Prices

March 15, 2016

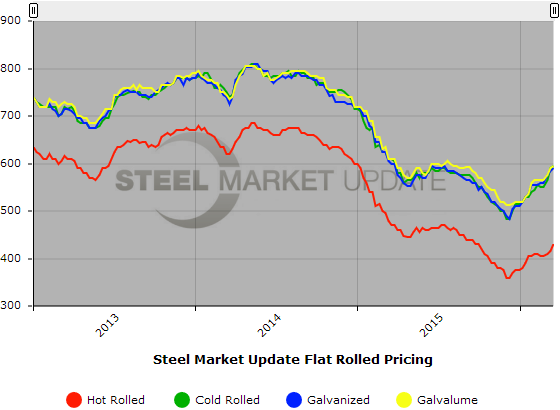

SMU Price Ranges & Indices: Prices Moving & Expected to Go Higher

Written by John Packard

Flat rolled steel prices continued to move higher over the past week. We are seeing even the weakest product, hot rolled, gaining traction as lead times move out due to the shutdown of US Steel and AK Steel mills (Granite City and Ashland). SMU was advised by both steel mills and steel buyers that orders have been brisk and there is little hot rolled left for the month of April production. One mini-mill told us that the integrated mills are “essentially out of the HR spot market.”

Add to this the fact that Nucor announced a plate price increase earlier today and the expectation has to be that another flat rolled increase of $40 per ton (the amount of the plate increase) is just around the corner. Add to that the successful (at least in our view) dumping determination by the US Department of Commerce and we see Momentum as being totally in the hands of the domestic steel mills.

We did receive a note from a manufacturing company this afternoon who said, “I think the mills are playing into a trap though. As you’ll remember, last summer the US mills went nuts and jacked up pricing to become the most costly steel suppliers on the planet. This, despite the fact that most, if not all, input costs were falling. The buying public immediately turned to imports and in 3-4 months, the market started it’s crash. The mills have already pushed three increases through the market and all have stuck, for a variety of reasons (several countries out due to AD/CVD, low inventories due to year end bleed off, input costs on the rise recently). In addition, the gap from landed import vs domestic price has been no more than $60/ton. When the gap meets/exceeds $80-$100/ton, imports will flow in again….”

A service center shared some thoughts with us this evening as well, “I think it’s the strongest we’ve seen thus far. Not runaway strong, but steady up, which is great. Mills are becoming less willing to negotiate on various factors, and some are only willing to quote fixed for 3-6 months, and not willing to look at index deals. Increasing Scrap prices are giving the mills the extra bit of momentum they needed to keep the movement going.”

At this moment here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $410-$450 per ton ($20.50/cwt- $22.50/cwt) with an average of $430 per ton ($21.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end increased $20 per ton. Our overall average is up $15 per ton over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $580-$610 per ton ($29.00/cwt- $30.50/cwt) with an average of $595 per ton ($29.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end increased $10 per ton. Our overall average increased $5 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.50/cwt ($570-$610 per ton) with an average of $29.50/cwt ($590 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is up $5 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $630-$670 per net ton with an average of $650 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.00/cwt ($580-$620 per ton) with an average base of $30.00/cwt ($600 per ton) FOB mill, east of the Rockies. Both the lower and upper end of our range increased $10 per ton compared to last week. Our overall average increased $10 per ton over one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$911 per net ton with an average of $891 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.