Government/Policy

February 16, 2016

Trade Evasion Concerns Addressed by Enforcement Act

Written by Sandy Williams

Last week, the Senate passed the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA). The bill contains important provisions of the Enforcing Orders and Reducing Customs Evasion (ENFORCE) Act that have been promoted by the U.S. steel and manufacturing industries to combat evasion of antidumping and countervailing duties .

Evasion is defined as failing to declare imports as subject to an AD/CVD order or declaring imports as subject to a lower AD/CVD rate. It also occurs when products are purposely shipped to a country not subject to duties (or to lower duties) and then sent on to the U.S. with a new country of origin declaration.

The new provisions require the U.S. Customs and Border Protection (CBP) to initiate an investigation within 30 days of receiving a petition and issue a preliminary determination in 90 days. The final determination must be made within a year (300 days). Violators found to have evaded AD/CVD orders will be subject to increased duties, potentially from the date of the initiation of the CBP investigation. CBP is held accountable for its determinations by the Court of International Trade.

Previously, CBP was not required to respond to allegations of duty evasion and lacked a formal mechanism for conducting an investigation. TFTEA provides new funding for trade enforcement efforts and increases the personnel at CBP devoted to identifying and punishing trade evasion.

“Steel imports are decimating the American steel industry and it is imperative that we have the strongest tools and resources to fight back,” said American Iron and Steel Institute President and CEO Thomas Gibson. “The ENFORCE Act would create new procedures at Customs and Border Protection to address the evasion of anti-dumping and countervailing duties within set deadlines.”

So how common is trade evasion? Frequent enough for the steel industry to take the issue very seriously.

“Rampant duty evasion undermines the impact of trade cases, thereby harming the domestic industry and its workforce,” said Steel Manufacturing Association President Philip Bell. “The passage of this legislation is an important step in ensuring that duties are collected and our nation’s trade laws are enforced.”

Alliance for American Manufacturing spokesman Jet Moody said. “”Countless U.S. jobs have been lost because of predatory trade practices like foreign dumping, subsidies, and other unfair practices This bill gives U.S. companies and American workers the tools to fight back, making it easier to address trade cheating with reforms to the processes of handling allegations of trade law evasion.”

Nucor’s sales team has seen firsthand the attempts to circumvent trade duties.

Nucor spokesperson Katherine Miller said, “In recent years, Nucor teammates have received solicitations from overseas entities offering their services to circumvent or evade hard-fought U.S. trade remedies through the use of shell companies, false import documents, and transshipment through third-party countries. The ENFORCE Act provides the government more effective tools to fight evasion, and sends a clear message that we are going to hold our trading partners accountable.”

Added Miller, “We are pleased Congress passed customs legislation which contained provisions of the ENFORCE Act addressing the evasion of anti-dumping and countervailing duty orders. Imports remain a major challenge and trade remedies are only effective if we can ensure authorized duties are actually collected. Duty evasion is a problem and further injures domestic steel companies.”

Lisa Harrison, Senior Vice President-Communications at AISI told SMU, “We consider duty evasion VERY serious, which is why we have been working with the Hill for years to see the successful passage of the ENFORCE Act.

A very illuminating report on duty evasion was prepared for Sen. Ron Wyden (D-OR) in November 2010. Staff members set out to see just how easy it was to find companies willing to participate in trade evasion.

In August 2010, a staff member created a fictitious company called AvisOne Traders, Inc (anagram for “evasion”) and set up a company profile on China’s largest business-to-business e-commerce website, Alibaba.com, in order to find companies willing to evade AD/CVD orders. During the two week period 120 companies were contacted regarding purchase of a variety of products. Forty-seven responses were received and, of those, written confirmation was received from 10 Chinese companies willing to evade duties on products shipped to the U.S.

The conclusion was:

“Foreign suppliers subject to AD/CVD orders and their U.S. importers avoid paying AD/CV duties by a number of unscrupulous schemes, including illegal transshipment and falsified country of origin markings, undervalued invoices to pay less duty, and misclassification of goods. In sum, they cheat.”

The staff member asked in each case, “Are your [products] subject to any U.S. anti-dumping duties? If so, in your experience is there any way to avoid paying the duties?”

Some of the responses follow:

Concrete nails: “Yes . you want concrete steel nails? if you want to avoid paying the duties ,there is the way is send the goods to Malaysia and change a box ,then send to U.S so what do you think about it .” (This is Illegal transshipment.)

Paper notebooks: “Thank you for your reply ! I am sorry so late reply you ! we have no experience to avoid paying the anti-dumping duties ,besides we make the commerical invoice , we write that the value of products is less than the factual cost .” (This company admits it undervalues products on commercial invoices, which is a form of duty evasion)

Rectangular tubular products: “Yes,there has a way to avoid paying the antidumping duties .It’s entrepot trade. Ex-port documents issued by the third countries so that facilitate you in yours customs clearance, avoid “anti-dumping duties”customs clearance. Can you accept the export file as payment terms, at the same time to third countries as its export documents, can reduce clearance documents tariffs?And i’ve make certain about that rectangular tubular products subject to any U.S. antidumping duties. Do you have any questions?” (This is illegal transshipment.)

A trading company based in Turkey was contacted about the purchase of OCTG pipes. The trader blatantly describes how it will ship OCTG with a false country of origin:

“JUST MY BIG SPANISH PARTNER WHICH WE MADE WITH THEM OVER 10 MILLION USD PIPE ORDERS BEFORE SAID ,THEY CAN SHIP GOODS FROM VALENCIA SPAIN WITH EU ORIGIN CERTIFICATE .GOODS WILL BE PRODUCED IN CHINA& THEY WILL CHANGE ORIGIN IN SPAIN AND REEXPORT .THIS ONE OK? ALSO OUR SPAIN SELLER CAN OFFER UKRAIN OR EU ORIGIN .”

The fictitious US importer tells the trader that what he has described is “circumvention” which is subject to firm prison time and ceases communication. The trader writes back:

“YOU ARE VEYR HARDWORKING PERSON. IT MEANS IF THEY CHANGE ORIGIN WITH COATING, PAINTING, BEVELLING ETC FORMALLY , ACCORDING TO EU LAW ALSO NOT POSSIBBLE TO USE CHINESE RAW MATERIAL ? SO I IGNORE IT.”

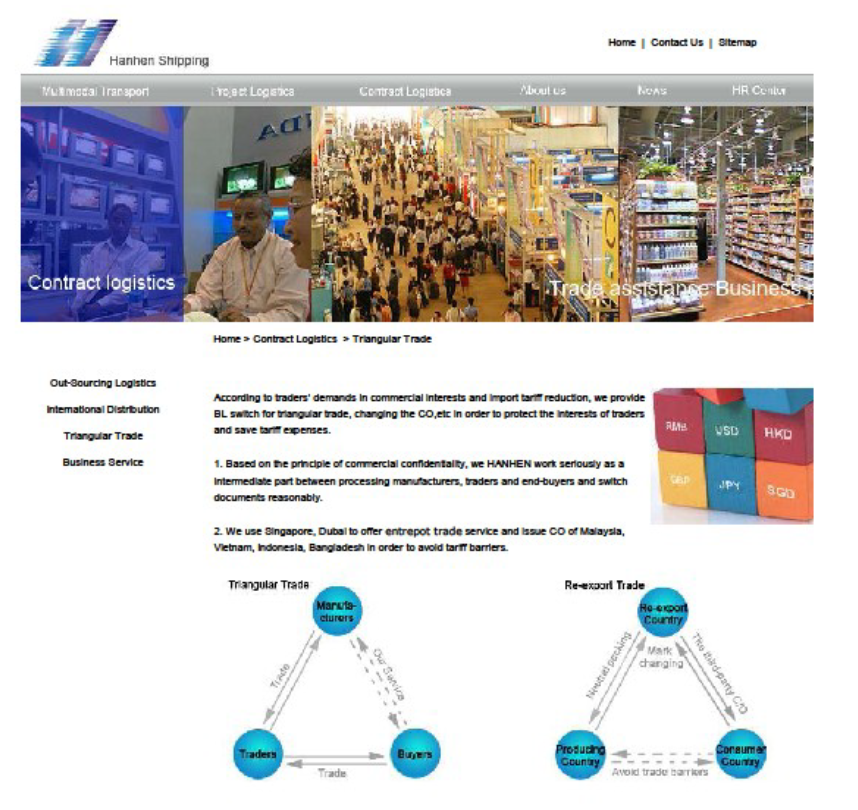

The report also prints ads from traders that do not hide their illegal means of conducting business. The one from Hanhen Shipping below has since removed the reference to re-export trade from its website.

Reports like the one prepared for Sen. Wyden’s office illustrate just how serious the situation is.

The Committee to Support U.S. Trade Laws (CSUSTL), a coalition of representatives from manufacturing, technology, agriculture and mining, applauded passage of the Trade Facilitation and Trade Enforcement Act.

Tamara Browne, one of the Co-Chairs of the CSUSTL Government Affairs Committee, noted the frustration that many domestic users of trade remedies have felt when foreign producers or their importers have evaded the duties owed through misclassification, undervaluation, transshipment and other practices.

“For all of us who have seen the positive effect that enforcement of our trade remedy laws can have on domestic producers and their workers, it is critical that evasion practices be found out and addressed. This new law will make the effort to crackdown on those who would evade the law more effective and preserve jobs in America.”