Prices

April 18, 2016

Analysis of Key Raw Materials: Iron Ore, Scrap, Coking Coal & Zinc

Written by John Packard

The following is one of the monthly analyses Steel Market Update does on key commodities and raw materials which impact steel prices: iron ore, scrap, coking coal as well as zinc and aluminum. Prices of the various commodities have been rising over the past month which is a net positive for the steel industry. The data shown in the article below was updated on April 18th 2016 and the article was written by Peter Wright, marketing and metallurgist specialist and one of our Steel 101 instructors:

Iron ore

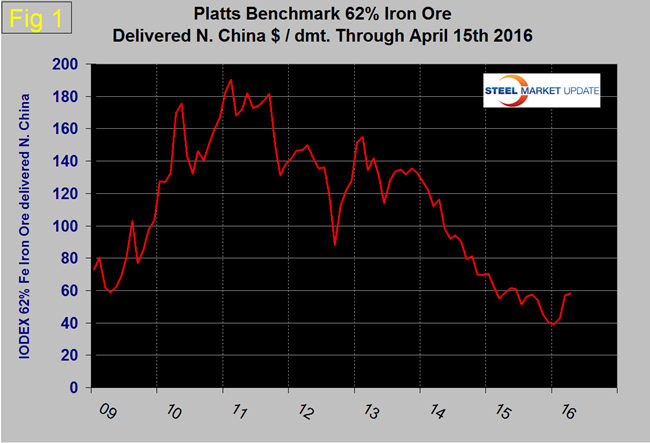

The Platts IODEX of 62% Fe delivered North China fell below $40 in early December and reached a low of $38.50 on December 15th. In week ending April 15th the price had recovered to $58.30, (Figure 1). The IODEX is down by 17% since the beginning of 2015 and by 54% since the beginning of 2014.

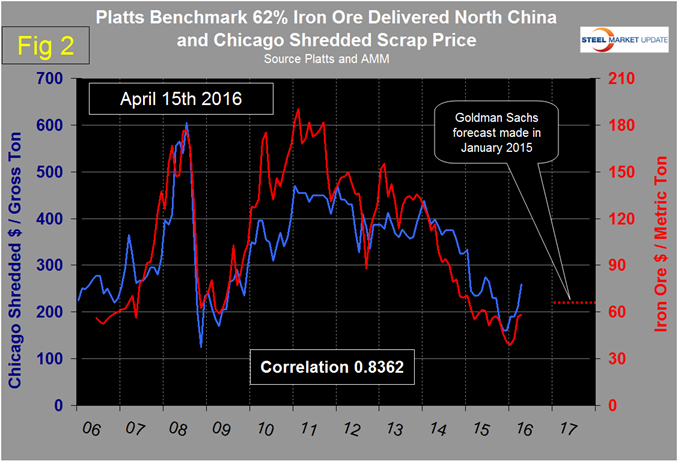

There is a long term relationship between the prices of iron ore and scrap. Figure 2 shows the IODEX, and the price of Chicago shredded through April 15th.

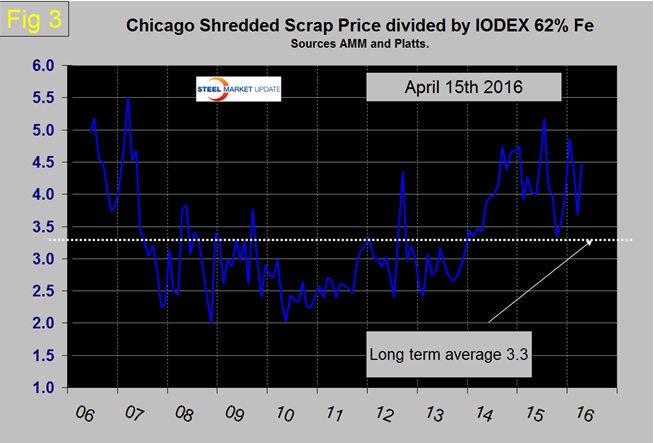

The price of Chicago shredded rose by $30 in January and $20 in March and $50 in April. The correlation between scrap and ore since January 2006 has been 83.62% and in the last 10 years on average, scrap in dollars per gross ton ($/gross ton) has been 3.3 x as expensive as ore in $ per dry metric ton (dmt). From early 2014 through September 2015 the integrated producers had an advantage when the price of scrap was as much as 5.2 x the price of ore. In 2016 the ratio has ranged from a low of 3.68 in March to 4.46 in April, (Figure 3).

Scrap

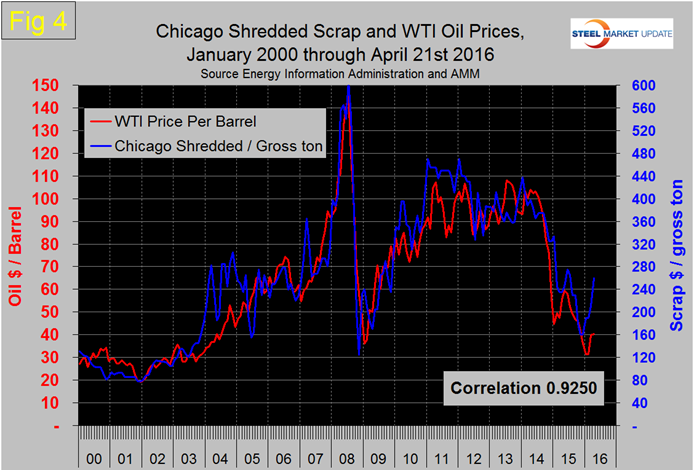

Historically there has been a close non-causal relationship between the price of scrap and the price of oil. Figure 4 shows the scrap / oil relationship through April 11th which is the latest data from the Energy Information Agency of the US government.

The scrap to oil price correlation is 0.9250 since January 2000 and 0.9371 in the 26 years since January 1990. We attribute the closeness of this relationship to the facts that both are global commodities and both are priced in dollars but, considering the political instability in the Middle East, we have never understood why this relationship was so close. The relationship has broken three times since 1990 one of which is 2016.

In 2004 a major fire in a West Virginia coal mine forced the integrated manufacturers to use more scrap. In 2011 the same thing happened when the price of iron ore went through the roof driven by contract cancelations by the big three oil cartel. Today the price of oil is being artificially depressed by OPEC’s attempt to gain market share at the expense of price. On Sunday of this week the major oil producers met in Doha and failed to reach an agreement to freeze production at the January level. Iran had made a last minute decision not to attend and in any case no-one expected Iran to agree to limit output now that the yoke of sanctions has been lifted. The bottom line today is that the price of oil is telling us nothing about likely future moves in the price of scrap.

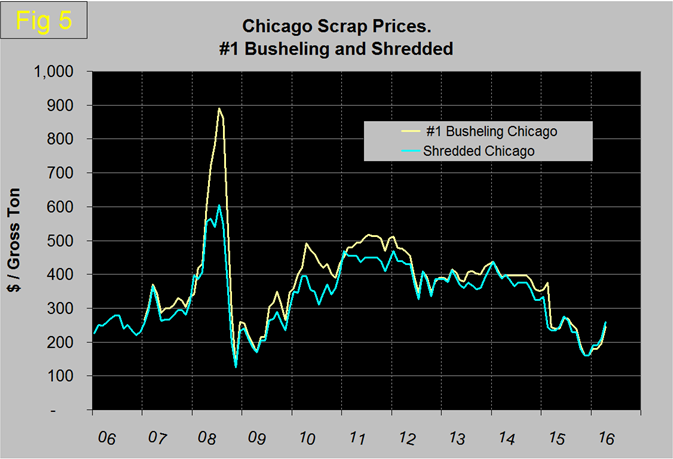

Figure 5 shows the relationship between shredded and #1 busheling both priced in Chicago. Normally busheling has a premium over shredded but since last April that has evaporated to the extent that busheling in January and February was reported by AMM to be $10 lower than shredded, in March and April was $15 lower.

Coking coal

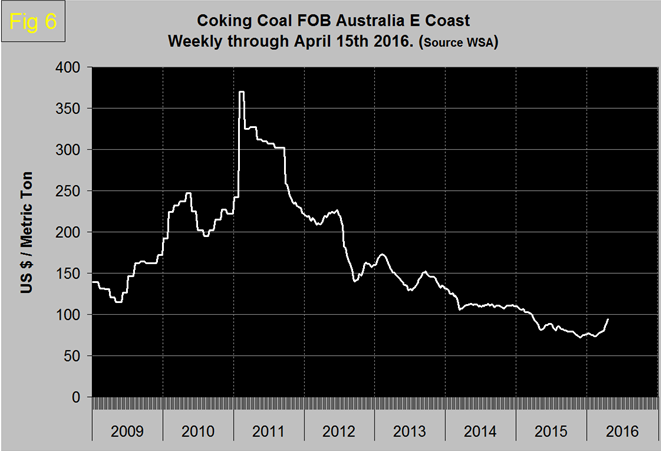

The price of coking coal FOB East Australian ports was over $300 per metric ton for most of 2011 then declined abruptly in the 4th Q of that year to $222 on December 30th. The price bottomed on November 27th 2015 at $72.30 and has since risen to $94.30 on April 15th, (Figure 6).

Zinc

According to the International Zinc Association, the major use of zinc is for galvanizing, other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publish a daily spot price of zinc which we have transcribed to Figure 7. Just as a point of reference we have included aluminum in the same graph. The price of zinc today is higher than at any time since July last year. At the end of April 2015 the 30 day spot zinc price peaked at $1.0381 / lb., then the price slid precipitously to $0.6723 in January of this year. As of April 18th the price has recovered to $0.8518. Aluminum is not following the same path as zinc this year.

SMU comment; all the raw materials prices that we track are increasing, a situation that bodes well for both global and domestic steel markets.