Market Segment

February 18, 2016

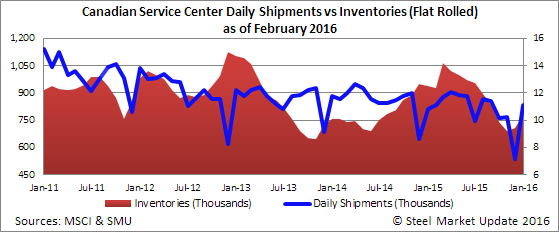

Canadian Distributor Flat Rolled Inventories Drop

Written by Brett Linton

A note from the Metals Service Center Institute (MSCI) regarding a change in data: “For this month’s Metals Activity Reports in Canada, and going forward, there have been changes in the companies in the sample. These changes result in a reduction in the number of product categories being reported. As indicated on the reports Carbon Structural and Aluminum Extruded Shapes are no longer included. The report totals and historical data also reflect these changes.”

Canadian shipments for all steel products in the month of January were 389,700 net tons, an increase of 42.8 percent from the month before but a decrease of 4.0 percent from January 2015. Inventories at the end of the month stood at 1,250,200 tons, up 7.2 percent from last month but down 19.2 percent from the same month one year ago. The daily average receipt rate for January was 23,695 tons per day (20 day month), up from 13,595 tons per day the month before (21 day month). Total January receipts were 188,400 tons higher than the December figure. According to the MSCI, total steel product inventories stood at 3.2 months at the end of January, down from 4.3 months at the end of December.

Flat Rolled

Canadian shipments of flat rolled products for the month of January were 222,200 tons, an increase of 48.6 percent from the month before but a decrease of 2.4 percent from the same month one year ago. Inventories at the end of the month were 778,900 tons, up 10.1 percent from last month but down 16.7 percent from the same month one year ago. The daily receipt rate for January was 14,675 tons per day, up from 7,990 tons per day the month before. Total tonnage received was 293,500 tons, up from 167,800 tons the month before. Flat rolled inventories stood at 3.5 months in January, down from 4.7 months of supply in December.

Plate

Canadian shipments for plate products in the month of January were 78,500 tons, an increase of 48.4 percent from the month before but a decrease of 1.6 percent from January 2015. Inventories at the end of the month were 195,200 tons, an increase of 1.1 percent from last month but a decrease of 40.2 percent from the same month one year ago. The daily average receipt rate for January was 4,030 tons per day, up from 2,343 tons per day the month before. Plate inventories ended the month at 2.5 months, down from 3.6 months in December.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of January were 44,300 tons, an increase of 22.0 percent from the month before but a decrease of 12.3 percent from the same month last year. Inventories at the end of the month were 135,300 tons, up 0.9 percent from last month but down 5.0 percent from the same month one year ago. The daily average receipt rate for January was 2,275 tons per day, up from 1,814 tons per day the month before. Total months on hand for pipe and tube inventories stood at 3.1 months, down from 3.7 months of supply at the end of December.