Government/Policy

May 1, 2016

Commerce Initiates AD/CVD Investigations on CTL Plate

Written by Sandy Williams

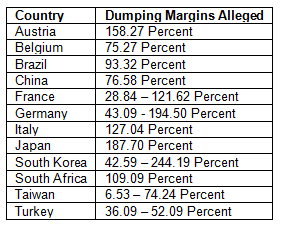

On April 29, 2016, the Department of Commerce initiated an antidumping duty (AD) investigation of imports of certain carbon and alloy steel cut-to-length plate (CTL plate) from Austria, Belgium, Brazil, China, France, Germany, Italy, Japan, Korea, South Africa, Taiwan, and Turkey, and countervailing duty (CVD) investigations of imports of CTL plate from Brazil, China, and Korea.

The petitioners in the case are ArcelorMittal USA, Nucor and SSAB.

The investigations cover certain carbon and alloy steel cut-to-length plate (CTL plate). CTL plate is a flat-rolled carbon and alloy steel product that is 4.75 mm or more in thickness and that has a defined length (i.e., it is not in coils). CTL plate is used in a wide variety of applications including welded load-bearing and structural applications such as in buildings or bridgework; transmission towers and light poles; agricultural, construction, and mining equipment; machine parts and tooling; heaving transportation equipment like ships, rail cars, tankers and barges; and large diameter line pipe.

Next Steps

The U.S. International Trade Commission (ITC) is scheduled to make its preliminary injury determinations on or before May 23, 2016. If the ITC determines that there is a reasonable indication that imports of CTL plate from Austria, Belgium, Brazil, China, France, Germany, Italy, Japan, Korea, South Africa, Taiwan, and/or Turkey materially injure, or threaten material injury to, the domestic industry, the investigations will continue and Commerce will be scheduled to make its preliminary CVD determinations in July 2016 and its preliminary AD determinations in September 2016, unless the statutory deadlines are extended.