Prices

February 23, 2016

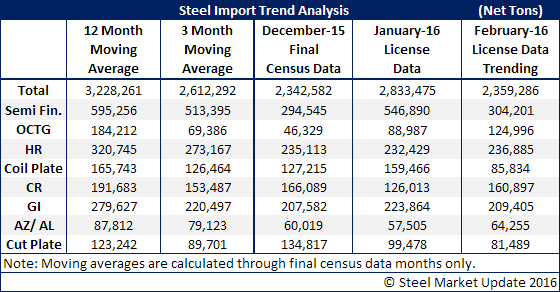

February Steel Imports Trending Toward 2.3 Million Tons

Written by John Packard

The U.S. Department of Commerce updated foreign steel import license data this afternoon (February 23rd). Based on a daily license rate of 81,355 tons, February is trending toward 2.2-2.3 million tons. This is slightly lower than the 2.4 million ton pace we saw based on license data through the 16th of February. At 2.3 million tons, if it holds up when the final count is in, it will be well below both the 12 month-moving average of 3.2 million tons as well as the 3 month moving average of 2.6 million.

When looking at flat rolled license data we are seeing hot rolled trending lower (Preliminary Determination on antidumping ruling is due in March), cold rolled appears to be stabilizing around 150-160,000 tons (Preliminary Determination on AD due next week), galvanized and Galvalume continue to drop below their 12MMA and 3MMA levels.

One surprise is we are starting to see OCTG (oil country tubular goods) licenses trending higher than what we had seen over the past few months.

Out of curiosity SMU took a look at steel exports out of Vietnam as this is one country that has been absorbing a portion of the Chinese cold rolled and galvanized market share here in the U.S. Their cold rolled licenses are trending toward a 16,700 net ton month. This is in line with what we saw in December and January from Vietnam. Galvanized, on the other hand, has been growing over the past three months with this month trending toward a 30,000 ton month. The previous two months were 18,277 net tons (Dec) and 21,223 net tons.

While attending the Port of Tampa Steel Conference I happen to be at dinner with a couple of trading companies and one of the port warehousing operations. A portion of the discussion was regarding the quality of the packing of a shipment (by container) of galvanized coils from Abu Dhabi in the United Arab Emirates. They are not a large exporter of galvanized averaging just 1,400 net tons during the months of December and January. They have 1,588 net tons of license requests for February. One year ago Abu Dhabi shipped 95 tons of galvanized to the United States.

Another “new” supplier of cold rolled showing up for the first time on the US DOC license data screen (which goes back to December 2014) is Thailand. Thailand has requested 5,200 net tons of cold rolled licenses so far for February.