Prices

January 19, 2016

January Imports Continue Trend Toward Low to Mid 2 Million Tons

Written by John Packard

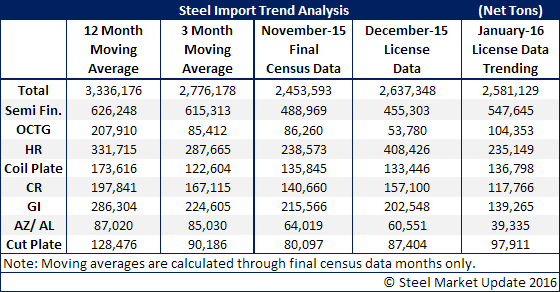

The U.S. Department of Commerce released foreign steel import license data for the month of January. Based on license data through the 19th of January steel imports are trending toward a 2.3-2.5 million net ton month. If the trend continues the month would be well below both the 3 month and 12 month moving averages and in line with November and December.

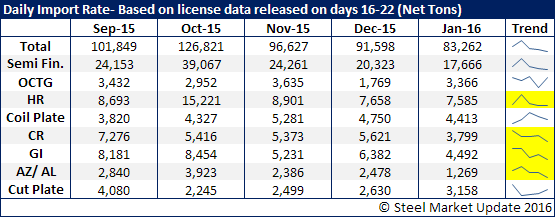

SMU likes to look at the data and compare it against other months at this point of the month (approximately 16-22 days of license data). We want to see how the daily license rate compares and as you can see by the table below January daily rate is below that of September, October, November and December. We have highlighted the four main flat rolled products and provided their trend line during this time period to give you a better feel for the direction imports of these products are headed.