Market Data

April 27, 2016

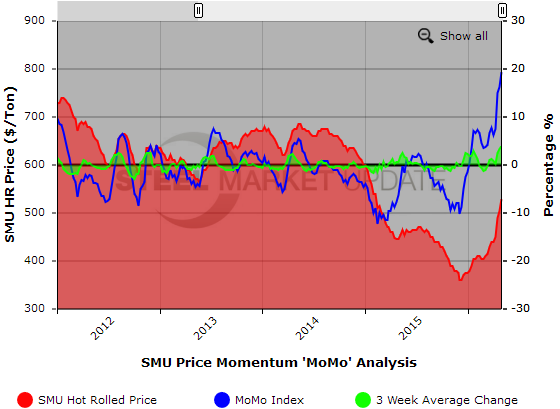

SMU HR Price MoMo Index Shows Increases Accelerating

Written by Brett Linton

The Steel Market Update (SMU) Price Momentum Index (MoMo) for hot rolled steel in the United States remained positive this week for the 17th consecutive week, following a 21 week negative streak. MoMo, a trailing indicator, is measured as a percentage and shows the relation of the current U.S. hot rolled coil price movements against the previous 12-week average spot price as recorded by Steel Market Update. A positive MoMo index indicates hot rolled steel prices are increasing, while a negative index indicates a decline in prices.

MoMo should not be confused with the SMU Price Momentum Indicator which is a forward looking indicator and is currently pointing toward higher pricing over the next 30 to 60 days.

MoMo was measured at 19.32 percent this week, meaning that the current HRC price is higher than the average price over the last 12 weeks.

The last time our MoMo index was this high was the week of January 25, 2011 when the index was +20.28 percent and the hot rolled price was $794 per ton.

The change in MoMo can be a useful indicator in depicting the severity of price movements and evaluating the directional trend for flat rolled steel prices. The week-over-week change in MoMo was +3.01 percent, following a change of +1.25 percent last week. This indicates that the hot rolled price movement is trending upwards and at a higher rate than the previous week.

To get a wider sense of the change in the MoMo Index and eliminate weekly fluctuations, we calculate a 3-week average change. The 3-week average change in the MoMo Index is +3.95 percent, following a change of +3.32 percent the week before. This shows that the movement in hot rolled prices is also accelerating and at a greater pace that the previous 3-week period.

The graph below demonstrates the relationship between the SMU hot rolled coil price, the SMU Price MoMo Index, and the three week moving average change in the MoMo Index. As published in our Tuesday evening issue, the SMU HRC price range for this week is $520-$540 per ton with an average price of $530, up $25 from last week.