Market Data

March 24, 2016

SMU Price Momentum Indicator Pointing Toward Higher Steel Prices

Written by John Packard

Flat rolled steel pricing momentum is clearly on the side of the domestic steel mills. You have a number of the integrated mills essentially out of the spot markets and lead times are extended. Even hot rolled lead times are moving out despite weakness in the energy markets. SMU Price Momentum Indicator continues to point toward Higher steel prices over the next 30 days and perhaps much longer than that.

![]() Higher scrap prices, especially if they come in at the upper end of the range being mentioned by our scrap sources ($40-$50/GT), will keep pressure on the domestic mills to raise prices again in early April for the 5th time since early December 2015. We heard from one steel buyer this afternoon, “Yikes, heard another round of price increases coming next week.” Next week may be a bit early but we would not be surprised to see price announcements during the first week of April.

Higher scrap prices, especially if they come in at the upper end of the range being mentioned by our scrap sources ($40-$50/GT), will keep pressure on the domestic mills to raise prices again in early April for the 5th time since early December 2015. We heard from one steel buyer this afternoon, “Yikes, heard another round of price increases coming next week.” Next week may be a bit early but we would not be surprised to see price announcements during the first week of April.

The market believes this cycle is being driven due to the pressure put on supply with the closures of the US Steel Fairfield blast furnace (hot end of the mill), the idling of Granite City’s hot end and that of AK Steel Ashland.

Here is how one large national service center put it to us earlier this week:

“Offer prices appear to be following increases (moving higher in kind), with range now around $430-460 on HR for Spot.

I recently received a Galvanized foreign (UAE) offer for late May ship, and price was roughly on par with domestic for same basic delivery window, so we passed.

I think the market does have “legs” even though it is driven mainly by supply side. I think Galvanized product by itself could present deeper challenges since it appears that the domestic production is running full, and may not be able to keep up with demand. Foreign may step in at some point, but new sources need to be developed and approved by buyers. This of course is a timely process. With CR, we know that there remains idle domestic capacity that could be brought back if warranted by demand. In the case of USS Granite, they could bring back some/all of the operations, but I don’t think that they intend to do so given the cash it would require to re-start. They seem content in their hunker-down mode for the time being.

My bigger concern in the near-term is, what happens if demand improves and domestic production remains fairly level?”

This is THE KEY QUESTION that all steel buyers (and sellers) need to be asking themselves. What happens if real demand is higher than anticipated or growing faster than anticipated? Answer, the industry may be in for a surprise (more volatility).

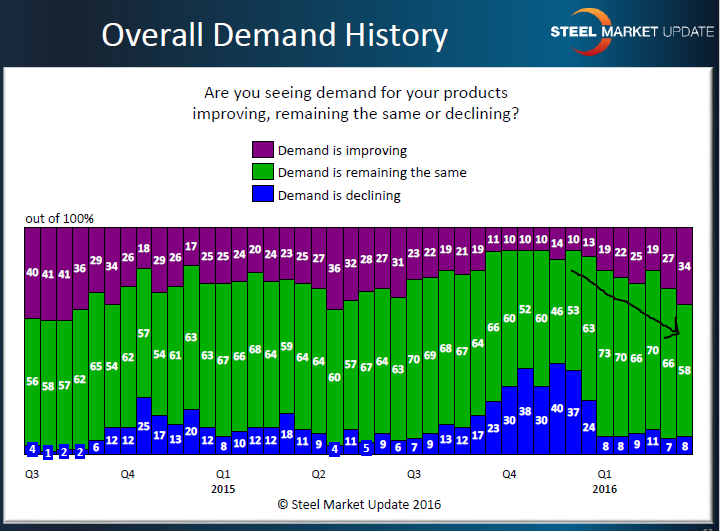

In our most recent flat rolled steel market analysis, we found an improving demand trend which helps explain our optimistic report regarding our Sentiment Index. The trend line shows demand as growing (see below) and is at its best level seen since very early in second quarter 2015 (when the trend reversed itself).

We may be seeing seasonal factors coming into play or, we can be catching the early end of a rising demand scenario in the domestic market. The graphic shown above contains data from both service centers and manufacturing companies which, when combined, total 83 percent of our respondents.

However, demand is not cut and dry in many market segments. I spoke with a metal building company recently who told me their business was up 30 percent so far this year. However, much of that could be attributed to a warmer than normal winter allowing companies to get into job sites sooner than expected. A steel mill that is involved in the Galvalume business reported some areas of the country (like the energy dependent Southwest) were off while other areas of the country were seeing better demand. The mill told us, “From my perspective demand is going to look a lot like last year with perhaps a modest plus. The key to Galvalume demand is where the steel comes from….”

So, we have to think not only about “real” demand but what impact will shrinking imports have on supply? As our buyer mentioned earlier in this article, why buy foreign if the prices being quoted (in his case galvanized from the UAE) are equal to domestic numbers?

We also have to be aware that the US Department of Commerce and the International Trade Commission still have more to say regarding the antidumping and countervailing duties on imports of hot rolled, cold rolled and corrosion resistant steels. We should see final resolution on the trade suits during July and August of this year (far enough out to keep supply pressure on for awhile).

From SMU perspective we expect the flat rolled steel markets to be volatile over the next couple of months and heaven help us should there be a major disruption in domestic supply for some reason….

Steel buyers should stay on their toes and stay tuned to SMU for more market developments.