Government/Policy

May 17, 2016

Failure to Respond Costly to China & Japan on Cold Rolled

Written by Sandy Williams

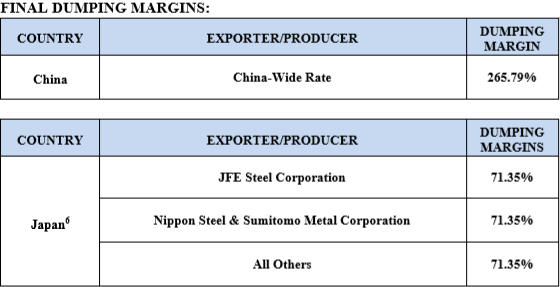

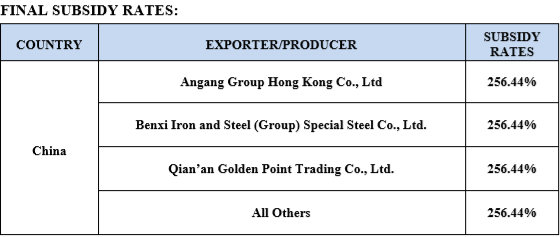

Today, the Department of Commerce announced its affirmative final determinations in the AD investigations of imports of certain cold-rolled steel flat products (cold-rolled steel) from China and Japan, and CVD investigation of imports of cold-rolled steel from China. Commerce determined imports of cold-rolled steel from China and Japan have been sold in the U.S. at dumping margins of 265.79 percent and 71.35 percent, respectively. Commerce also determined that imports of cold-rolled steel from China received countervailable subsidies of 256.44 percent.

The investigations cover certain cold-rolled, flat-rolled, steel products, neither clad, plated, nor coated with metal, but whether or not annealed, painted, varnished, or coated with plastics or other non-metallic substances. Cold-rolled steel may be used “as is” or further processed by galvanizing or coating. Cold-rolled steel is primarily used in appliances, automotive products, containers, and construction.

In the China AD investigation, no company responded to Commerce’s requests for information during the respondent-selection phase of the proceeding. Accordingly, all producers/exporters in China received a final dumping margin of 265.79 percent based on adverse facts available.

In the China CVD investigation, the Government of China, mandatory respondents Angang Group Hong Kong Co., Ltd. and Benxi Iron and Steel (Group) Special Steel Co., Ltd., and Qian’an Golden Point Trading Co., Ltd., a non-cooperative exporter, all failed to respond to Commerce’s requests for information. Thus, all imports of cold-rolled steel from China will be subject to a CVD rate of 256.44 percent.

In the Japan AD investigation, mandatory respondents JFE Steel Corporation and Nippon Steel & Sumitomo Metal Corporation did not respond to Commerce’s requests for information. Accordingly, both mandatory respondents received a final dumping margin of 71.35 percent based on adverse facts available. All other producers/exporters in Japan received a final dumping margin of 71.35 percent.

The petitioners for these investigations are AK Steel Corporation (OH), ArcelorMittal USA LLC (IL), Nucor Corporation (NC), Steel Dynamics, Inc. (IN), and United States Steel Corporation (PA).

As a result of the affirmative final AD determinations, Commerce will instruct U.S. Customs and Border Protection (CBP) to collect cash deposits equal to the applicable weighted-average dumping margins. Further, as a result of the affirmative final CVD determination, if the U.S. International Trade Commission (ITC) issues an affirmative injury determination, Commerce will order the resumption of the suspension of liquidation and will require cash deposits for CVD duties equal to the final subsidy rates established during the investigation. Commerce will also adjust the AD cash deposit rates by the amount of the CVD export subsidies, where appropriate. If the ITC issues negative injury determinations, the investigations will be terminated and no producers or exporters will be subject to future cash deposits for either AD or CVD duties. In such an event, all previously collected cash deposits will be refunded.

Commerce found that critical circumstances exist with respect to certain exporters from China and Japan. Where critical circumstances were found, CBP will be instructed to retroactively impose provisional measures on entries of cold-rolled steel flat products effective 90 days prior to publication of the preliminary determinations in the Federal Register.

NEXT STEPS:

The ITC is scheduled to make its final injury determination in the investigations of colled-rolled steel from China and Japan on June 30, 2016.

If the ITC makes affirmative final determinations that imports of cold-rolled steel from China and/or Japan materially injure, or threaten material injury to, the domestic industry, Commerce will issue AD and CVD orders. If the ITC makes negative determinations of injury, the investigations will be terminated.

Commerce’s final determinations in the investigations of cold-rolled steel from Brazil, India, Korea, Russia, and United Kingdom have been extended, and they are scheduled to be announced on or about July 13, 2016.

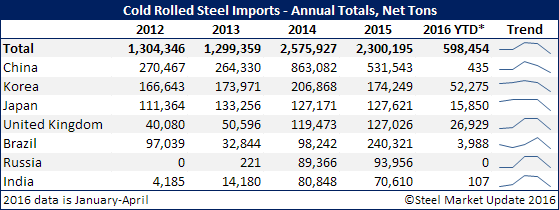

History of Cold Rolled Imports from Countries Associated with Cold Rolled Trade Suits: