was a few dollars below last trade at $545 and last settlement. The discount to spot for Q4’16 remains above $85 which is significant.

In addition Q1’17 traded at $521/ST which is pretty much in line with recent settlements and Cal’17 is offered at $525/ST.

HR futures open interest rose slightly, from 21,990 contracts to 22,060 contracts or 441,200 ST.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Scrap

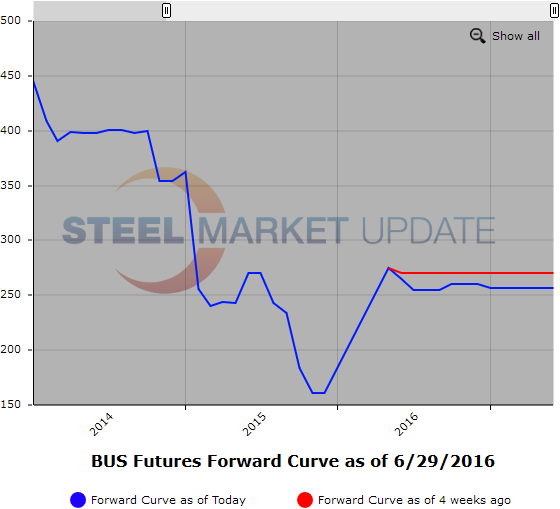

Not much has changed from last week as early market talk suggests obsolete grades will probably be off $10 maybe $15/GT. While market chatter for busheling scrap (BUS) is sideways. BUS futures conitinue to be offered at a modest discount to spot. In BUS futures curve we are seeing 2H’16 BUS $253 bid per GT. Q4’16 BUS $250 bid/$260 offered. 1H’17 BUS $250 bid.

LME Steel Scrap sees slightly lower levels again this week. Wednesday TSI reported benchmark for CFR at $217/MT. Market chatter is that a number of vessels have been sold around $220 so it seems the export flow is starting up again after a lull. Q3’16 CFR remains just north of $200/MT.

Another graphic is below, but of the BUS Futures Forward Curve.