Prices

June 16, 2016

Hot Rolled Futures: Backwardation Means Opportunity

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

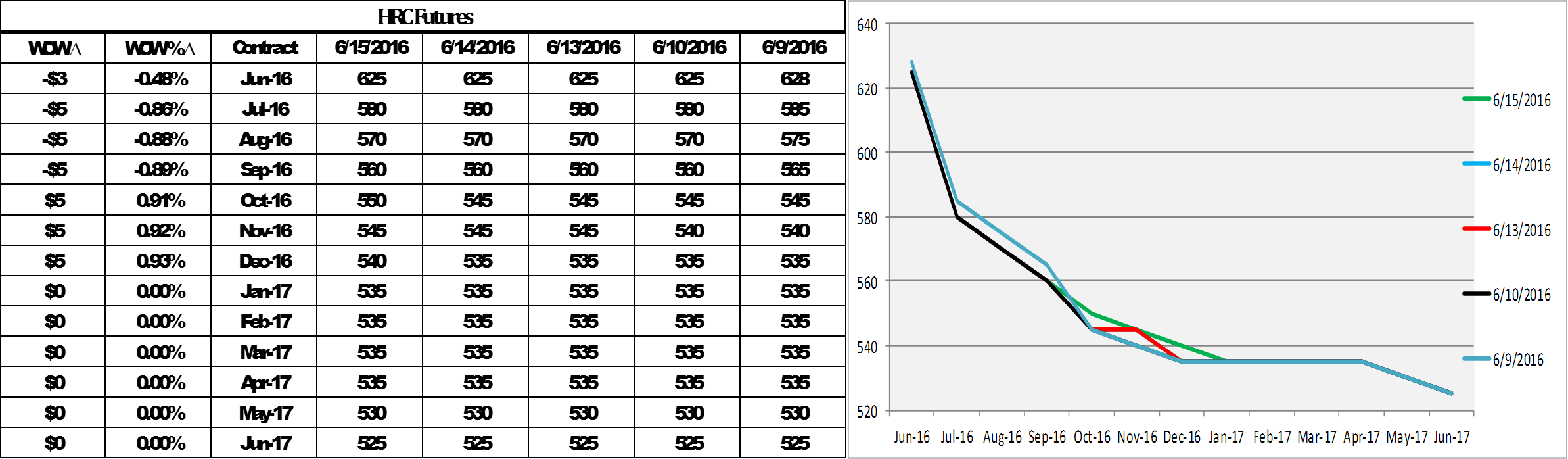

The curve didn’t move much week over week. Q3 moved down $5 and Q4 moved up $5. The curve is still steeply backwardated and the opportunity du jour is to lock in your tons for Q4 now at $80 below the June futures price.

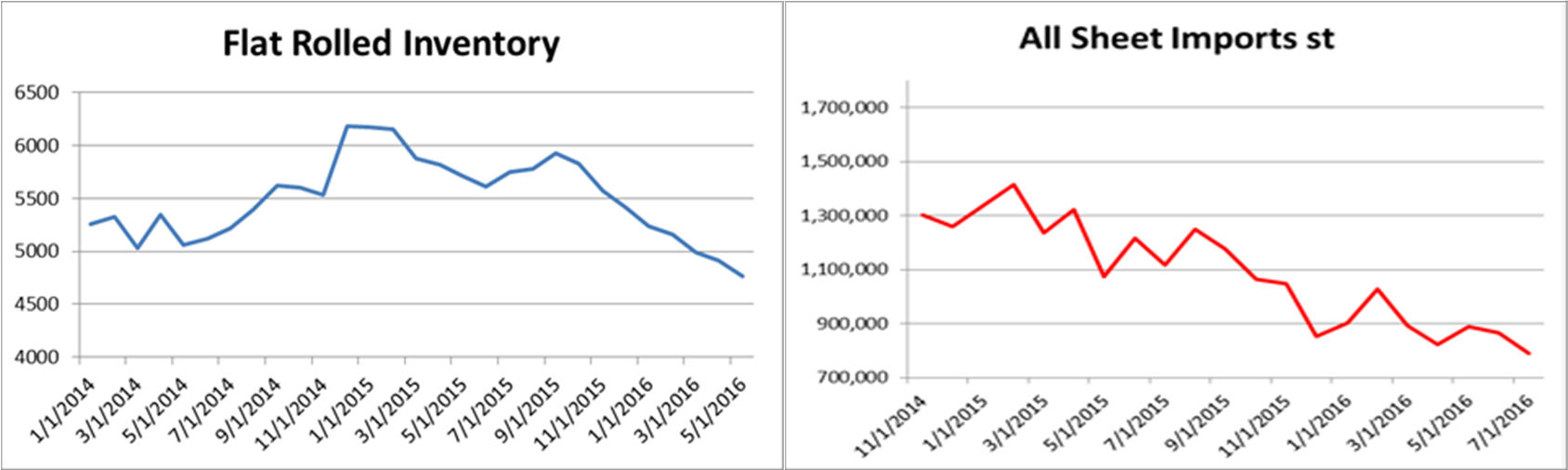

With last year’s mill closures, falling service center inventory levels and plummeting imports (with no solution to banned countries); the fundamentals do not favor a collapse in prices. What to watch out for? Does the dollar rip higher?

Anything can happen, but that’s why they play the game as they say. Now may be a good time to transfer some Q4 and Q1 2017 risk while the getting is good.

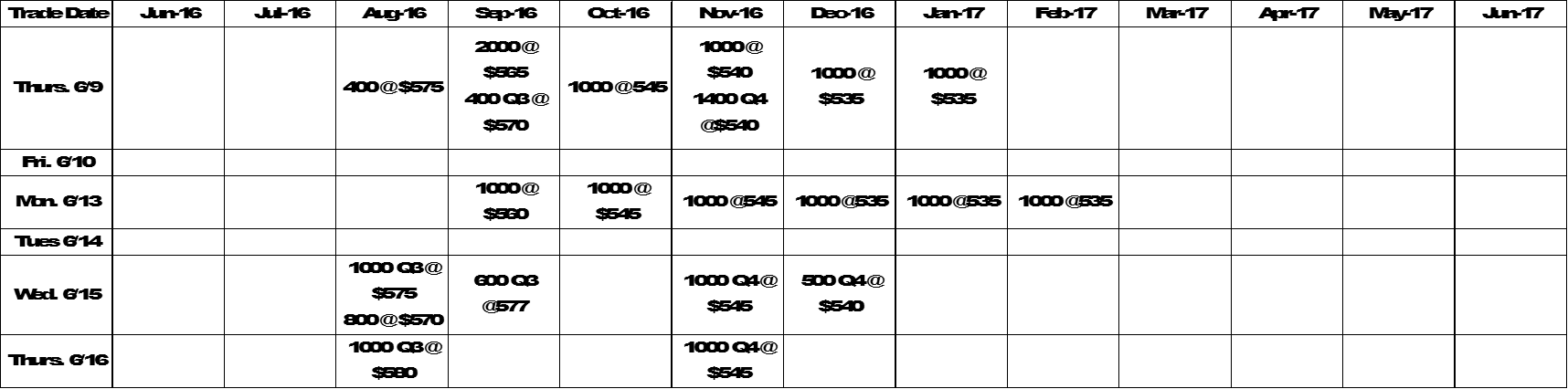

33,200 short tons traded last week with current open interest at 422,100 short tons. Last week’s trades are shown below.