Government/Policy

January 19, 2016

Attorney Lewis Liebowitz Updates SMU on Status of Trade Cases

Written by John Packard

With all of the key flat rolled products, hot rolled, cold rolled and corrosion resistant steels involved in antidumping and countervailing trade suits and the results of the preliminary determinations coming out it can be daunting to keep track of where each case rests at this point in time. Steel Market Update reached out to trade attorney Lewis Liebowitz to help us (and our readers) understand the status of each product and what are the important dates to remember as of today. Things change and we are finding the process quite complicated and far from over. Here is what we know so far:

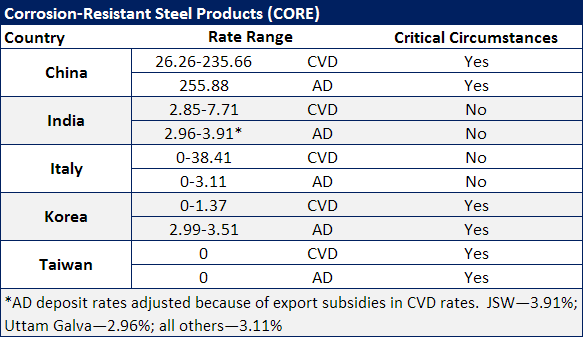

Preliminary Determinations Status for CORE: Corrosion Resistant Steels (Galvanized/Galvalume, etc.)

The corrosion resistant case which covers galvanized, Galvalume and other coated steels was the first case to be filed by the domestic steel mills. The initial case for antidumping (AD) and countervailing duty (CVD) was filed on June 3, 2015 against China, India, Taiwan, South Korea and Italy. Critical circumstances were filed on July 24, 2015.

Petition filed: June 3, 2015

Preliminary CVD determinations: November 3, 2015

Preliminary AD determinations: December 22, 2015

Final AD and CVD determinations: May 10, 2016 (Taiwan March 8)

Final ITC determinations: July 7, 2016

The corrosion resistant trade case, had both countervailing duty (CVD) and antidumping (AD) preliminary determinations announcements made by the US Department of Commerce. At the same time the results of the critical circumstances challenge were also made. Here is the status of each country based on the CVD, AD and critical circumstances:

Adjustment of AD duty deposit rates to account for export subsidies

Trade attorney and Leadership Summit speaker on trade told SMU regarding the CORE deposit rates required, “Commerce will adjust AD deposit rates to deduct countervailing duties attributable to export subsidies. The only respondents adjusted in the CORE preliminary determination were from India. Two exporters received a reduction in the AD deposit rate because export subsidies were found for those exporters: JSW and Uttam Galva. Their AD deposit rates were adjusted to 3.91% and 2.96% from 6.64% and 6.92%, respectively. The “all others” AD rate was adjusted from 6.76% to 3.11% for the same reason. For all other countries, Commerce did not adjust the AD deposit rates because there were no export subsidies.”

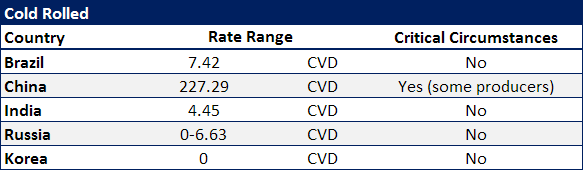

Preliminary Determinations Status for Cold Rolled

The domestic steel mills filed trade cases on cold rolled steels against China, Brazil, India, Japan, South Korea, Netherlands, Russia and the United Kingdom.

Petition filed: July 28, 2015

Preliminary CVD determinations: December 22, 2015

Preliminary AD determinations: February 23, 2016

Final AD and CVD determinations: May 10, 2016 (could be extended)

Final ITC determination: May 16, 2016 (could be extended)

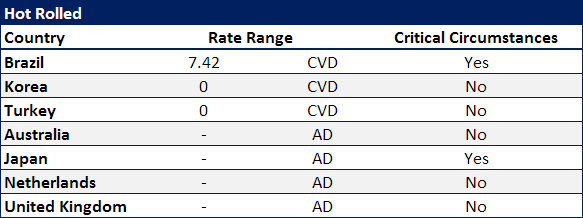

Preliminary Determinations Status for Hot Rolled

Lewis Liebowitz explained the just published CVD preliminary determination on hot rolled to us and our readers with the following:

Last week (January 15), the Commerce Department published preliminary determinations in the countervailing duty investigations of certain hot rolled steel (HR steel) from Brazil, Turkey and Korea. Commerce determined that Brazil was providing subsidies for HR steel; but it determined that de minimis subsidies were provided for HR steel from Turkey and Korea. Therefore, the preliminary determinations for Turkey and Korea were negative and no duty deposits will be required for those countries.

The AD investigations of HR steel from those three countries, as well as Australia, Japan, the Netherlands and the United Kingdom are still pending. The decision deadline for the AD investigations is March 8. Domestic petitioners did not file CVD petitions against Australia, Japan, the Netherlands or the UK.

The CVD investigations against Brazil, Korea and Turkey will all continue—a Commerce preliminary negative determination does not end the investigations. The final CVD determinations were “aligned” with the final AD determinations, meaning that all AD and CVD final determinations in the HR steel investigations will be announced on the same day (currently May 22, 2016). The final determination date could be postponed by up to 75 days until mid-July.

The negative preliminary determinations on Turkey and Korea mean that no CVD deposits are payable on HR steel from those countries until the final determinations. If the final determinations are negative, the CVD investigations will terminate.

The Brazil determination was affirmative. Effective January 15, 2016, entries of HR steel from Brazil will require CVD cash deposits of 7.42 percent of entered value. In addition, entries up to 90 days before the effective date are potentially subject to countervailing duties because Commerce found “critical circumstances” on imports from Brazil (and Japan) in December.

Commerce will instruct Customs to require estimated duty deposits for all entries on or after January 15, and may be instructed to collect duty deposits for entries back to October 15, 2015 because of critical circumstances determinations.

As you know, AD and CVD orders are issued if the Commerce Department finds dumping and subsidies, and the International Trade Commission finds material injury or threat of injury to the domestic industry competing with the imports. The final ITC injury determinations are due within 45 days after the Commerce final determinations (the current date is July 7, but this could be postponed).

Petition filed: August 11, 2015

Preliminary CVD determinations: January 15, 2016

Preliminary AD determinations: March 8, 2016

Final AD and CVD determinations: May 23, 2016 (could be extended)

Final ITC determinations: July 7, 2016 (could be extended)