Analysis

January 15, 2016

November Heating and Cooling Equipment Shipment Data

Written by Brett Linton

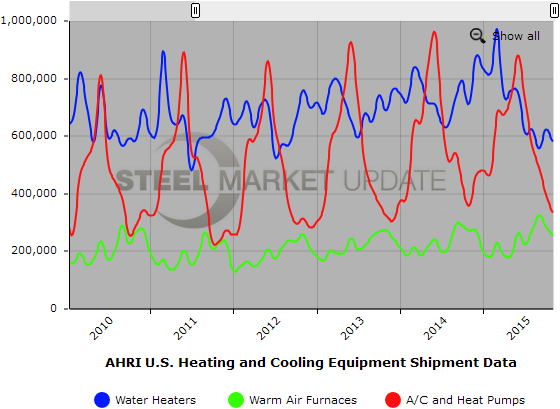

Below is the latest release issued by the the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) regarding residential and commercial heating and cooling equipment shipments through November 2015. You may read the press release on their website here.

Residential Storage Water Heaters

U.S. shipments of residential gas storage water heaters for November 2015 decreased 17.3 percent to 299,338 units, down from 362,082 units shipped in November 2014. Residential electric storage water heater shipments decreased 21.8 percent in November 2015 to 264,885 units, down from 338,796 units shipped in November 2014.

For the year-to-date, U.S. shipments of residential gas storage water heaters decreased 0.8 percent to 3,992,228, compared to 4,026,183 units shipped during the same period in 2014. Residential electric storage water heater shipments decreased 4.4 percent year-to-date to 3,691,380 units, compared to 3,860,772 units shipped during the same period in 2014.

Commercial Storage Water Heaters

Commercial gas storage water heater shipments decreased 0.2 percent in November 2015 to 7,157 units, down from 7,169 units shipped in November 2014. Commercial electric storage water heater shipments increased 38.8 percent in November 2015 to 7,237 units, up from 5,213 units shipped in November 2014.

Year-to-date U.S. shipments of commercial gas storage water heaters increased 3.1 percent to 88,790 units, compared with 86,113 units shipped during the same period in 2014. Year-to-date commercial electric storage water heater shipments increased 18.6 percent to 79,675 units, up from 67,189 units shipped during the same period in 2014.

Warm Air Furnaces

U.S. shipments of gas warm air furnaces for November 2015 decreased 6.2 percent to 248,953 units, down from 265,299 units shipped in November 2014. Oil warm air furnace shipments increased 32.0 percent to 5,379 units in November 2015, up from 4,076 units shipped in November 2014.

Year-to-date U.S. shipments of gas warm air furnaces increased 3.7 percent to 2,559,567 units, compared with 2,468,626 units shipped during the same period in 2014. Year-to-date U.S. shipments of oil warm air furnaces increased 11.0 percent to 33,984, compared with 30,611 units shipped during the same period in 2014.

Central Air Conditioners and Air-Source Heat Pumps

U.S. shipments of central air conditioners and air-source heat pumps totaled 334,907 units in November 2015, down 6.6 percent from 358,479 units shipped in November 2014. U.S. shipments of air conditioners decreased 4.2 percent to 218,076 units, down from 227,523 units shipped in November 2014. U.S. shipments of air-source heat pumps decreased 10.8 percent to 116,831 units, down from 130,956 units shipped in November 2014.

Year-to-date combined shipments of central air conditioners and air-source heat pumps increased 0.6 percent to 6,432,670 units, up from 6,391,815 units shipped in November 2014. Year-to-date shipments of central air conditioners increased 1.9 percent to 4,300,554 units, up from 4,221,291 units shipped during the same period in 2014. The year-to-date total for heat pump shipments decreased 1.8 percent to 2,132,116 units, down from 2,170,524 units shipped during the same period in 2014.

Below is a graph showing the history of water heater, warm air furnace, and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.