Government/Policy

May 26, 2016

SMU Analysis: Changes from Preliminary to Final Determination AD/CVD Rates

Written by John Packard

Steel Market Update (SMU) does not anticipate the spread between hot rolled base prices and those of domestic galvanized/Galvalume will be reduced any time soon. The U.S. Department of Commerce latest ruling on corrosion resistant steels will put new wind in the steel mills sails. The DOC final determinations on antidumping (AD) and countervailing duties (CVD) against China, Korea, Taiwan, India and Italy surprised many as being much higher than anticipated.

The net result may be even fewer galvanized and Galvalume foreign steel suppliers coming to the United States. We also expect more upward pressure may be brought to bear on galvanized and Galvalume prices here in the States.

Steel Market Update spoke with a number of trading companies today and they expressed surprise and many were clearly spooked at the reversal of the Preliminary Determinations with Korea, India and Italy. Even Taiwan did not skate away free and clear with the latest rulings.

You must remember when reviewing the Final Determination ruling that this is a two step process. There is a Final ruling on Antidumping (AD) and then there is a Final ruling on Countervailing Duty (CVD) and the two are then combined (with a formula to adjust AD rates for export subsidies paid in country) with the result being the Final Department of Commerce deposit recommendation. The International Trade Commission will reach their final injury determination on corrosion resistant steels in July. They have the final say and they can overturn, reduce or otherwise alter what the US Department of Commerce has done to date.

SMU spoke with trade attorney Lewis E. Leibowitz (Lewis.Leibowitz@lellawoffice.com) about the DOC ruling and what it means. Essentially what have changed are the deposit rates that will be charged on steel imports arriving from the affected countries when they enter the United States. In the case of countervailing duties the collection date is backdated. We will have more on the specific deposit rates, dates and any products not covered next week when we return from the Memorial Day Holiday.

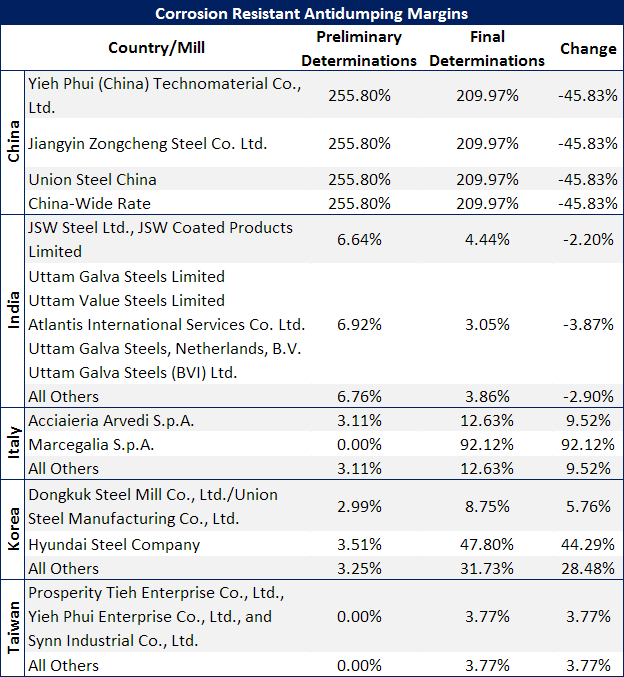

Brett Linton in our office compared the Preliminary Determination on Antidumping to the Final Determination and we put the results into a clean table for you to review (see below). Of particular interest, from our perspective, are the increases seen for Italy, Korea and Taiwan. The Indian mills did receive a small reduction in their AD rates. Chinese rates were reduced but continue to be prohibitive.

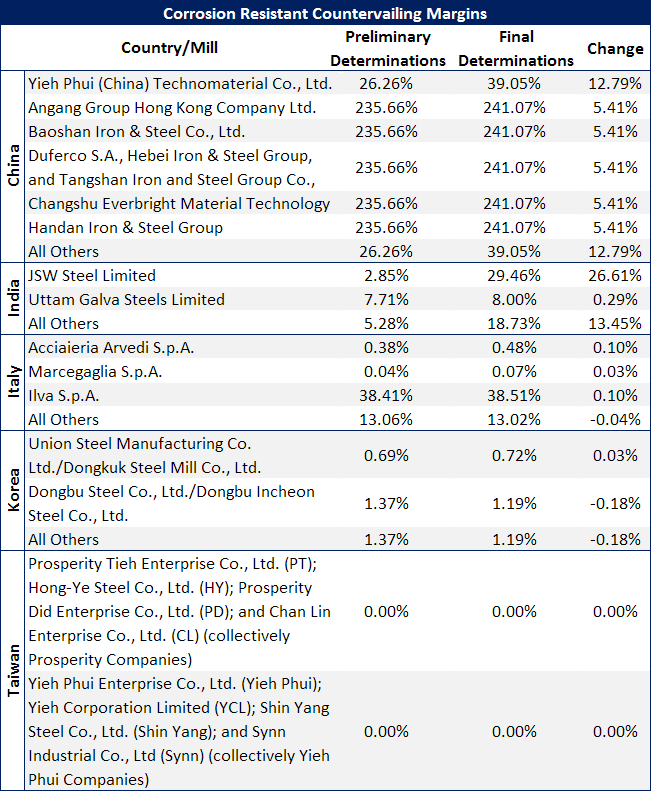

The second piece of the puzzle is the countervailing duty Final Determination which saw increases in China, India and Italy (Arvedi and Marcegaglia), no change in Taiwan (zero) and a small reduction in Korea.