Prices

April 14, 2016

February Ferrous Scrap Exports Snap Back after January Low

Written by Brett Linton

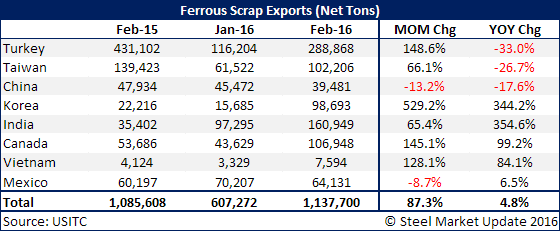

February ferrous scrap exports totaled 1,137,700 net tons (1,032,105 metric tons) with Turkey, India, Canada, Taiwan, and Korea being the top five countries receiving scrap from the United States. These five countries accounted for 66.6 percent of all scrap exports.

Total February ferrous scrap exports were 87.3 percent higher than previous month. Despite the large month over month increase, February levels are in line with the 2015 monthly average of 1,191,011 tons per month, and January 2016 levels were just abnormally low.

The most significant change month over month went to Turkey, which jumped up 172,664 tons or 148.6 percent from January to February (following a 394,301 ton decrease from December to January). Other significant changes include a 83,008 ton increase in scrap exports coming from Korea, a 63,654 ton increase from India, and a 63,319 ton increase in exports from Canada.

Comparing February 2016 to February 2015, February 2016 total scrap exports are 4.8 percent higher than the same month one year ago. While exports from Turkey declined by 142,234 tons or 33.0 percent, and increase in scrap coming from Korea, India, and Canada negated the change.

The table below lists the top eight importing countries along with the total amount of exported ferrous scrap.

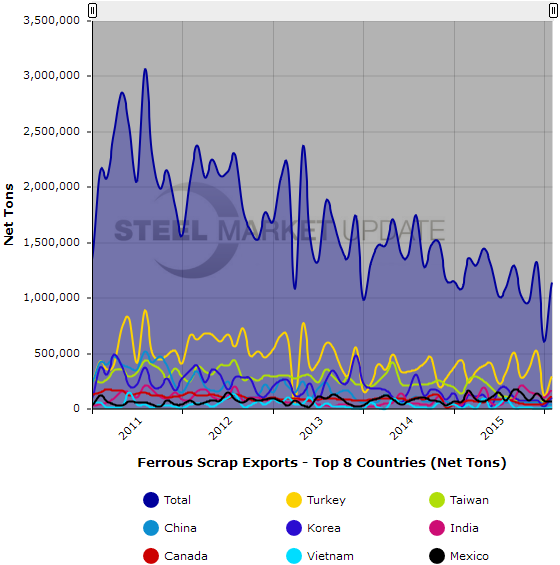

Below is a graph showing the history of total ferrous scrap exports, to use it’s interactive features and explore different countries you must visit out website by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.