Prices

March 22, 2016

Slab Imports Pushing March Import Trend Higher

Written by John Packard

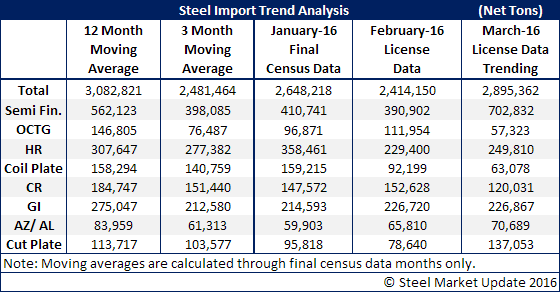

The U.S. Department of Commerce released new foreign steel import license request for the month of March 2016. Based on data through the 22nd of the month imports are trending higher than the past two months. At this point, SMU believes imports for March will settle somewhere around 2.6 to 2.8 million net tons.

If you are about to panic we would recommend that you relax as the biggest bump is in semi-finished (slabs) which are the steel mills reacting to stronger order books. As you can see by the table below, semi-finished imports are trending up by 300,000 tons. At the same time hot rolled, cold rolled and galvanized are trending less than their three month and twelve month moving averages…