Prices

December 22, 2015

SMU Price Ranges & Indices: Modest Moves Higher

Written by John Packard

Steel Market Update is seeing prices as being modestly higher than they were both two weeks ago as well as last week. On average, cold rolled and coated steels have the most strength with lead times on many of these products having extended into February (and some coated into March) at most of the mills (but not all). Hot rolled continues to struggle and, although higher, we have not yet seen the mills as having collected the full $40 on HRC.

Based on the dialogue we had with steel buyers over the past 24 to 48 hours, we found the number of transactions dropping due to the Holidays and the markets were still settling – especially on hot rolled. We caught numbers as low as $340 on HRC but the majority of the numbers we heard from buyers were at $380 per ton. The $380 seems to be the number the mills are trying to reach, hold and then move up from.

A service center on the east coast shared the following information with SMU earlier today, “The mills’ published numbers seem to be sticking. I heard Cold Rolled numbers from $500 to $550 per ton the past few days. At this time, we are not buying any, so I did not attempt to negotiate. Coated bases are the same as Cold Rolled and they are firm prices. Lead-times on coated have moved out, it appears the mills are busy in that arena. I hope for the sake of the industry that prices remain at the current level through the first quarter. If the domestics raise their prices, before collecting any of their current increase, then they deserve to be broke. We should be allowed to roll the current increase into the market before their next increase is announced. More importantly, we all need to see where the imports are coming from and to what levels they arrive. Until then, there is plenty of Cold Rolled in everyone’s inventory and we need to continue to de-stock. By then, the picture should be much clearer.”

Other buyers are also talking about the potential of a second price increase with similar sentiment as the service center quoted above, give them some time to collect the increases already announced.

What impact the CORE antidumping announcement will have on the psyche of the market is not yet known. Although in early discussions with buyers this evening, we are hearing that China is out but the other players may well still be active (or reborn). Plus we have countries like Vietnam and Brazil that have become bigger players since the trade suits were filed.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $350-$400 per ton ($17.50/cwt- $20.00/cwt) with an average of $375 per ton ($18.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is $5 per ton higher than last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 3-4 weeks.

Cold Rolled Coil: SMU Range is $490-$540 per ton ($24.50/cwt- $27.00/cwt) with an average of $515 per ton ($25.75/cwt) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to last week while the upper end increased $20 per ton. Our overall average is up $15 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $24.50/cwt-$26.50/cwt ($490-$530 per ton) with an average of $25.50/cwt ($510 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is up $5 per ton from last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $550-$590 per net ton with an average of $570 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $25.00/cwt-$27.00/cwt ($500-$540 per ton) with an average of $26.00/cwt ($520 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained the same. Our overall average is up $5 per ton over one week ago. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $791-$831 per net ton with an average of $811 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

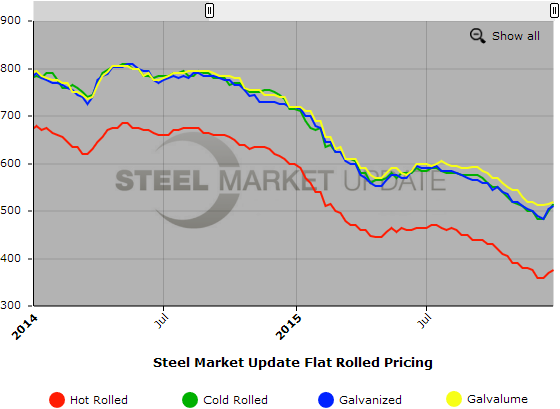

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.