Prices

December 22, 2015

Weekly Raw Steel Production Slips Again

Written by Brett Linton

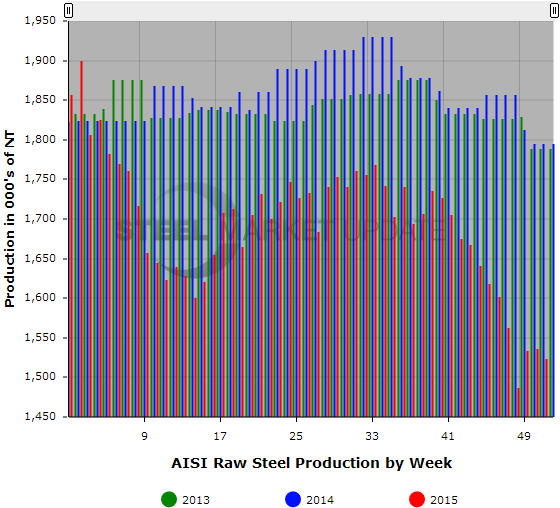

For the week ending December 19, 2015, the American Iron & Steel Institute (AISI) estimated the U.S. steel industry produced 1,523,000 net tons of raw steel, a 0.8 percent decrease over the previous week and a 15.2 percent decrease over the same week one year ago. The estimated capacity utilization rate is 63.7 percent, down from 64.2 percent last week and down from 74.6 percent this time last year.

Estimated total raw steel produced for 2015 YTD is reported to be 85,387,000 tons, down 9.1 percent from the 93,911,000 tons produced during the same period in 2014. The average capacity utilization rate for 2015 YTD is estimated to be 71.2 percent, down from 77.5 percent for 2014 YTD.

Week-over-week changes per district are as follows: Northeast at 191,000 tons, down 1,000 tons. Great Lakes at 573,000 tons, up 26,000 tons. Midwest at 202,000 tons, down 15,000 tons. South at 492,000 tons, down 14,000 tons. West at 65,000 tons, down 9,000 tons. Total production was 1,523,000 tons, down 13,000 tons.

SMU Note: Below is a graphic showing the weekly raw steel production history. To use the graphs interactive capabilities, you must view it on our website. You can do this by clicking here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.