Government/Policy

April 27, 2016

USS Section 337 Complaint Accuses Chinese Traders of Falsifying Origin

Written by Sandy Williams

US Steel maintains that Chinese manufacturers and distributors use false documents and transship products through other countries to disguise the country of origin.

Numerous antidumping and countervailing duty orders have been placed on Chinese steel products over the years. US Steel maintains that China continues to circumvent these orders by using such methods in violation of the Lanham Act 15 U.S. Code § 1125. The Lanham (Trademark) Act was first enacted in July 1946 to prohibit activities such as trademark infringement, trademark dilution and false advertising.

The Act specifically prohibits false designations of origin and false descriptions of goods and service used in commerce which:

- is likely to cause confusion, or to cause mistake, or to deceive as to the affiliation, connection, or association of such person with another person, or as to the origin, sponsorship, or approval of his or her goods, services, or commercial activities by another person, or

- in commercial advertising or promotion, misrepresents the nature, characteristics, qualities, or geographic origin of his or her or another person’s goods, services, or commercial activities.

Such actions are subject to civil action and include governmental entities. The Act further states:

Any goods marked or labeled in contravention of the provisions of this section shall not be imported into the United States or admitted to entry at any customhouse of the United States.

US Steel states in the Section 337 filing that import records suggest that Chinese manufacturers and distributors transship significant volume to the U.S. to disguise the origin of Chinese steel.

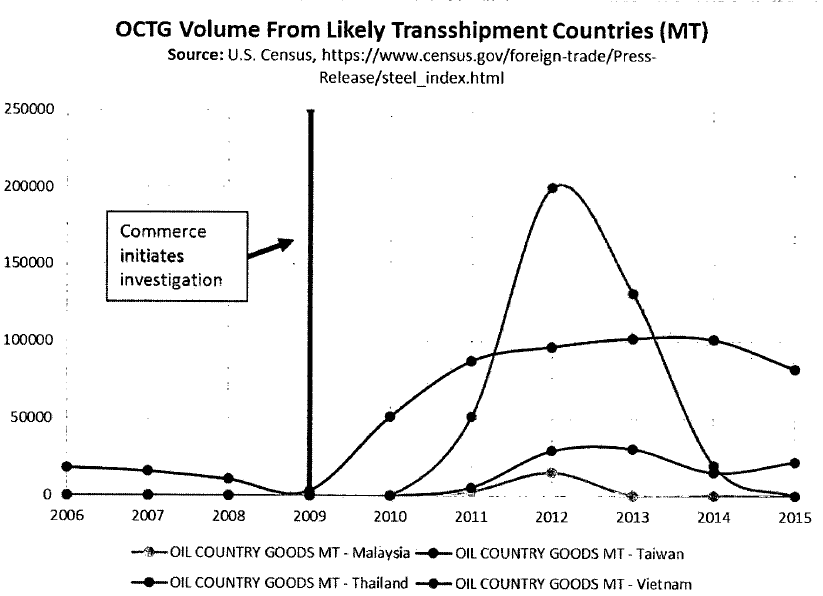

Import records are cited which show the jump in OCTG volumes from Malaysia, Thailand, Taiwan and Vietnam after the AD/CVD duties were ordered on Chinese OCTG products in 2009. The pattern was repeated as Commerce initiated AD/CVD duties on corrosion-resistant steel and cold-rolled steel imports in 2015.

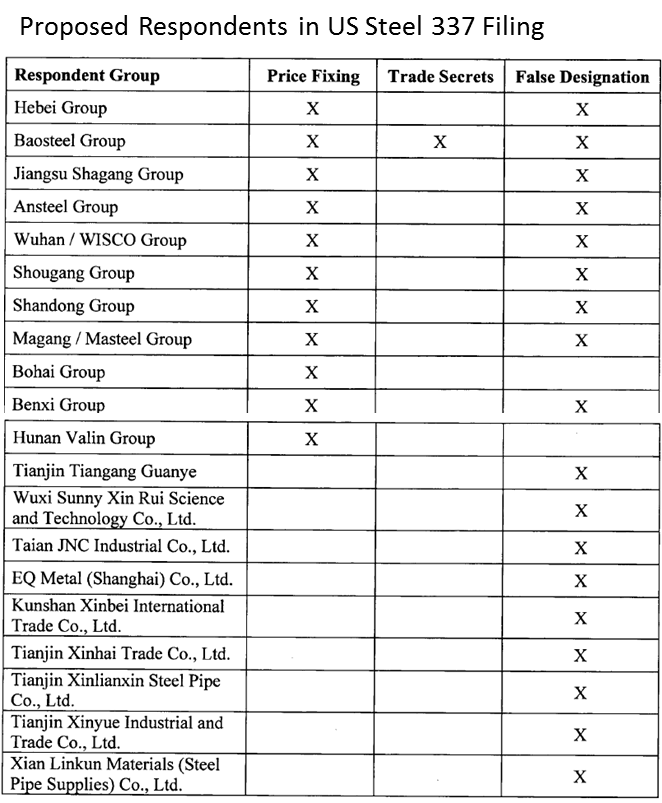

A specific example of transshipment was given for Tianjin Tiangang Guanye Co., LTD (TTG), a distributor for Baosteel and Ansteel and other Chinese steel manufacturers.

In March 2016 a prospective customer contacted TTG regarding purchase of cold-rolled steel products and expressed concern about U.S. duty costs. TTF offered to use “entrepot trade.” The TTG representative explained:

We export the goods to Thailand. when the goods arrive thailand, our agent will receive the goods, and they will export the goods to you with their company name. (Goods made in china from us) And there is no special handle from yourside. our agent will handle CIF Port Elizabeth for you. so it is same import procedures from china. Only different point the goods delivery port from Laem Chabang Port Thailand. but goods from us made in china.

(Note: the emphasis was included in the original communique.)

A clarification was provided by TTF that the Bill of Lading would show Thailand but the prospect would receive an emailed mill test certification showing the steel was made in China. The certificate listed Baosteel Iron & Steel Co. as the original mill.

Several examples of false transactions like this one are detailed in the 337 filing.

US Steel notes that Chinese manufacturers exported 112.4 million metric tons of steel worldwide in 2016, 2 million tons which the U.S. Census Bureau reports was exported to the U.S. That 2 million tons is vastly understated, however, says US Steel, due to transshipment fraud.