Market Data

January 31, 2016

January: End of Month Data

Written by John Packard

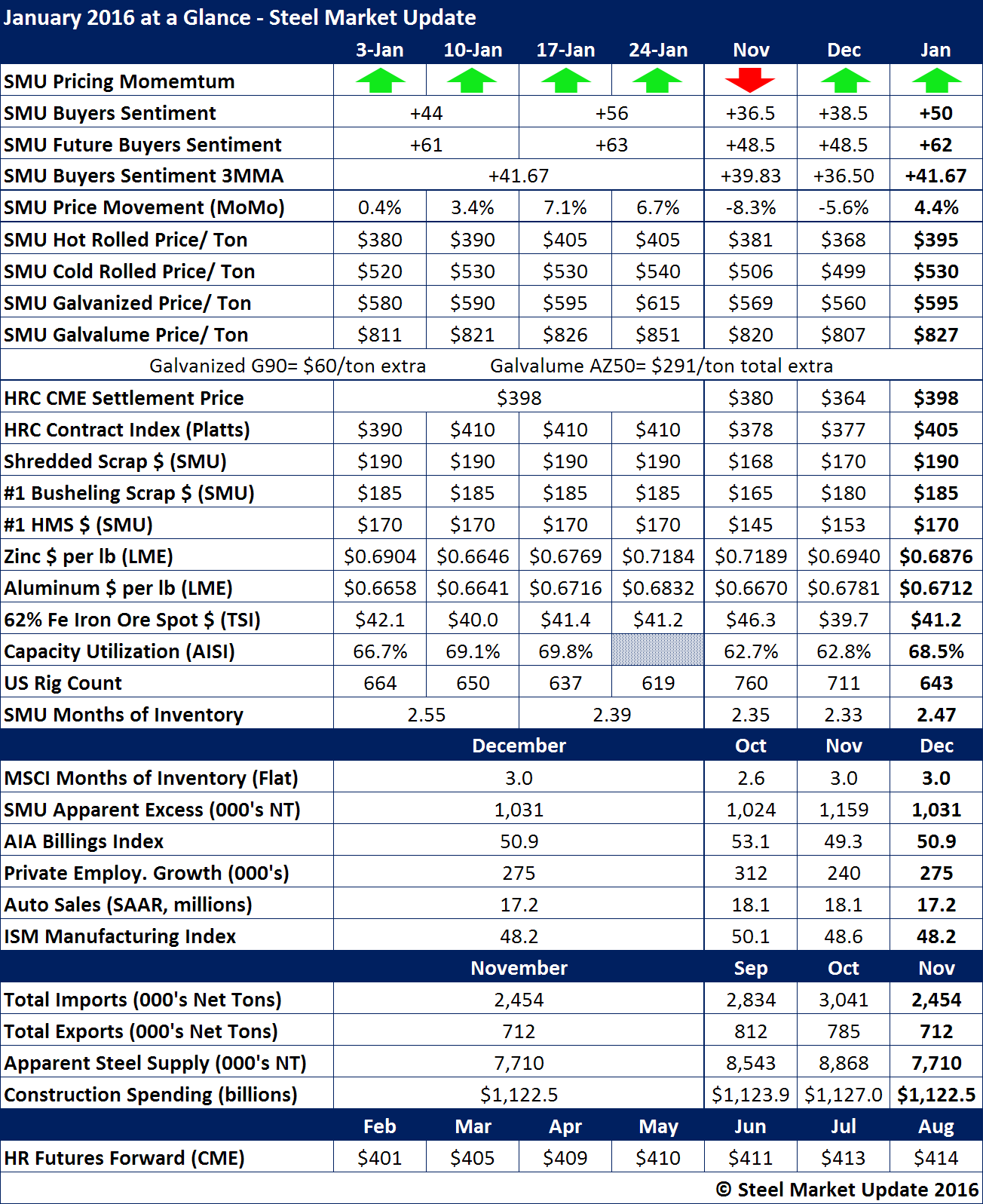

We ended the month of January on a positive note. SMU Price Momentum Indicator continues to point toward higher prices over the next 30 days. Our Sentiment Index broke through an extended downward (growing pessimism) trend and is now heading higher (more optimistic). We believe a portion of the improvement is due to flat rolled steel prices heading higher and partially may be due to moving into the New Year.

Our HRC average for the month was $395 per ton, slightly lower than the CME settlement price for January which was $398 per ton. Platts has been running slightly higher at $403 per ton.

Scrap prices rose modestly at the beginning of the month while zinc closed the month up slightly to $0.7364 per pound and aluminum ended the month at $0.6892 per pound. Spot iron ore (China) has been hovering just above $40/dmt as the month ended.

Capacity utilization rates have been improving and are very close to breaking through the 70 percent level in the coming days.

SMU Apparent Excess (Premium product) is dropping and we anticipate will be close to “balanced” by March barring any unforeseen circumstances.

ISM Manufacturing Index is below 50.0 for the second month in a row.