Market Data

January 5, 2016

The ISM Manufacturing Index Contracts Again in December

Written by Peter Wright

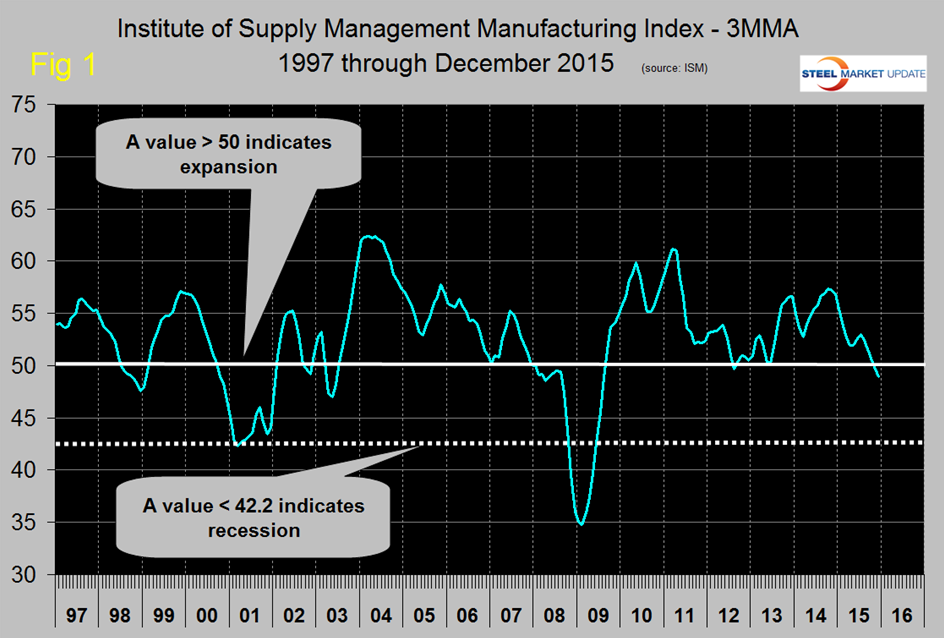

The Institute of Supply Management released their December report on January 4th 2016 with a value of 48.6 which is the lowest since June 2009. An explanation of the ISM index is given at the end of this piece. After seven straight months of decline the three month moving average (3MMA) of the index had positive growth on a month/month basis in June and July but since then has had five more months of contraction ending up at 48.97 in December.

Any number >50 indicates expansion therefore for the first time since August 2012 the 3MMA of this index is signaling contraction. This is only the third month in over six years that the index has not exceeded the positive growth threshold of 50 (Figure 1).

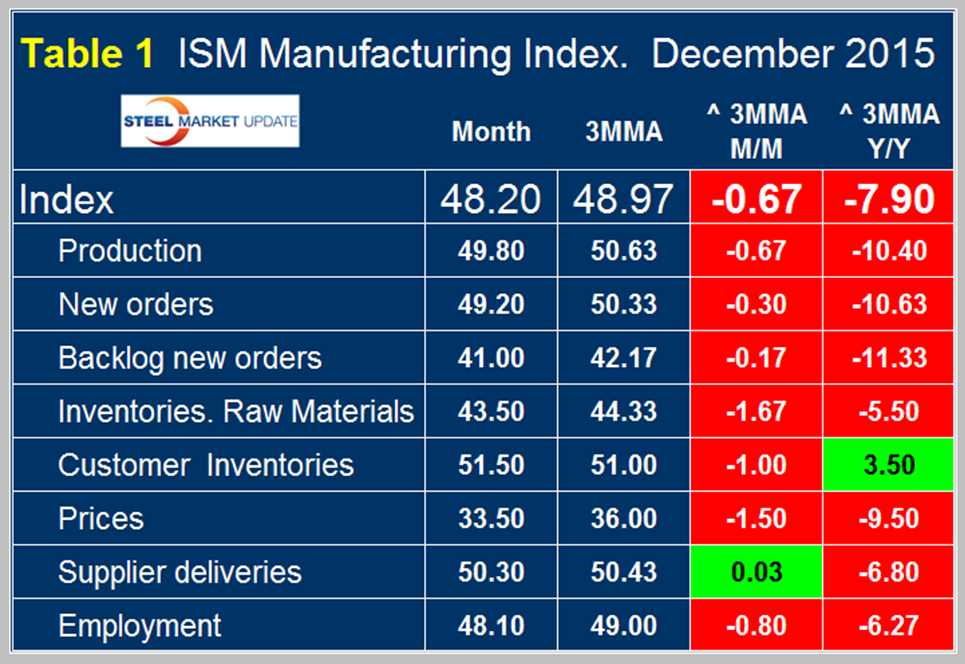

Table 1 shows the break down for November by sub index with the monthly result, the 3MMA, the growth of the 3MMA m/m and y/y for each.

The table shows that the 3MMA y/y growth was negative 7.9 which was the tenth consecutive month of negative growth after eleven straight months of positive year over year (y/y) growth. Month over month the only component to have positive growth was supplier deliveries and year over year only customer inventories had positive growth.

SMU comment: this report is very disappointing but continues the trend that has been obvious for a while. Manufacturing is slowing and according to this index has now gone into contraction. The ISM index has been in general agreement with the Federal Reserve Industrial Production Index which had positive year over year growth for 65 months prior to November this year. On a 3MMA basis the rate of growth of the IP index through November has slowed every month since January and in November had negative growth for the first time since February 2010. In November the 3MMA of the IP index contracted by 0.03 percent.

The official news release from the ISM is included below. Note the ISM discusses monthly values not the three month moving averages that we prefer in our SMU analyses.

PMI at 48.2 percent; New Orders, Production and Employment Contracting, Supplier Deliveries Slowing, Inventories Contracting

(Tempe, Arizona) — Economic activity in the manufacturing sector contracted in December for the second consecutive month, while the overall economy grew for the 79th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report On Business. The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee. “The December PMI registered 48.2 percent, a decrease of 0.4 percentage point from the November reading of 48.6 percent. The New Orders Index registered 49.2 percent, an increase of 0.3 percentage point from the reading of 48.9 percent in November. The Production Index registered 49.8 percent, 0.6 percentage point higher than the November reading of 49.2 percent. The Employment Index registered 48.1 percent, 3.2 percentage points below the November reading of 51.3 percent. The Prices Index registered 33.5 percent, a decrease of 2 percentage points from the November reading of 35.5 percent, indicating lower raw materials prices for the 14th consecutive month. The New Export Orders Index registered 51 percent up 3.5 percentage points from the November reading of 47.5 percent and the Imports Index registered 45.5 percent, down 3.5 percentage points from the November reading of 49 percent. As was the case in November, 10 out of 18 manufacturing industries reported contraction in December. Contraction in new orders, production, employment and raw materials inventories accounted for the overall softness in December.”

Of the 18 manufacturing industries, six are reporting growth in December in the following order:

Printing & Related Support Activities; Textile Mills; Paper Products; Miscellaneous Manufacturing; Chemical Products; and Food, Beverage & Tobacco Products. The 10 industries reporting contraction in December — listed in order — are: Apparel, Leather & Allied Products; Plastics & Rubber Products; Machinery; Primary Metals; Fabricated Metal Products; Transportation Equipment; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Wood Products; and Nonmetallic Mineral Products.

Explanation: The Manufacturing ISM Report on Business is published monthly by the Institute for Supply Management, the first supply institute in the world. Founded in 1915, ISM exists to lead and serve the supply management profession and is a highly influential and respected association in the global marketplace. ISM’s mission is to enhance the value and performance of procurement and supply chain management practitioners and their organizations worldwide. This report has been issued by the association since 1931, except for a four-year interruption during World War II. The report is based on data compiled from purchasing and supply executives nationwide. Membership of the Manufacturing Business Survey Committee is diversified by NAICS, based on each industry’s contribution to gross domestic product (GDP). The PMI is a diffusion index. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. A PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining. A PMI in excess of 42.2 percent, over a period of time, indicates that the overall economy, or gross domestic product (GDP), is generally expanding; below 42.2 percent, it is generally declining. The distance from 50 percent or 42.2 percent is indicative of the strength of the expansion or decline. With some of the indicators within this report, ISM has indicated the departure point between expansion and decline of comparable government series, as determined by regression analysis.