Prices

February 14, 2016

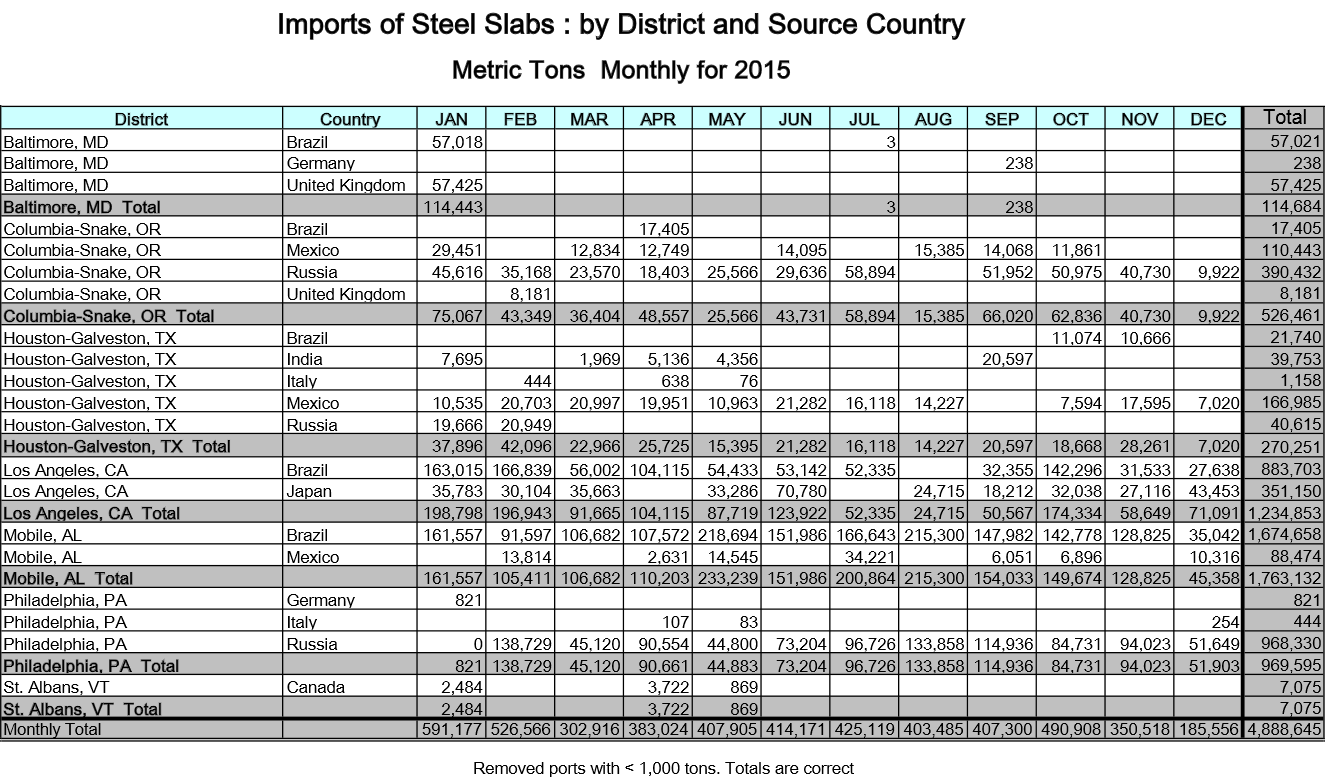

Imports of Slabs to the US in 2015 by Source Country and Port of Entry

Written by Peter Wright

In 2015, 4.9 million metric tons of slabs were imported into the US. Of that tonnage 1.8 million tonnes (1,984 million net tons) came into Mobile (bound for AMNS Calvert) and 1.2 million (1.322 million net tons) into Los Angeles (bound for California Steel).

Most of the Mobile tonnage came from Brazil and the Los Angeles tonnage was split 2/3:1/3 between Brazil and Japan (California Steel is a 50/50 joint venture between Vale in Brazil and JFE Steel in Japan).

Brazil at 2.7 million tonnes shipped in over half of the total.

Russia shipped 1.4 million tonnes of which almost a million came into Philadelphia (NLMK Russia reported shipping 1.221 million tonnes to their USA facility during fiscal year 2015).

Mexico shipped in 366,000 tonnes.

By month through 2015 January saw the highest tonnage and December the lowest though there was not a steady progression between those two levels. March through November saw a fairly steady rate of entry.

Note that you can click the image below to see it in a larger format.