Prices

January 7, 2016

Hot Rolled Futures: China Comes Home to Roost!

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Assisting Andre with tonight’s article is Jack Marshall also associated with CrunchRisk. Here is how Andre and Jack saw trading over the past week:

Financial Markets

So, the China malaise is finally catching up with the financial markets here. The market should have checked in with the steel community a year ago, we could have told them what was coming! Since Dec. 29th , the S+P 500 has dropped from 2075 to 1932 or just under 7%! The bad news is we’re likely now headed to test the August lows which was 1824 on this March futures contract, or another 5.5%, before this correction has determined if it is to be a mild correction, or something worse. As we all know, rising interest rates are not good for stocks, and worse still we have to add to it the continued poor data coming out of China, the ever emerging Sunni/Shia civil war coming out of the Middle East, and, let’s not forget, the media circus of an election we have brewing at home, ranging from a coterie of fascism, socialism and meism. Let’s just say that a bull market of 6-7 years at all-time highs has a few headwinds to deal with.

Copper has capitulated as well and is now right on the $2.00/lb psychological threshold, having breached it briefly today. $2/lb is a big deal. It’s the number way back in 2002-3 time zone that everyone couldn’t belief we breached on the way up. We have now come full circle. China, which brought Copper up to such heights, is now the reason it has no friends. The China industrial frenzy is over, and I’m not saying that Copper can’t hold $2/lb. and rally from here, but I’d be more inclined to think that Copper will breach $2/lb. and test lower for China’s malaise is just too great to warrant a recovery from here, and all industrial commodities will need to test the price of the cost to produce, and even lower; just like we have in steel.

Crude is a different story for me. Its collapse thus far represents the China hangover, however, supply/demand is not so out of whack in crude that we couldn’t see a real rebound at some point. The caveat to this would be if the U.S. caught a cold too, then all bets are off. Cost to produce really pinches in the mid 20’s so we’re not far from the bottom in crude in the big picture with Crude at $33.20/bbl. On the Feb future.

Steel

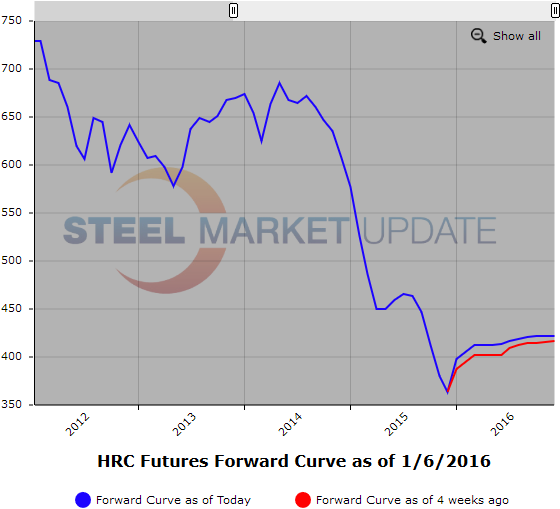

The HR futures focus has shifted from the front end of the forward curve to encompass all of 2016. HR futures prices are trading back above $400/ST [$20.00cwt] with the current shape of the HR curve in 2016 reflecting a steady rise in future HR prices. However, while most of the recent futures trading activity has been focused on HR Q1’16 we are starting to see increased interest in 2H’16 as sellers have started hitting bids which has lead to a flattening of the forward curve in calendar 2016. Current value in Q1’16 is $406/ST [$20.30cwt], 2H’16 is $418/ST [$20.90cwt]. Exchange futures trading volume has been light through the turn of the year with roughly 9,000ST trading, but we should expect that to pick up here as we get going into the new year. Open Interest for HR is currently 22,645 contracts or 452,900ST.

Spot $386/ST

Q1’16 $406/ST

2H’16 $418/ST

Busheling Scrap (BUS)

Early reports are that BUS will come in about $20 higher in the low $180 range. Starting to feel like we have found a price bottom in scrap. Trading sub 160/GT was probably not sustainable. In spite of the strong USD, low energy prices, and soft iron ore prices enough short term demand in the form of inventory replenishment is helping to lift trading prices. East Coast shipments of scrap to Turkey have traded around $188/MT which is sideways to recent shipments. If anything CFR Turkey scrap has been moving sideways.

Current CME BUS interests we have seen are 1H’16 $165/GT bid – offered @ $190/GT. We continue to get inquiries for Cal’16. LME steel scrap interests: Jan’16 offered @ $192/MT, Feb’16 offered @ $195/MT.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.