Market Data

March 15, 2016

Oil and Gas Prices and Rotary Rig Count Analysis

Written by Peter Wright

The following analysis was done by Peter Wright who writes a number of analytical articles for Steel Market Update. The energy markets are key markets for steel so it is important for our readers to understand oil and gas prices as well as the tubular products associated with drilling and transportation of oil and gas.

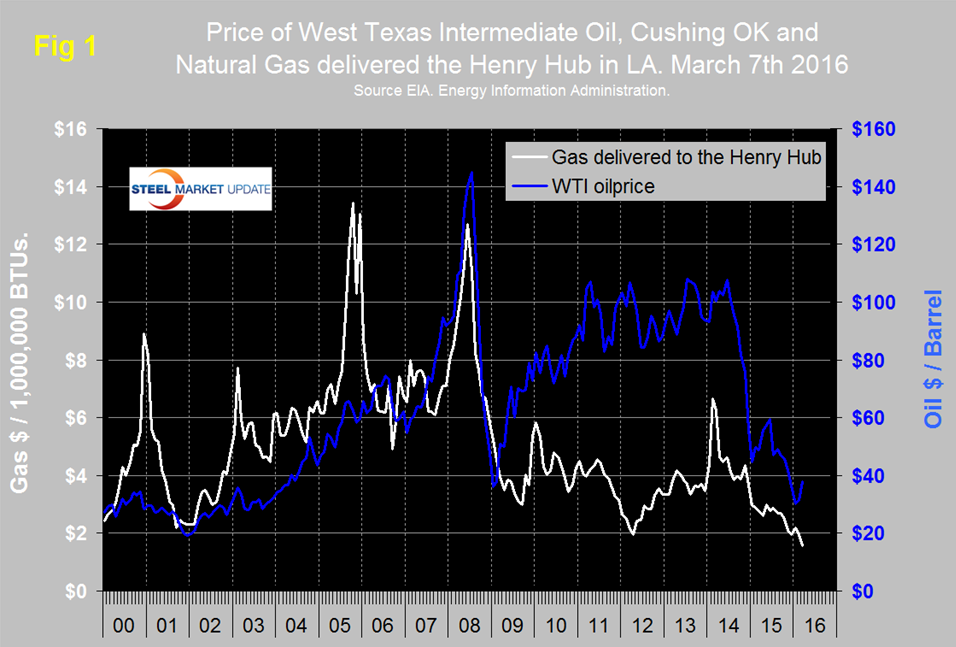

Figure 1 shows historical oil and gas prices since January 2000. The daily spot price of West Texas Intermediate (WTI) closed at $37.90 on March 7th up from $29.71 February 8th, according to the latest daily figure available from the Energy Information Administration (EIA).

Brent closed at $39.02 on March 7th. The futures price for WTI on March 14th was $37.18 which is still well below the recent high of $59.53 on June 15th 2015. The Short-Term Energy Outlook (STEO) released on March 8 forecasts that North Sea Brent crude oil prices will average $34 per barrel (b) in 2016 and $40/b in 2017, $3/b and $10/b lower, respectively, than expected in last month’s STEO. EIA expects that West Texas Intermediate (WTI) prices will average the same as Brent in 2016 and 2017, based on the assumption that the two crudes will compete in the U.S. Gulf Coast refinery market during the forecast period, with similar transportation differentials from their respective pricing points to that market.

The price of natural gas, delivered the Henry Hub in Louisiana closed at $1.57 on March 4th down from $2.11 on February 5th. March 4th was the latest data published by the EIA. The price has been trending down for two years and is now lower than at any time since our data began in January 1997. The United States is awash in natural gas in spite of the fact that U.S. power stations are expected to fuel the largest share of electricity generation in 2016 at 33 percent, compared with 32 percent for coal. This would be the first time that natural gas provides more electricity generation than coal on an annual average basis. In 2017, natural gas and coal are both forecast to fuel 32 percent of electricity generation. For renewables, the forecast share of total electricity generation supplied by hydro-power rises from 6 percent in 2016 to 7 percent in 2017, and the forecast share for other renewables increases from 8 percent in 2016 to 9 percent in 2017. Temperatures were warmer than normal in February, which contributed to Henry Hub spot prices declining throughout the month and averaging $1.99/MMBtu. As a result of warmer-than-expected weather, this month’s STEO revises upward the forecast for end-of-March 2016 working inventories to 2,288 Bcf, compared with 2,096 Bcf in last month’s forecast.

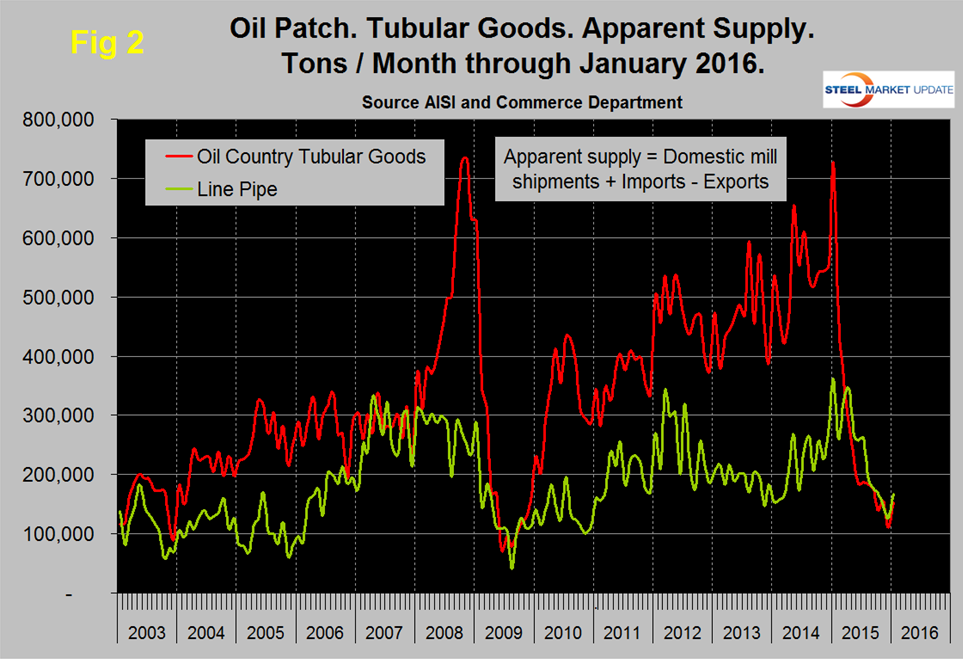

Figure 2 shows the apparent supply of the two main steel tubular products used in oil and gas production from January 2003 through January 2016 (Apparent supply is a proxy for demand).

The demand for OCTD and line pipe improved in January but are still historically low. Imports of pipe and tube were down by 62.1 percent year/year in three months through January, which was more than any other product.

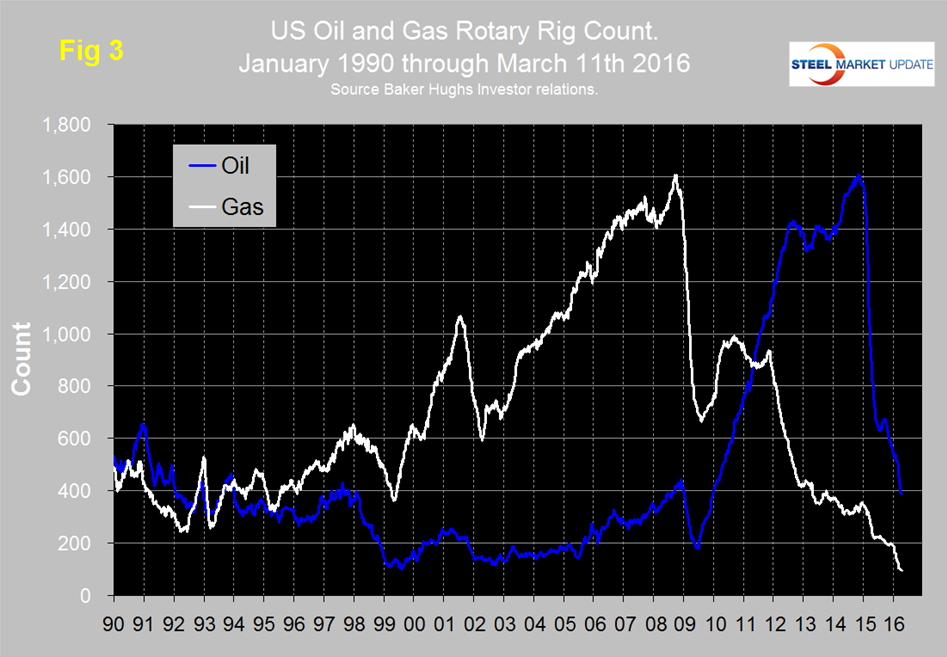

The total number of operating rigs in the US and Canada on March 12th was 578, down from 830 at the start of 2016 and down from 2,018 on January 2nd 2015. Year over year the total US and Canada rig count is down by 57.0 percent. Figure 3 shows the Baker Hughes US Rotary Rig Counts for oil and gas equipment in the US through March 11th (explanation below).

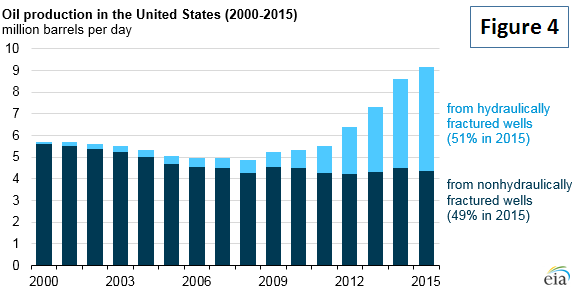

The decline in the US oil rig count hesitated in July and August but since then has been continuous, was down by 53 in the last month and this year it has been in free fall. Even though hydraulic fracturing has been in use for more than six decades, it has only recently been used to produce a significant portion of crude oil in the United States. This technique, often used in combination with horizontal drilling, has allowed the United States to increase its oil production faster than at any time in its history. Based on the most recent available data, the EIA estimates that oil production from hydraulically fractured wells now makes up about half of total U.S. crude oil production (Figure 4).

U.S. crude oil production averaged an estimated 9.4 million barrels per day (b/d) in 2015, and it is forecast to average 8.7 million b/d in 2016 and 8.2 million b/d in 2017. EIA estimates that crude oil production in February averaged 9.1 million b/d, which was 80,000 b/d below the January level.

After a slight recovery in late 2011 the decline in the gas rig count has continued and accelerated through February to the point that the number of operating rigs is now lower than at any time since our data began in January 1988. The decline hesitated this month but it’s too soon to tell if that signals a bottom.

On a regional basis in the US, the big three states for operating rigs are Texas, Oklahoma and North Dakota. Texas at 213 on March 11th was down from 318 at the beginning of the year, Oklahoma at 67 was down from 87 and North Dakota at 32 was down from 53.

About the Baker Hughes Rotary Rig Count: These are a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States. Rigs are considered active from the time they break ground until the time they reach their target depth and may be establishing a new well or sidetracking an existing one. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies.