Prices

January 7, 2016

Flat, Long, and Semi-Finished Steel Imports Analysis

Written by Peter Wright

Licensed data for December was reported by the Steel Import Monitoring System of the US Commerce Department on January 5th. At SMU we perform a detailed analysis of this data, an explanation of our methodology is given at the end of this write up. Total rolled product licensed imports in the single month of December were 1,955,625 short tons, up by 6.1 percent from the preliminary November volume. We prefer not to dwell on single months results because of the extreme variability that can occur in individual products. In the comments below we use three month moving averages (3MMA) to get a more representative picture. The 3MMA through December was 1,996,248 tons, down by 3.1 percent from the 3MMA through November. On the same basis flat rolled was down by 2.8 percent, long products up by 4.5 percent and pipe and tube down by 11.3 percent.

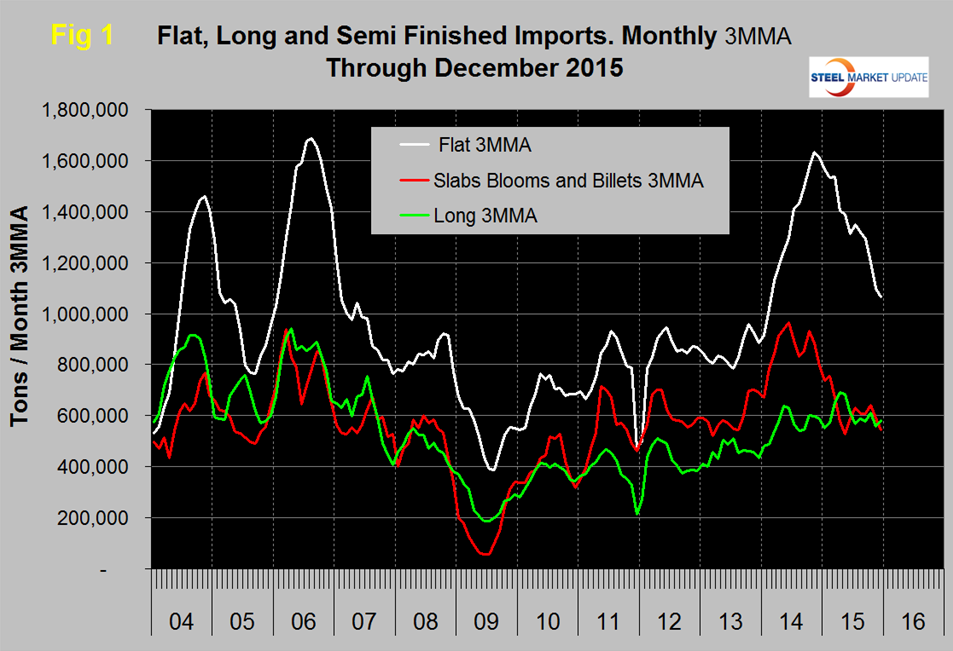

Figure 1 shows the 3MMA through December licenses for semi-finished, flat and long products.

Flat includes all hot and cold rolled sheet and strip plus all coated sheet products including tin-plate plus both discrete and coiled plate. The 3MMA of flat rolled imports peaked at 1,634,000 tons in November 2014 and declined to 1,066,419 tons in December 2015. In November 2014 the 3MMA of semi-finished imports was 884,641 tons, this volume declined to 544,106 tons in December 2015. Long product imports have been stuck in the range 519,000 tons to 772,000 tons since March 2014 with no particular trend evident. In December the 3MMA of long product imports was 582,654 tons.

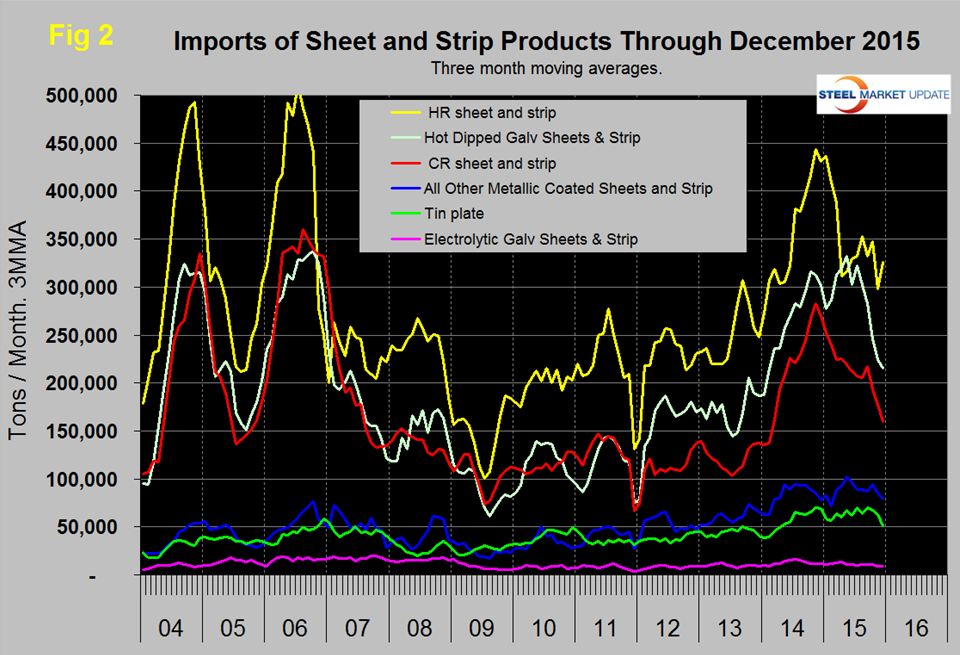

Figure 2 shows the trend of sheet and strip products since January 2011.

Of the big three tonnage items, HR, CR and HDG, all three are down by over 100,000 tons per month since their peak but hot rolled has stalled in the last nine months as cold rolled and HDG have continued to decline. All other metallic coated (mainly galvalume) and tin plate are more or less where they were 18 months ago. Electro-galvanized has been little changed in three years.

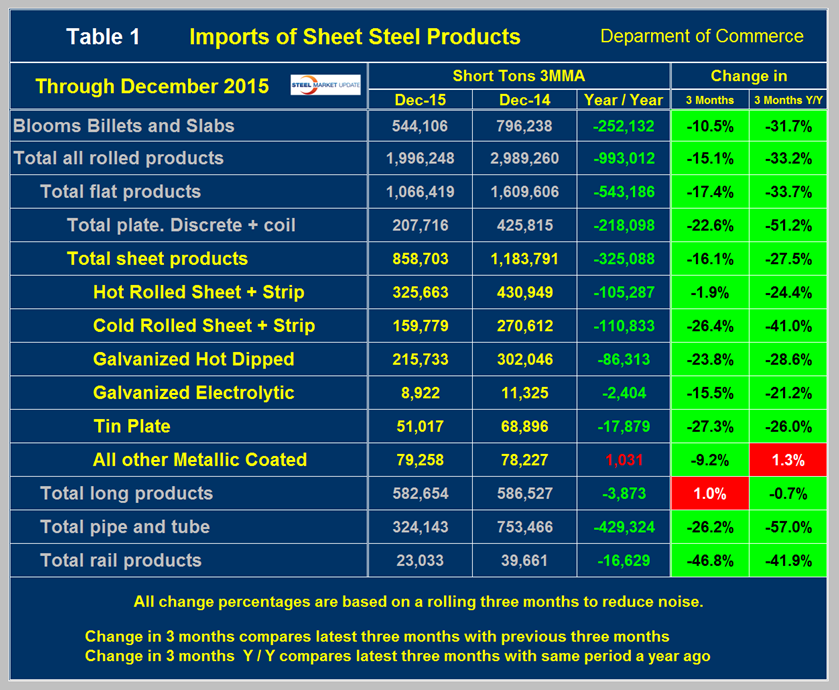

Table 1 provides an analysis of major product groups and of sheet products in detail.

It compares the average monthly tonnage in the latest three months through December with both three months through September (3M/3M) and three months through December 2014 (Y/Y). On a Y/Y basis all products except longs and galvalume were down by double digits led by plate and tubulars which were both down by over 50 percent. Semi-finished slabs, blooms and billets were down by 10.5 percent 3M/3M and down by 31.7 percent Y/Y. The total volume of hot worked products was 1,946,248 tons in December on a 3MMA basis, down by almost a million tons from December 2014. The total hot worked tonnage was down by 15.1 percent 3M/3M and down by 33.2 percent Y/Y. These trends indicate that in the big picture the overall volume of imports is falling fast but the rate of decline has slowed as shown by cases where the three month decline is less than the year over year decline. The color codes in Table 1 for the three month and year over year change show which products are improving and which have still experienced import volume increases in these two time frames.

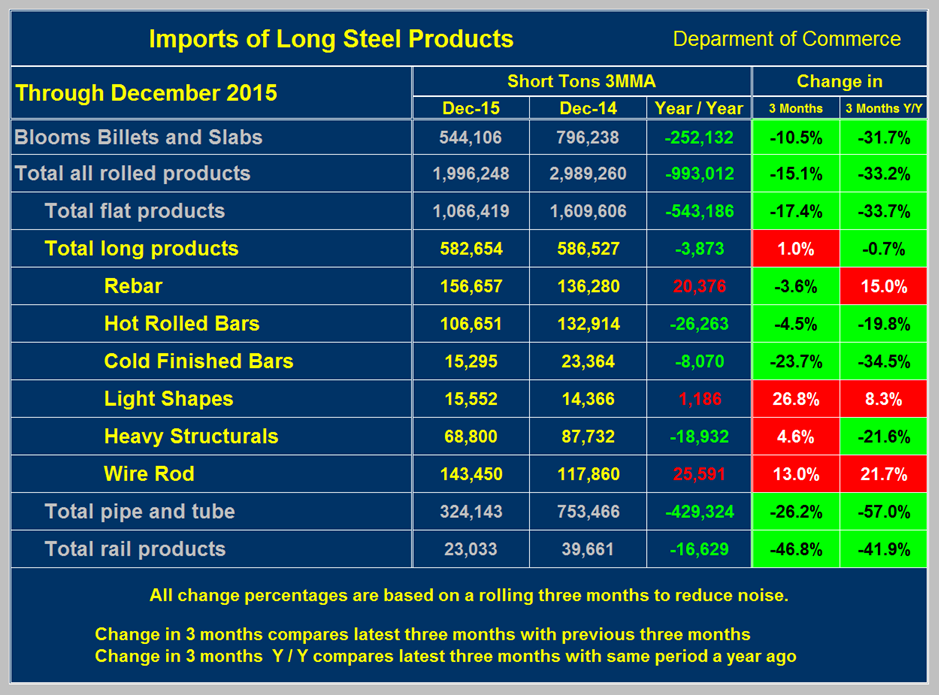

Table 2 shows the same analysis for long products and it is immediately obvious that the situation is far different than for flat rolled.

For total long products the tonnage was down by only 3,873 tons Y/Y which was 0.7 percent. In 3M/3M the volume actually increased by 1.0 percent. Light shapes had a particularly strong surge in the three months through December 3M/3M with an 8.3 percent increase year over year. Rebar and wire rod both experienced a more than 20,000 ton increase year over year. Imports of pipe and tube declined by 26.2 percent 3M/3M and by 57.0 percent Y/Y.

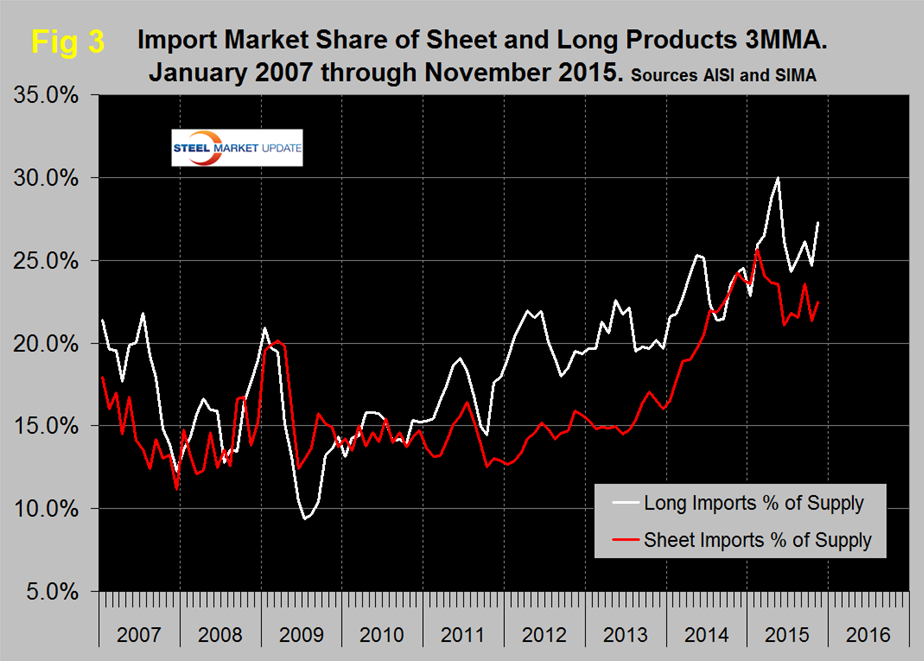

Figure 3 shows the import market share of sheet and long products through November which is the latest data available for total steel supply.

The import market share of sheet products peaked at 24.3 percent in March, fell to 21.3 in October then rose again to 22.5 percent in November. For long products the import share peaked at 30 percent in May, declined to 24.7 percent in October then in this latest data bounced back to 27.3 percent.

Explanation: The SMU publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by product, by district of entry and by source nation which is available on the premium member section of our web site. The early look, the latest of which you are reading now has been based on three month moving averages (3MMA) using the latest licensed data, either the preliminary or final data for the previous month and final data for earlier months. We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. We are more interested in direction than we are in absolute volumes at this stage. The main issue with the license data is that the month in which the tonnage arrives is often not the same month in which the license was recorded. In 2014 as a whole our data showed that the reported licensed tonnage of all carbon and low alloy products was 2.3 percent less than actually receipts, close enough, we believe, to confidently include licensed data in this current update. The discrepancy declined continuously during the course of the twelve month evaluation as a longer time period was considered.