Market Segment

February 22, 2016

North Star BlueScope Strong Performer for BlueScope Steel

Written by Sandy Williams

BlueScope Steel is one of only a handful of major steel companies around the world that is reporting profit. Underlying EBIT for the first half of FY 2016 was $166.5 million, up 35 percent year over year..

Commenting on the outlook for the company, CEO Paul O’Malley said, “Notwithstanding a challenging macroeconomic environment, we are benefitting from the significant cost reductions and process improvements we are implementing, we expect 2H FY2016 underlying EBIT to be up to 60% higher than 2H FY2015….Pretty good second half outlook expected for the business.”

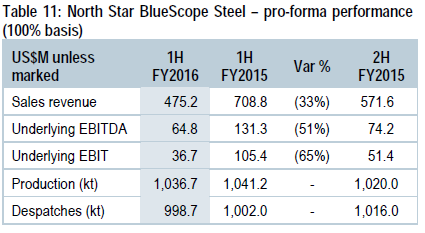

BlueScope acquired the remaining 50 percent of its U.S. asset, North Star BlueScope Steel in Delta, Ohio, in October 2015. BlueScope Steel provided a pro forma performance chart on a 100 percent basis, in U.S. dollars, that is used below for data on North Star’s results for 1H 2016.

North Star has been operating at 100 percent capacity utilization compared to the U.S. industry average of less than 70 percent.

Total shipments at North Star in the first half of FY 2016 were 998,700 tonnes, down slightly from 1,016,000 tonnes in the second half of FY 2015. Sales revenue totaled $475.2 resulting in an underlying EBIT of $36.7 million, down 65 percent year over year due to lower HRC pricing in 1H 2016. A softer spread of $203 per tonne was noted due to Midwest HRC steel prices falling lower than raw material prices during the half that was partially offset by FX translation.

The portion of North Star shipments attributable directly to BlueScope Steel was 42 million tonnes, exactly as forecast by BlueScope and accomplished during a “tough cycle in the U.S.”

“We think that North Star was one of only two steel companies in the United States that was actually profitable in the second quarter of the fiscal year,” said O’Malley. “The quality of the asset, the low cost base, the performance is very, very good. Spreads are starting to increase. It’s a cyclical business, but one that we think is very well-positioned.”

During the earnings conference call O’Malley was asked to comment on the U.S. HRC price hikes and antidumping cases.

“North America hot rolled coil prices have come off their bottom by about $20 to $30 a ton, and that’s pre-any dumping rulings on hot rolled which are expected I think in March,” said O’Malley. “So, there is some expectation, sorry, and there has been reduction of imports into the North American market as well. So, one thing I’ve always learned about North America is don’t get people’s business forecasting in January or February or March because it’s so cold it’s hard to be positive, but it will be really interesting to see how those prices and demand move post the anti-dumping rulings in March, and as one moves into the more productive spring and summer months.”

On the U.S. building sector O’Malley commented, “I’ve said that there has been some softening in industrial demand driven by less agricultural spending infrastructure because commodity prices for agricultural products have dropped a bit in the U.S., but also I think the strength of the U.S. dollar is bit of an issue.”

An analyst on the call asked O’Malley to comment on whether BlueScope’s market intelligence in China has seen a reduction of crude steel production.

“Our understanding of China and intelligence are probably two words you don’t always put together, but what we are seeing is that, in our conversations, many of the mills are challenged in making money. That steel, I think, is being produced in many millions of tons off the back of excess liquidity, not out of the back of positive cash flow. So it’s a question of how long many of the mills are funded and we know some of the significant mills that made money 12 months ago have lost billions of real money in this past year. So there will be production slowdowns, but you’ve got the flip side of social disruption on widespread job loss.

“But we also do know that mills are actually being required to invest in quite significant environmental capital projects and they are spending that money, particularly in the large mills. So in a normal world, you’d say that they will be, there would be capital reductions. What I don’t know is how much balance sheet reconstruction could occur and clearly we see that real timing even in our own markets so that can keep mills going. So we think that production will come off a bit, that exports will come off a bit, but it will take longer than one would normally expect.”