Prices

December 29, 2015

November Imports Drop to 47 Month Low

Written by John Packard

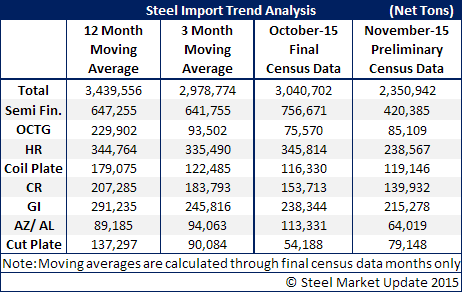

Based on the Preliminary License Data recently released by the U.S. Department of Commerce, foreign steel imports for the month of November were 2,350,942 net tons. This is the lowest total seen for any month since December 2011 when 2,064,143 net tons were reported. November 2015 imports were 1,343,207 tons less than November 2014 when the US DOC reported 3,694,149 net tons of foreign steel imports into the United States.

We saw major reductions in:

Semi-Finished – at 420,385 net tons the lowest level of imports since March 2015 (414,824 net tons).

Oil Country Tubular Goods (OCTG) – well below both the 12 month and 3 month moving averages.

Hot Rolled (HR) – lowest level seen since October 2013 (215,551 net tons).

Cold Rolled (CR) – lowest level seen since February 2014 (137,993 net tons).

Galvanized (GI) – below both 12 month and 3 month moving averages. The last time GI imports was this low was December 2013 when the US received 174,186 net tons.

Galvalume (AZ) and Aluminized (AL) – well below both 12 month and 3 month moving averages and the lowest level seen since February 2015 when foreign imports were 58,431 net tons.