Prices

January 28, 2016

2015 Foreign Steel Imports Drop 12.7%

Written by John Packard

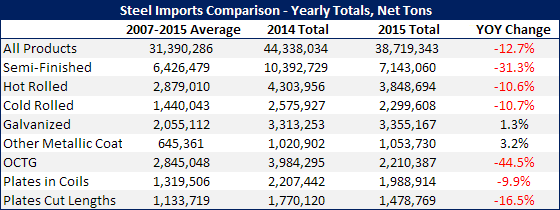

Foreign steel imports for calendar year 2015 came in at 38,719,343 net tons. This represents a 12.7 percent reduction in tonnage compared to 2014. However, 2015 is still well above the average of imports seen over the past seven years. We saw large reductions in tonnage for semi-finished (mostly slabs), hot rolled, cold rolled, plates (cut length and coils) and OCTG. Coated products were one area where we actually saw a slight increase which is a bit of a surprise considering the corrosion resistant trade suit was the first one filed back in early June 2015.

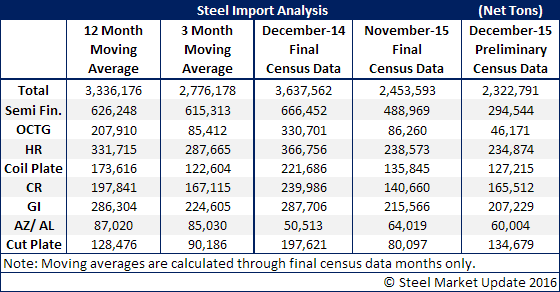

The U.S. Department of Commerce released preliminary census data for the month of December 2015. December 2015 imports are being reported as being 2,322,791 net tons down 1.3 million tons from the 3,637,562 net tons imported during December 2014.

As you can see in the table below there have been some significant changes in a number of the products that we watch on a consistent basis. Oil Country Tubular Goods (OCTG) at 46,171 tons is nowhere near the 330,701 tons imported one year earlier. A good portion of the change is due to the weakness in the energy markets.

Semi-finished (mostly slabs) were down significantly over the prior month, 3MMA and 12MMA as well as what we saw one year earlier.

At the moment, we are expecting January imports to be slightly higher than December at 2.5-2.7 million nets tons.

As we have mentioned in the past, license data provides us a feel for the trend but we tend to see 100,000-300,000 variances in the census data versus the license data. We have written articles on this subject in the past which you can see on our website blog and/or our past newsletter articles.