Government/Policy

May 26, 2016

DOC Announces Final AD/CVD Determinations on Imports of Corrosion-Resistant Steel

Written by Sandy Williams

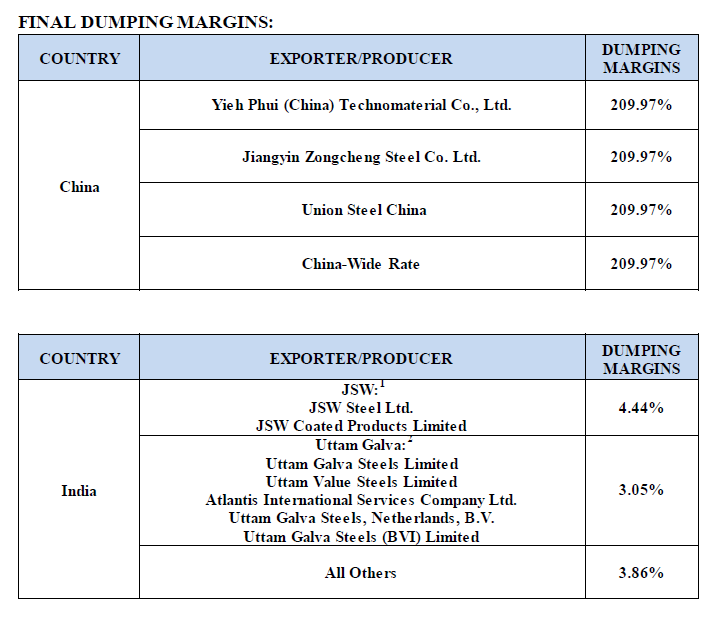

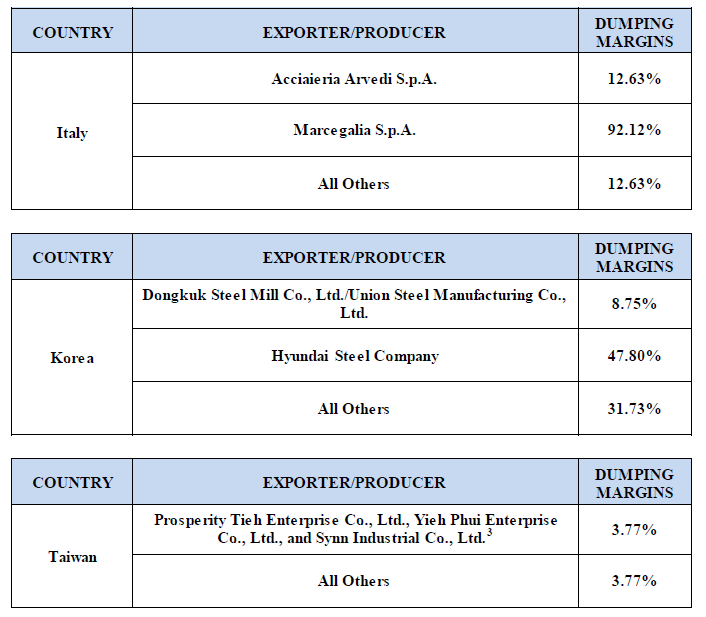

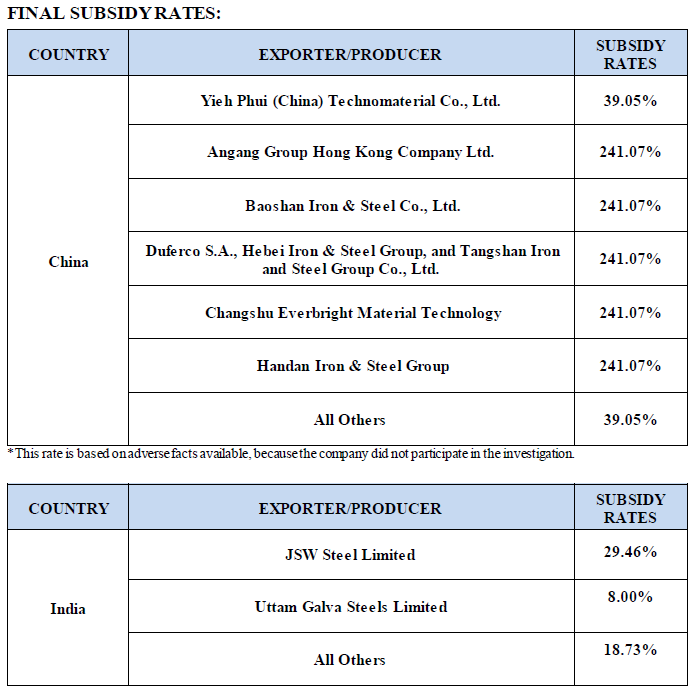

The Department of Commerce announced on Wednesday affirmative final determinations in AD and CVD investigations of imports of corrosion-resistant steel products (CORE) from China, India, Italy, Korea; an affirmative final determination in the AD investigation of imports of CORE from Taiwan; and a negative final determination in the CVD investigation of imports of CORE from Taiwan. The investigations cover certain corrosion-resistant steel products, which are certain flat-rolled steel products that have been clad, coated or plated with corrosion- or heat-resistant metals (e.g., zinc, aluminum) to prevent corrosion and thereby extend the service life of products made from the steel. Corrosion-resistant steel products are typically used in the manufacture of trucks and automobiles, appliances, agricultural equipment, and industrial equipment. Included are galvanized, galvannealed, aluminized steels as well as Galvalume steels.

For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the United States at less than its fair value. For the purpose of CVD investigations, a countervailable subsidy is financial assistance from a foreign government that benefits the production of goods from foreign companies and is limited to specific enterprises or industries, or is contingent either upon export performance or upon the use of domestic goods over imported goods.

Next Steps:

The U.S. International Trade Commission is scheduled to make its final injury determinations on July 8, 2016.

If the ITC makes affirmative final determinations that imports of CORE from China, India, Italy, Taiwan, and/or Korea materially injure, or threaten material injury to, the domestic industry, Commerce will issue Antidumping and Countervailing Duty orders on July 15, 2016. If the ITC makes negative determinations of injury, the investigations will be terminated.