Prices

May 24, 2016

Steel Buyers Worry Mills May “Reach Too Far”

Written by John Packard

Whenever SMU speaks to steel buyers about flat rolled steel pricing cycles we inevitably hear about how the domestic steel mills have a tendency to over-correct to both the low and the high sides of the cycle (boom/bust). In the process there seems to be an assurance that market volatility will continue to be significant as the markets try to return to the mean. Every cycle has its driving force: too much (or too little) supply, extended (or short) lead times, too much (or not enough) service center inventories, too much (or too little) foreign steel imports, etc.

We are in a supply constrained price cycle. The reduction of foreign steel imports, removal of the excess service center steel inventory, and the idling of some domestic steelmaking capacity has resulted in much longer lead times and a name-your-price environment at the mill level.

As we move about the industry talking to steel buyers, we are finding companies around the country questioning how much further can prices go without damaging the steel using community.

A Chicago area service center buyer told us in an email this afternoon, “I am not a buyer at the current spot levels. We have been marginally able to pass along all of the increases to accounts that truly need the steel. Domestic mills are extremely tight on availability right now. The market does feel like it “should” be topping out based on demand, flat input costs and Chinese prices sliding, but then CSI just announced a $7.50 cwt price increase this morning. So I am not sure about the direction of prices from here. Foreign steel is a value and I believe there is enough coming to cool down a lot of these increases and balance out supply. Ours is an industry of over corrections and we are quickly heading too high right now to be sustainable, so it looks like the boom / bust cycles are continuing.”

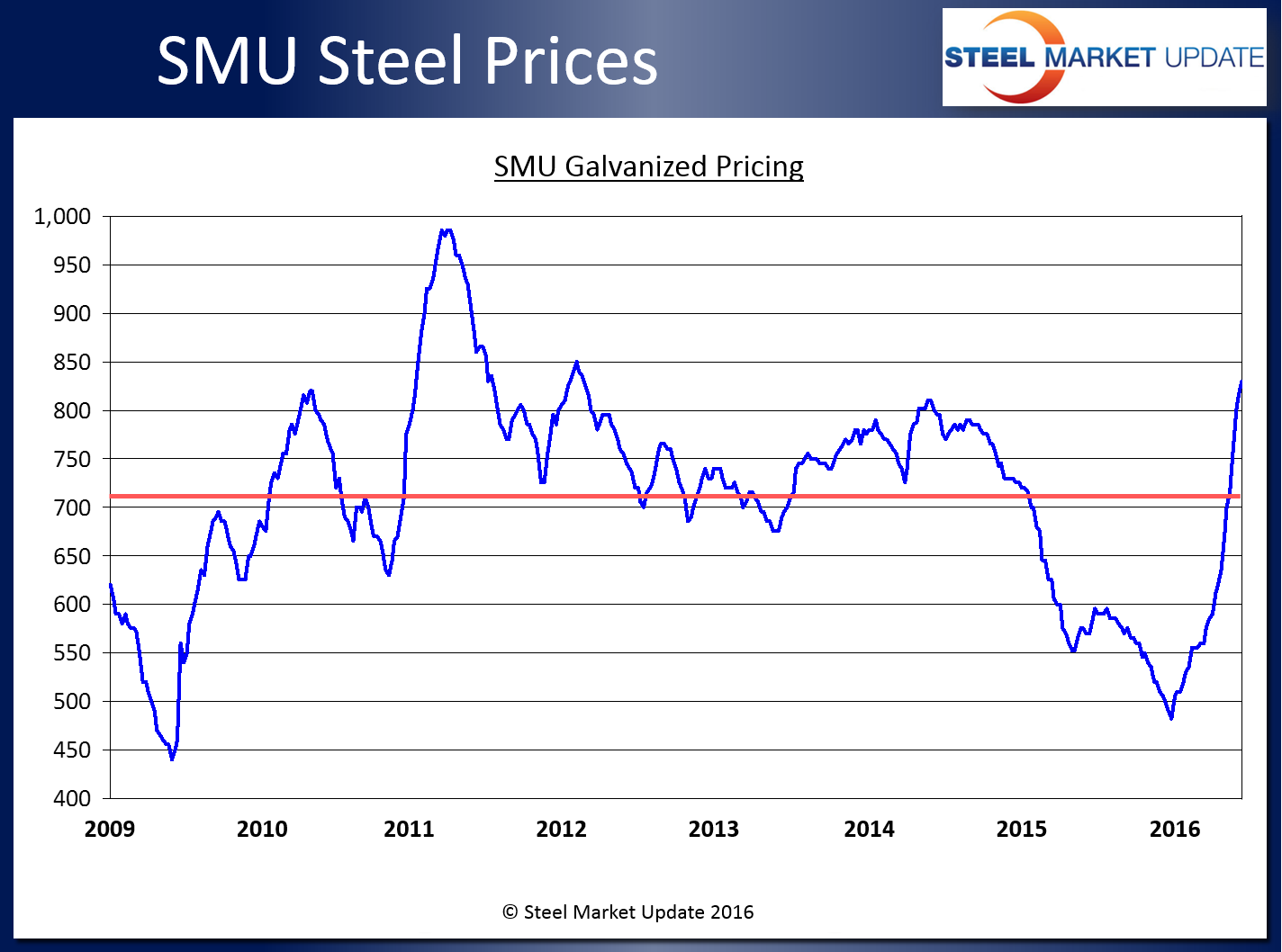

As we spoke with galvanized wholesalers this morning on the HARDI monthly conference call we heard one say, “Momentum is definitely on mill side and there is a little bit of angst in the market place. Certainly from customers who see a lot of activity, and a lot of them are pretty busy, and there is a little disbelief that prices are where they are….” This wholesaler executive went on to muse, “…have seen spot offers on galvanized in $42.50 range. It is reaching an area that is unsettling. I know base prices are different with every market, and it is hard to compare this with previous markets, but when prices get to $42 there is no history, there is very little history. It has gone to 48 and then tanks right back down, it doesn’t stay in the $40 range that long. To form a comfort level going long and stocking up is not easy to do. I don’t like buying steel at $42.50. I don’t feel comfortable in light that this is such a global market, a wildcard, just very unsettling.”

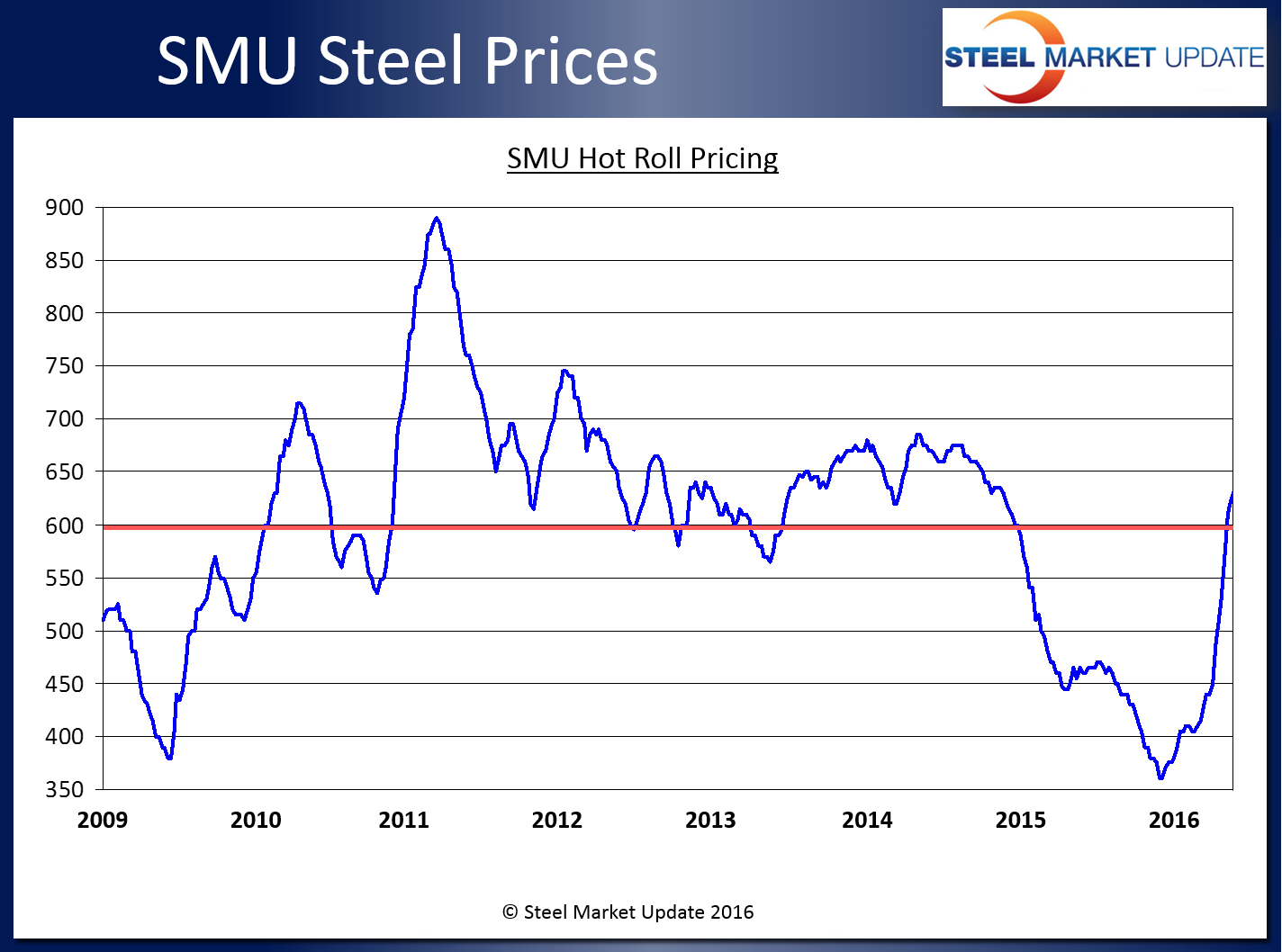

We published these numbers before but we find it interesting to review the average price for hot rolled, cold rolled and base price on galvanized and Galvalume since we began indexing flat rolled pricing back in January 2009.

Hot Rolled Average = $597 per ton ($29.85/cwt)

Cold Rolled Average = $709 per ton ($35.45/cwt)

Galvanized Base Average = $35.47/cwt

Galvalume Base Average = $35.64/cwt

Here is what the hot rolled and galvanized graphics look like. The reason we are showing both is because there has been a disconnect between the normal $100-$120 per ton spread between HRC and CR/GI pricing and the graphic shows this disconnect very well:

First Hot Rolled (the red line is the average shown above):

And then the galvanized graphic (the red line is the average shown above):

The general manager of a large service center group told us this morning, “I think the mills need to take a pause, and recognize that the spreads to foreign are getting too rich, and are giving buyers the incentive to look anywhere for an outlet. The mills have played this market very smartly up until now, and there’s a danger that they will reach too far. They should be making a healthy living at current prices, and if buyers have some confidence that conditions will be stable for a bit, it would allow them to be able to plan better and know what their near-term price exposure is. The market appears concerned that a significant price reversal could come, but with inventories as low as they are, mill demand ahead should remain stable. I believe a return to “normal” booking patterns would help to increase transparency, which is lacking at the moment and creating needless uncertainty. This is an opportunity for the domestic mills to show that they have their customer’s backs and that they want to keep the market stable and/or steer it to a soft landing if global steel conditions deteriorate.”

We have already heard from our steel buying sources that ArcelorMittal has informed some of their customers of cold rolled base prices going to $880 per ton (HR @ $640 and GI @ $840). We have heard that $880 number associated with CR and coated elsewhere, although we are unaware of anyone actually paying that price at this time.

At the same time, this morning during our HARDI conference call we also learned that there is material available to buy (not at all mills but some) should you be willing to pay the price and risk building inventories.