Prices

February 16, 2016

February Steel Imports Trending Toward 2.4 Million Ton Month

Written by John Packard

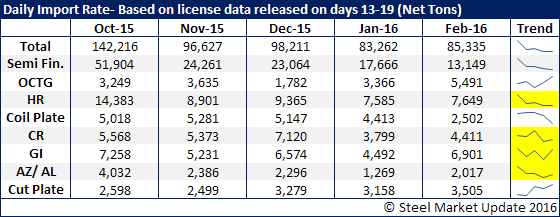

The U.S. Department of Commerce released foreign steel import license data through the 16th of February this afternoon. Licenses are running in line with what we saw during the month of January. January (which has 31 days) is looking like a 2.6-2.8 million ton month. February should be slightly less than that and currently is projected at 2.4 million tons.

In the table below we review where license data has averaged for the past 4 months at this point during the month. The highlighted yellow areas are showing the trend during up through the 16th of February. Next week we will lay out a more detailed view of the monthly data for the previous months and a projection for each item for the month of February based on the data through February 23rd.