Prices

May 19, 2016

Hot Rolled Futures: Modest Volume Traded this Week

Written by John Packard

The following article was written by Jack Marshall of Crunch Risk, LLC. Here is how Crunch Risk saw hot rolled futures and busheling scrap futures trading over the past week:

HRC Steel

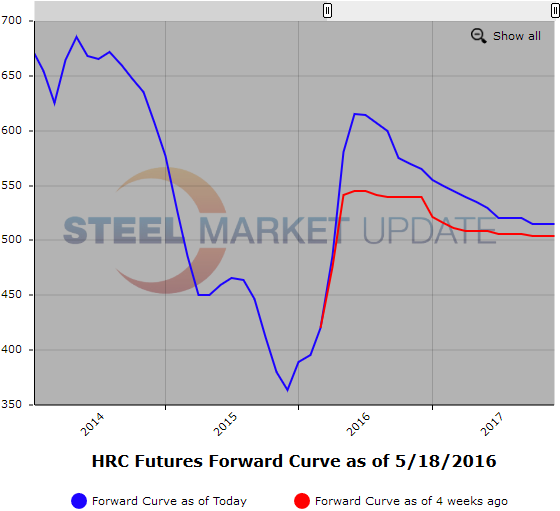

Hot Rolled futures (HRC) have traded modest volume this week (9280 Short Tons). Falling prices of inputs and steel in Asia have given participants pause. Finally Q3’16 HR futures have traded in the low $600 range which appears to be close to where the HR physical spot market has been trading.

CME HR spot month futures rose to $581/ST on preliminary index average but HR market focus continues in Q3’16 and Q4’16 which it should be noted is heavily backwardated based on yesterday’s settlements of Q3’16 @ $607/ST and Q4’16 @ $570/ST.

Down $37 reflects a fairly strong view that this latest move higher in HR prices is temporary. HR prices have been rising steadily since December and are currently taking a breather after a $225 per ton move higher.

This last week Q3’16 traded @ $585/ST, $592/ST, and $607/ST. In Q4’16 $565/ST and $570/ST. Of note Oct’16 traded @ $565/ST on 3680 ST.

Open Interest HR futures last 441,840 ST.

Wednesday CME settlements:

Spot month (May) $581

Q3’16 $607

Q4’16 $570

Cal’17 $530

Scrap

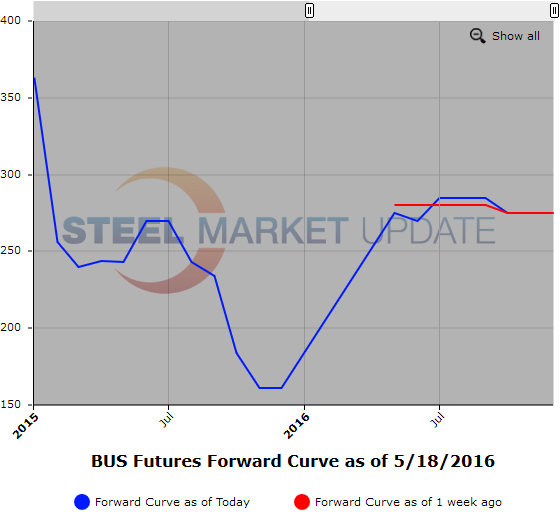

A retreat in CFR Turkish scrap prices can be attributed to Chinese Hot Rolled and Chinese billet prices significantly falling from their recent highs. The news has helped increase inquiry activity in CFR Turkey (HMS 80/20). This is the LME contract, but it also can clear under CME (FSF). We are seeing lower offers FSF Q3’16 $280/MT offer and Q4’16 $270/MT offer with spot last reported at $302/MT off $24 from its recent high.

Some really interesting trades happening in BUS scrap futures as it was being dragged up by Hot Rolled. Some generators looking at the resultant high levels to maybe lock in revenue on generation, i.e. we could pay Cal’17 BUS futures @ $255/GT against an HR bid we have at $525 in that period. BUS is also offered Q3’16 at $285/GT and Q4’16 $275/GT.