Government/Policy

January 12, 2016

The Numbers: Hot Rolled Imports from Brazil, Turkey & Korea

Written by John Packard

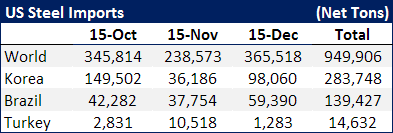

We thought our readers might find it interesting to review the past four years worth of imports from the three countries mentioned in the countervailing (CVD) duty preliminary determination just released by the U.S. Department of Commerce. The numbers in the table below are net tons and are annualized (yes, Brazil only shipped 4,467 tons of hot rolled into the U.S. during calendar year 2012).

Both Turkey and Brazil have become much larger players with Brazil having the highest percentage of growth from 2014 to 2015.

Note: The 2015 total will not be exact as it has December licenses data numbers and not the final census numbers as all of the other months.

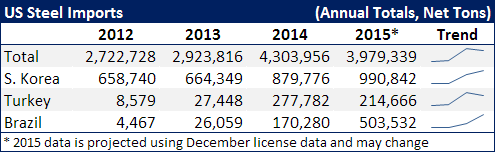

October – December 2015 HRC Imports

Turkey has become a non-factor in the hot rolled coil import markets as you can see by the data collected on the last three months 2015.

Brazil and Korea, on the other hand, either felt very comfortable in their position as not dumping HRC into the U.S. market or were willing to take the risk. In the case of Korea, that risk (so far, the final determinations have not been announced) has paid off and they did not receive an affirmative ruling on countervailing duties.

Brazil will be liable for cash deposits against most of the steel seen in the table below since they were found to be liable for countervailing duties and that they had surged (critical circumstances) after they knew that dumping suits were coming. Again, as with Korea and Turkey above, the story is not yet over as we have to wait for antidumping (AD) preliminary determinations on hot rolled coil as well as the final determinations.

We encourage those interested in learning more about trade suits, changes in the law and language governing AD/CVD, the next step for each product and how your company can protect your interests, to attend our Leadership Summit Conference in Palm Beach Gardens on March 7-9, 2016. Details can be found on our website.