Prices

March 15, 2016

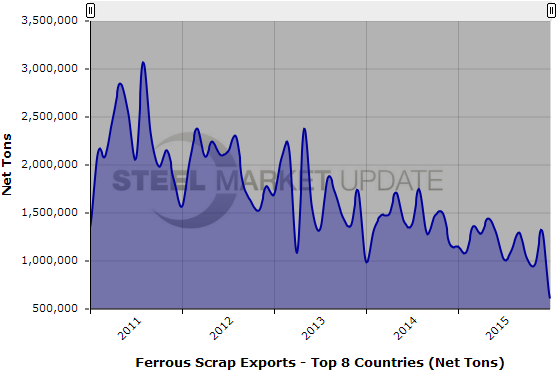

January Ferrous Scrap Exports Cut in Half

Written by Brett Linton

January ferrous scrap exports totaled 607,272 net tons (550,909 metric tons) with Turkey, India, Mexico, Peru, and Taiwan being the top five countries receiving scrap from the United States. These five countries accounted for 67.3 percent of all scrap exports.

Total January ferrous scrap exports were 53.9 percent lower than previous month and 47.1 percent lower than the same month one year ago. The last time total ferrous scrap exports were this low was in September 2001 when 578,952 tons of ferrous scrap was exported. The most significant change month over month went to Turkey, with a decrease of 394,301 tons from December to January and at the lowest levels seen since April 2013.

The table below lists the top eight importing countries along with the total amount of exported ferrous scrap.

Below is a graph showing the history of total ferrous scrap exports, to use it’s interactive features and explore different countries you must visit out website by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.