Prices

April 19, 2016

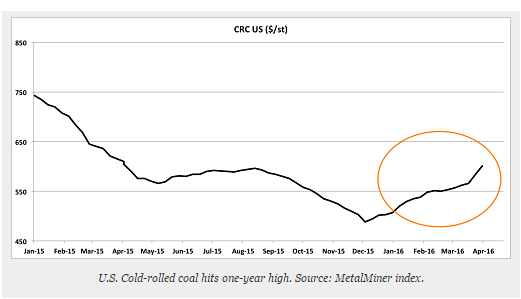

Steel Mills Boosting Prices: Cold Rolled Coil Hits a 1-Year High

Written by Sandy Williams

There have been a number of questions about whether steel prices have the staying power to continue to move higher from here. We thought we would bring in another opinion on the subject. MetalMiner published an article on the subject just yesterday and they have allowed us to reproduce the article in tonight’s newsletter. Lisa Reisman, Co-Founder and Executive Editor of MetalMiner will be joining us in Atlanta for our 6th Steel Summit Conference as a presenter about steel and metals price moves and forecast. More information about the conference is available online.

The following article was written by Raul de Frutos and published in MetalMiner on April 18, 2016.

Steel is being a different animal this year. While metals such as aluminum, copper and nickel are trading barely above multiyear lows, we are witnessing strong price momentum in domestic steel prices.

Cold-rolled coil is a good example. Prices last week climbed above $600 per standard ton, the metal’s highest price level since April 2015.

Why, in an Oversupplied Market, Did Steel Prices Get a Boost?

The duties imposed on steel products caused steel imports to taper down in a big way over the last three of months and U.S. steel mills now have the power to raise their base selling prices. U.S. aluminum markets didn’t enjoy this kind of protection. However, even if they did, which they might, aluminum prices wouldn’t get the same boost.

The reason is that aluminum (like the rest of base metals) is more global in nature than steel. U.S. steel prices can be much higher than in the rest of the world because prices are not decided on exchange-based trading unlike aluminum which is linked to London Metal Exchange reference prices. So, even if duties were imposed on aluminum products, aluminum producers couldn’t arbitrarily hike their selling prices.

Is This Rally Backed Up by Fundamentals?

In the short-to-medium term it is, whereas long-term it really isn’t since steel demand in China keeps contracting. The recent positive sentiment might help U.S. steel mills increase their spot offers even further, but we could see a revision later this year. Although there seems to be short-term scarcity of steel in U.S. markets, there is still plenty of steel overhanging in global markets. We’ll have to wait to see how much further mills can raise steel prices in Q2 before buyers turn to international suppliers for cheaper prices.

Chinese Exports Rise Sharply in March

Another factor driving global steel prices this year has been expectations of a decline in Chinese steel exports as earlier this year China committed to curtail its excess steel capacity. However, the latest data doesn’t seem to suggest that. In March, Chinese steel exports surged 30% compared to the same period last year. In Q1, Chinese steel exports are up 8% compared to the same quarter last year. That seems to suggest that rising steel prices have only ensured that Chinese steel mills produce more of the metal.

What This Means For Metal Buyers

Market dynamics are quite different for steel markets than to the rest of base metals. U.S. mills now have the power to increase their spot prices. Buyers should have, by now, locked in prices for the next one or two quarters.

Longer-term, there are still plenty of events that could change market sentiment later this year, limiting domestic mills’ ability to raise prices. We’ll have to keep monitoring markets to watch for more clues.

Lisa Reisman of MetalMiner to Speak at 6th Steel Summit Conference