Market Data

January 15, 2016

Shipments and Supply of Sheet Products through November 2015

Written by Peter Wright

This report compares domestic mill shipments and total supply to the market. It quantifies market direction by product and enables a side by side comparison showing the degree to which imports have absorbed demand. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU.

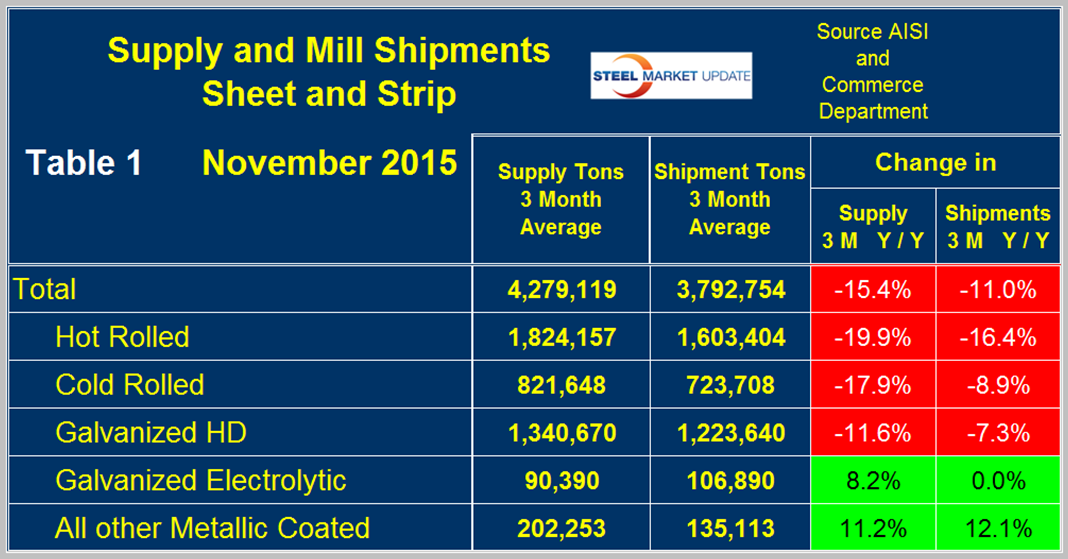

![]() Table 1 shows both supply and mill shipments of sheet products (shipments includes exports) side by side as a three month average for the periods September through November for both 2014 and 2015.

Table 1 shows both supply and mill shipments of sheet products (shipments includes exports) side by side as a three month average for the periods September through November for both 2014 and 2015.

Comparing these two periods total supply to the market was down by 15.4 percent and shipments were down by 11.0 percent. The fact that supply was down by more than shipments means that imports put less pressure on the market than they did in most of 2015. Table 1 breaks down the total into the individual sheet products and it can be seen that for the big three items, HR, CR and HDG, shipments all fared better than supply. Supply of hot rolled was down by 19.9 percent and shipments were down by 16.4 percent, cold rolled supply was down by 17.9 percent as shipments were down by 8.9 percent. HDG supply was down by 11.6 percent as shipments declined 7.3 percent. This means that in all three cases imports gave up some ground. Electro-galvanized lost ground to imports as supply was up by 8.2 percent and shipments were flat. Electro-galvanized enjoys a trade surplus which weakened in November. Other metallic coated products (mainly Galvalume) bucked the trend and continued to have positive growth in both supply and shipments with 11.2 percent and 12.1 percent respectively. A review of supply and shipments separately for individual sheet products is given below.

Apparent Supply

Apparent Supply is a proxy for market demand and is defined as domestic mill shipments to domestic locations plus imports. In three months through November 2015 the average monthly supply of sheet and strip was 4,279,000 tons, down by 15.4 percent year over year as mentioned above. In the last three months supply was down by 12.1 percent compared to June through August and down by 6.6 percent YTD. The short term decline (3 months) is less than the long term (12 months) which means that the decline is slowing. Table 2 shows the change in supply by product on this basis through November.

There is a big difference between products. Galvalume looks good on all three time comparisons. HR, CR and HDG declined in all three time comparisons though for HR and CR the decline is slowing. Electro galvanized had a very strong month in October which resulted in a positive 20.5 percent growth in 3 months year over year.

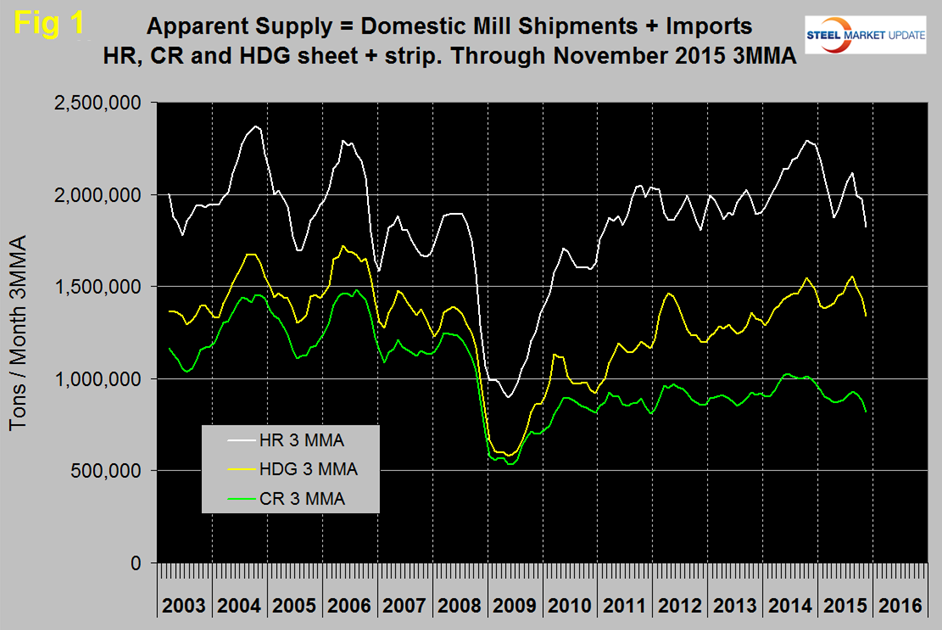

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2003 as three month moving averages.

Hot rolled declined every month November through April then picked up in May, June, July and August before declining again in September, October and November. Cold rolled also declined in November 2014 through April 2015, picked up more slowly in May through August and also declined in September, October and November. Hot dipped galvanized also experienced a decline in September, October and November. In Q4 2014 all three were in higher demand than at any time since the recession. That is no longer the case for any of them.

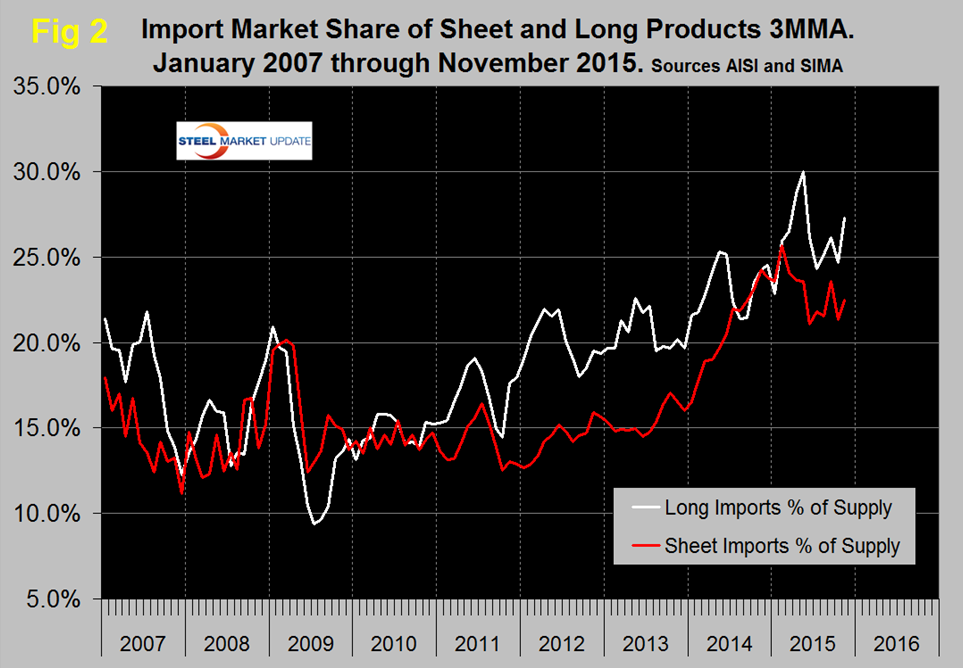

Figure 2 shows import market share of sheet products and includes long products for comparison.

Based on a 3MMA the import market share of sheet products was 22.5 percent in November, the highest since May. This level resulted from a decline in the market rather than an increase in imports. Import market share of long products in November was 27.3 percent, up from 24.7 percent in October. This was also due to a decrease in supply rather than an increase in imports.

Mill Shipments

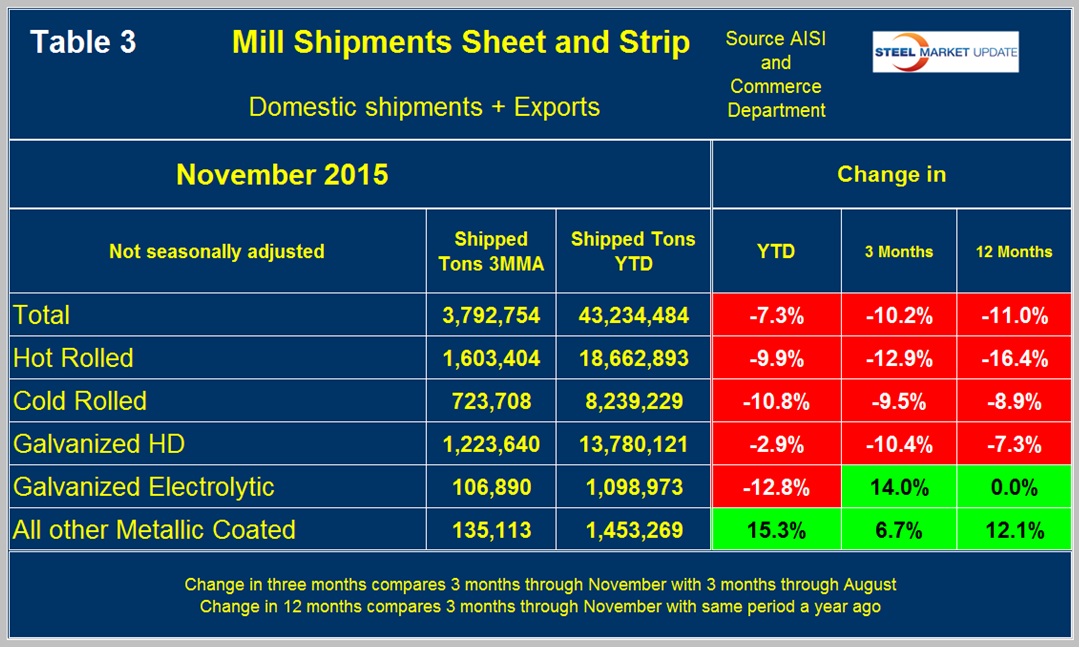

Table 3 shows that total shipments of sheet and strip products including hot rolled, cold rolled and all coated products were down by 11.0 percent in 3 months through November year over year and down by 10.2 percent comparing three months through November with three months through August.

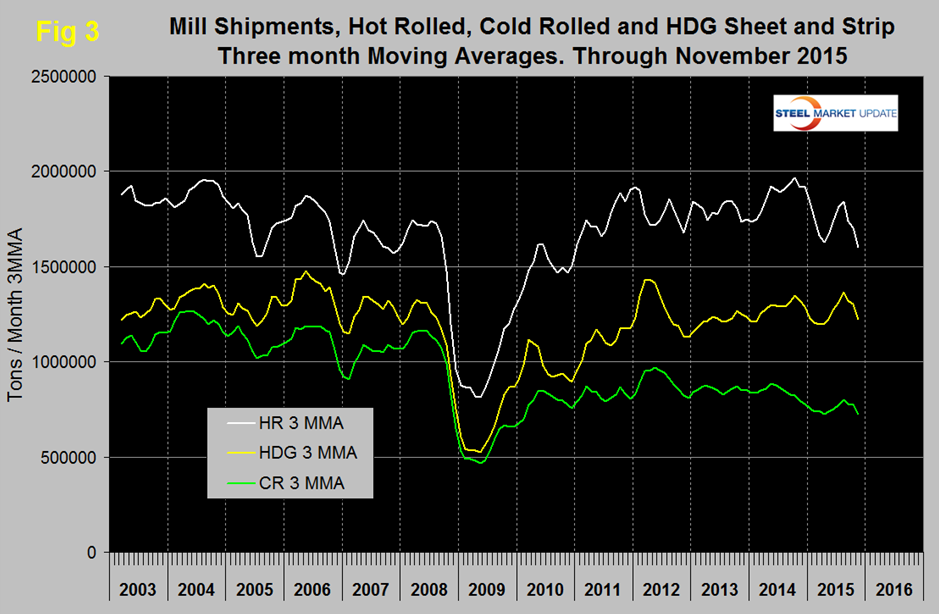

All the numbers in this report illustrate why it’s necessary to look at different time periods to get the whole picture. Individual products performed quite differently with other metallic coated faring the best, being up on all three time comparisons. Figure 3 puts the results for the three main products into the long term context since January 2003.

SMU Comment: November as a single month was terrible for both shipments and supply. This was somewhat obscured by our 3MMA analysis which is why we don’t dwell on a single month’s result. Hopefully December will help to mitigate the November numbers. We believe that manufacturing accounts for about 60 percent of steel consumption in the US and that figure is higher for sheet products than for longs. Import market share is still very high, longs being even worse than sheet products. However imports are no longer in the driver’s seat when it comes to absorbing market share. It is evident as we write many of the reports for publication in the Steel Market Update newsletters that it’s possible to slant an analysis anyway we want based on the time periods being examined. For that reason we always provide tabular data with quantitative short time period comparisons as well as graphical analysis of a much longer time frame. We hope this gives you the reader the best picture of what is going on.