Market Data

June 1, 2016

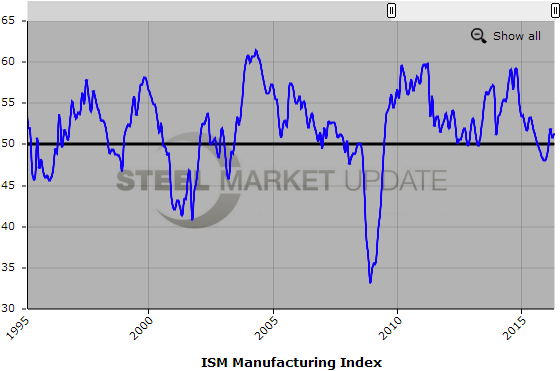

ISM Manufacturing PMI Gains 0.5 Points in May

Written by Sandy Williams

Manufacturing grew for the third straight month according to supply executives surveyed in the ISM Manufacturing Report on Business.

The May PMI was 51.3, up 0.5 percent from April. Although the PMI didn’t have a large gain, the three month upward trend is good news since the PMI was in contraction (below 50) from October through February. Overall, says ISM, the economy has seen growth for 84 consecutive months.

The new orders index read 55.7 percent, down 0.1 percentage point from April. Production at 52.6 percent, slipped 1.6 points from April to May.

No gains were seen in the employment index which remained unchanged at 49.2 percent. The inventory index for raw materials showed a slight reduction of 0.5 points for a reading of 45 percent while customer inventories were at 50.0 indicating no change. The prices paid index increased by 4.5 points indicating higher raw material prices for the third month.

The indexes for new export orders and imports were unchanged at 52.2 and 50.0, respectively.

Bradley Holcomb, chair of the Institute for Supply Management, told Modern Materials Handling in an interview that the May report is encouraging.

“There is a lot to like about this, and it starts with new orders,” said Holcomb. “While they are down slightly from April, they are still essentially even over all. Production is also following suit, according to assets and inventory on hand, along with backlog of orders (down 3.5 percent to 47.0) but not viewed as a concern.”

The index for supplier deliveries slowed at a faster rate in May, gaining 5 points to register 54.1 (a reading above 50 indicates slower deliveries)

“What this means is that the supply chain is tightening,” said Holcomb. “This is reflected in May inventories at 45 (down 0.5 percent from April). That combination indicates that things are tightening up and is a good thing. As for the low inventories, credit goes to inventory supply managers for keeping inventories in check to this point, but I think those days are numbered, where it needs to starts to grow, assuming new orders continue to head up. It is a huge factor; there is a lot of money tied up in inventories. Supplier deliveries slowed down, and we don’t want to run out of specific inventories as new orders come along.”

Respondents in the survey had the following comments:

- “Continued brisk order flow for our business.” (Fabricated Metal Products)

- “Steady to slightly up production rates vs. prior month.” (Machinery)

- “Business is still good, but slowing.” (Transportation Equipment)

- “Business conditions are stable; demand is steady for our products.” (Miscellaneous Manufacturing)

- “Our business remains to be strong, but many of my suppliers are telling me their business is flat.” (Plastics & Rubber Products)

- “Oil & Gas continues to struggle to meet cost controls required in the new low-oil price environment.” (Petroleum & Coal Products)

- “Market is improving steadily in both orders and pricing.” (Wood Products)

- “Slowdown in Chinese economy causing low orders.” (Computer & Electronic Products)