Government/Policy

April 3, 2016

Plate Dumping Suit Imminent

Written by John Packard

According to ArcelorMittal USA comments made during the Association of Steel Distributors meeting over the weekend which SMU attended, a trade case on steel plate imports will be filed within the next few weeks. ArcelorMittal along with Nucor and SSAB have been working on the documentation for an extended period of time and our understanding is that work has been completed by the mill attorneys and the next step should be the filing.

When asked what countries were involved we were told “similar names as the light flat rolled cases” which means countries like Turkey, Korea and China would most likely be included.

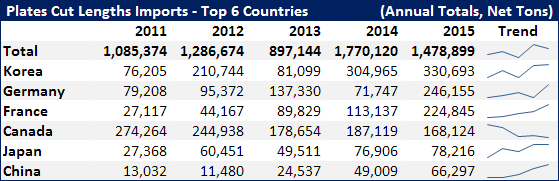

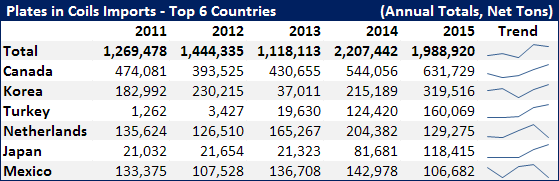

We took a look at plate imports over the past few years to see what countries might be involved. When dealing with plate you have both plate in coils as well as cut to length plate to consider. We are showing the top five or six exporting countries for each (coil & cut to length) for your review.

With the addition of a plate trade case all of the sheet and plate products will have been hit by the domestic steel mills. In 2015 trade cases were filed on corrosion resistant (galvanized/Galvalume), cold rolled and hot rolled steels. All of those cases have gone through the preliminary determination process and are waiting on final determinations from both the US Department of Commerce and the International Trade Commission (ITC).