Market Data

December 20, 2015

SMU Survey: Now is a Good Time to Buy...

Written by John Packard

On Friday, SMU was speaking with the CEO of a Midwest-based service center who was advising us that, in his opinion, based on the conversations he was having with his mill suppliers, we should expect more flat rolled steel price increases to come. The mills were already asking his company for more and the mills’ order books were beginning to fill.

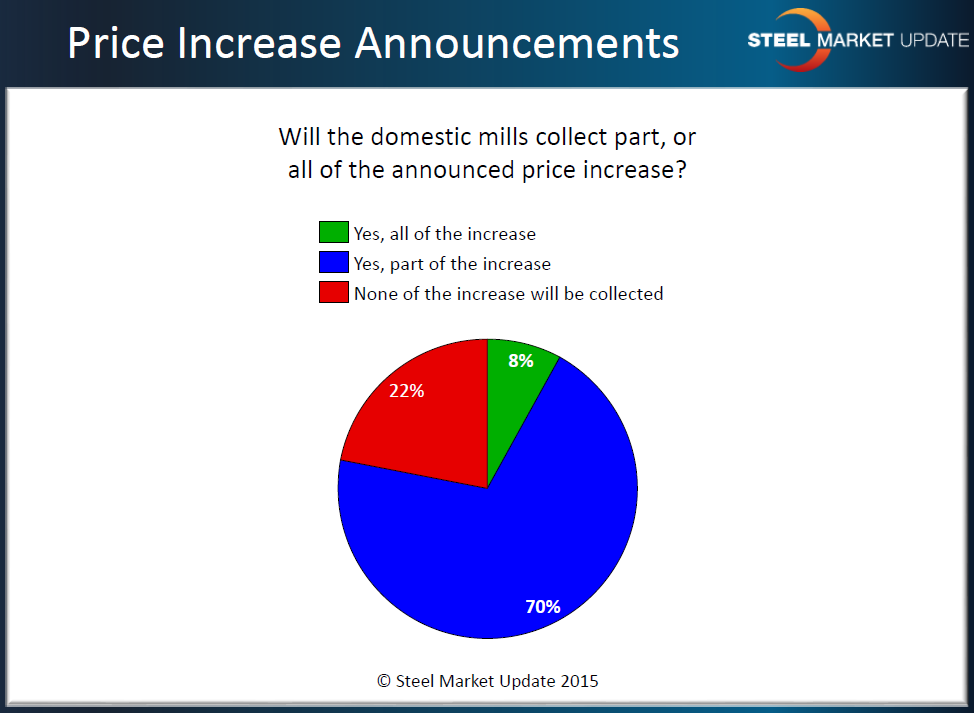

Our flat rolled steel market analysis conducted this past week picked up on the opinion of steel buyers and sellers that the price increases were being collected (at least a portion, immediately).

Out of curiosity we went back to May’s price increase announcement to see what kind of response we got regarding whether the increase would “stick” or not. At that time the market was split with 47 percent believing that the increases would not stick and 53 percent that it would. Ultimately, the increase was only partially collected before the market started back down once again (dead cat bounce).

With 78 percent of those responding to our questionnaire last week either reporting part (70 percent) or all (8 percent) of the increase would be collected, we are of the opinion that buyers are more receptive to this increase being justified compared to the last one in May.

What Our Respondents Were Saying About Increases Being Collected:

“Maybe $20/ton [will be collected]. Looks like scrap will go up $10 which will help support the announced increases, but the market is not robust for other than automotive.” Manufacturing company

“Increases will not hold until demand gets better.” Service center

“Depending on the mill all or part but it looks like pricing on CRC and coated up at least $40 ton.” Service center

“[Increases will] probably not [be collected] as overall demand is currently the key driver. Unless buyers get ‘spooked’ and start a frenzy my guess is increases will not stick.” HVAC Wholesaler

“Price won’t go up until it stops going down. The increase announcements may stop the slide, but won’t be collected until there’s demand for OCTG line pipe.” Manufacturing company

“I believe they will collect almost all of the increase.” Service center

“Establishes at least a floor hopefully. Need a couple of others to announce as well.” Service center

SMU Note: Essentially all of the domestic mills have announced price increases publically (we have not seen anything from US Steel but they are not a big player in the spot markets).

Is Now a Good Time to Buy?

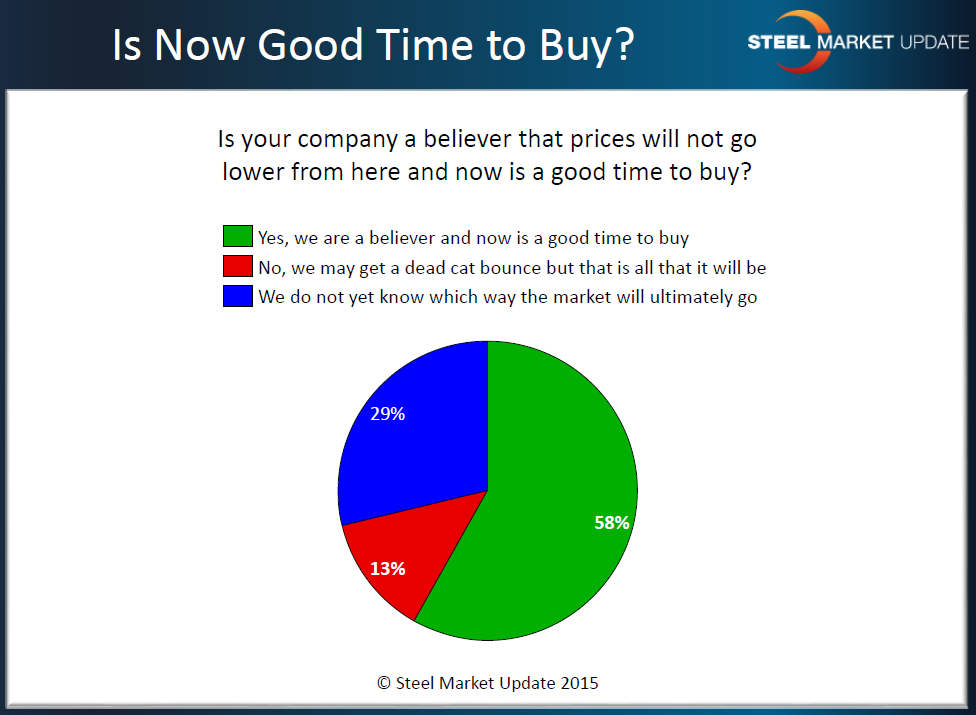

Perhaps an even more important and telling piece of information is how do buyers and sellers of flat rolled steel feel about their company’s need to buy steel and is now a good time to buy steel?

As you can see by the graphic below, the majority of those responding to last week’s questionnaire (58 percent) believe that prices will not go lower from here and that now is a good time to buy steel.

There is another 29 percent that will most likely move with the majority as the indexes start printing the new higher averages on hot rolled, cold rolled and coated steels.

Having the market psyche of the opinion that they need to get off the sidelines and buy will create longer lead times and more confident domestic mill commercial departments which will hold prices in check and move to raise them further in the weeks ahead if their order books, do indeed, improve.

What Our Respondents Were Saying About Now Being a Good Time to Buy:

“I think the market has hit the bottom and the mills will get a small increase. Looks like all of 2016 will not go above $430 to $450/ton for HR.” Manufacturing company – SMU Note: The low we had on hot rolled was $360 per ton (average). So, a $430 to $450 number would be a fairly hefty increase should scrap and iron ore remain low (and the dollar remain high).

“I believe they will capture part of this increase, but it’s impossible to foresee whether there will be success getting further increases from there.” Service center

A service center who reported now as being a good time to buy left the following comment, “More importantly this is clearly our customers’ perception.”

“We believe there is some pent-up demand that will start materializing in the beginning of the year. If prices go lower, more facilities idle or close, pushing it back up. I think we’re almost at absolute zero.” Manufacturing company

“We will buy but not at the full increase, thus we will wait some time until we see which way the demand goes.” Manufacturing company

“We don’t believe that prices will go lower than the pricing we have locked up for 1st & 2nd Qtr. But if it should it would be very slight. Not worth the risk. Best to act now.” Manufacturing company

“Interest rates may go up on Wednesday, raw material input costs including energy continue to fall (or at best stabilize) and demand is questionable into the second quarter at best. Mills need a good lock out for a month or so. This has all the makings of a dead cat bounce.” Manufacturing company