Prices

December 17, 2015

Hot Rolled Futures- Price Hikes: Will they Shift the Momentum on Pricing?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

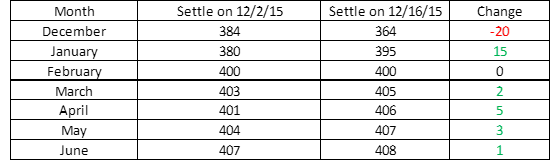

Well, it had to happen sooner or later, and this commentary will be our first for SMU wherein futures pricing has actually increased relative to our last comment. Though we must note that of course this comes with the important caveat that the spot month of December has continued to move lower. The December month will stand out below, but it mostly a result of how the futures market trades, i.e., the spot month price reflects the actual index average and no longer just market expectations. So with that said, here is how it looks compared to two weeks ago:

Now obviously the market is not exactly setting the world on fire, but with the first quarter of 2016 now firmly sitting above $400/ton on last night’s valuation (and note that period has traded a few thousand tons this week at $401/ton) there is finally a glimmer of hope emerging that a sustained increase in pricing could finally be in the cards. This is at least in part a result of the efforts from most domestic mills to collective get behind a $40/ton price increase announcement that was made official late last week. The $400 level also appears to hold some psychological significance for traders, as breaching that level, which was largely seen as key support, no doubt aided the market’s descent lower.

So many readers will be asking, “will these mill increases really stick”? The simple answer is that it’s still a “maybe”, at least in the sense that a $40/ton increase is clearly not being achieved in any way in the near term. That said, these slight increases in spot pricing are clearly real, it’s just a question of whether those increase becomes a momentary blip, or are the beginning of a sustained drive higher. The answer to this issue; blip on the radar or signal of real momentum shift, might well lie in the various announcements related to pending trade actions against flat-rolled steel imports.

As of just this week, preliminary countervailing duties have been announced for imports of cold rolled steel with the predictable outcome of huge preliminary duties against China. Chinese imports are looking at 227.29 percent in countervailing duties, by far the largest percentage in the group. Next in terms of magnitude was Brazil which saw a 7.42 percent duty. Indian producers saw only 4.45 percent and Russian (excepting Severstal) at 6.33 percent. Korean producers, to the surprise of some, were able to dodge the bullet entirely. Commerce department’s final determinations are set for May 9th. Futures market activity has been rather muted after news of these levels broke, as even though the market was waiting for these numbers, the increasing spot price has traders more focused on whether these numbers have met market expectations or not, and that may take a few more days to fully digest.

Our informal surveys suggest that mills are still hungry for orders and that the increases that were announced have already pushed some buyers to take a look at their import options, which would naturally be a bad sign for sustainability. The reality is that this is a very difficult backdrop against which to push an increase; oil prices continue to collapse and the forward projections for OCTG demand continue to crumble along with collapsing crude values. All other industrial metals remain under pressure as well. This leaves the mill in a difficult negotiating position. Ultimately, more capacity may yet need to come offline before a truly sustainable drive beyond $400 is possible. Well, that and some better news on the trade case front. In the meantime, we expect modest increases to continue, but buyers are likely to remain cautious on paying up on a full mill increase.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

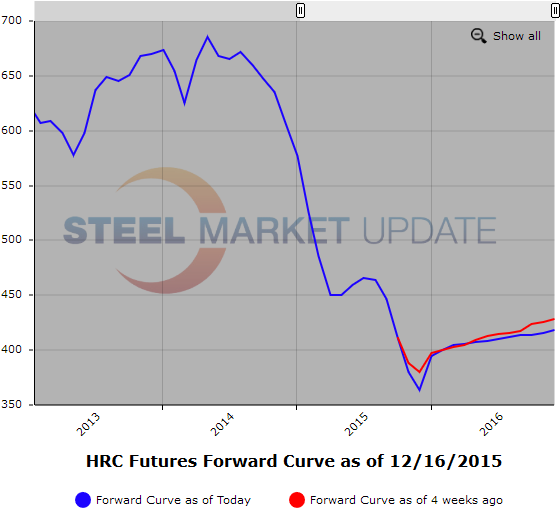

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.