Government/Policy

June 26, 2016

ITC Finds Injury in Corrosion-Resistant Steel Trade Case

Written by Sandy Williams

The U.S. International Trade Commission announced Friday that it made an affirmative decision on injury to U.S. steel producers by imports of corrosion resistant steel products from China, India, Italy, Korea, and Taiwan. The USITC determined by unanimous vote that the U.S. steel industry was materially injured by the import of corrosion-resistant steel products (galvanized, Galvalume, aluminized, etc.) sold at less than fair value and subsidized by the five countries.

The decision follows an earlier one late last week in which all six commissioners found injury in the case of imports of cold-rolled flat products from China and Japan.

As a result of the US ITC’s affirmative determinations, Commerce will issue a countervailing duty order on imports of these products from China, India, Italy, and Korea and antidumping duty orders on imports of these products from China, India, Italy, Korea, and Taiwan.

In addition, the Commission made negative findings with respect to critical circumstances in regard to imports of these products from China, Italy, Korea, and Taiwan. As a result, goods will not be subject to retroactive countervailing duties and antidumping duties that would have been based on the dates of the Department of Commerce’s affirmative preliminary determinations. The ITC also did not find critical circumstances in the cold-rolled flat steel decision announced earlier last week.

The products covered by these investigations are certain flat‐rolled steel products, either clad, plated, or coated with corrosion‐resistant metals such as zinc, aluminum, or zinc‐, aluminum‐, nickel‐ or iron‐based alloys, whether or not corrugated or painted, varnished, laminated, or coated with plastics or other non‐metallic substances in addition to the metallic coating. The products covered include coils that have a width of 12.7 mm or greater, regardless of form of coil (e.g., in successively superimposed layers, spirally oscillating, etc.) and products not in coils (e.g., in straight lengths).

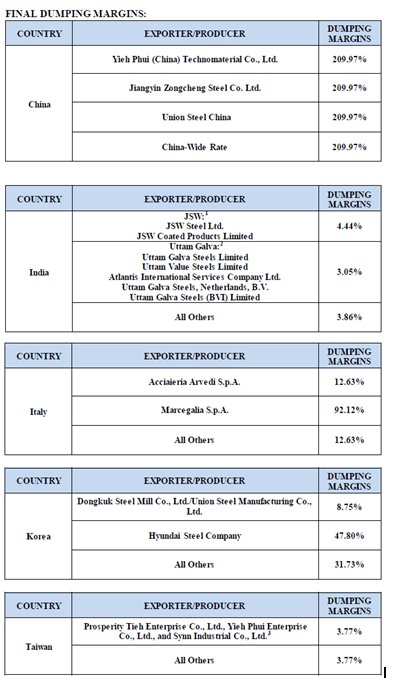

The subsidy and dumping margins determined by the Department of Commerce in their final decision on May 25, 2016 were: