Prices

December 17, 2015

December Steel Import Trend Analysis

Written by John Packard

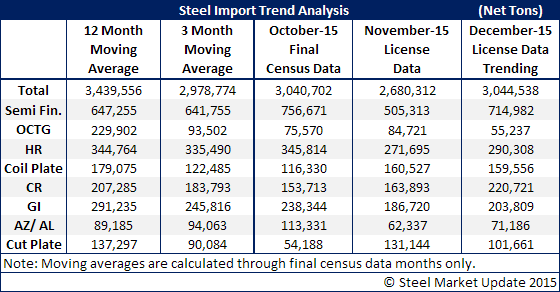

Late Tuesday afternoon the U.S. Department of Commerce released updated import license data for December. Based on the data through the first 15 days of the month it appears December imports will be very similar to November. We remind our readers that license data this early in the month should be taken with a grain of salt and not literally. The final numbers can vary. What the license data does show is the trend and we found some interesting things in the numbers.

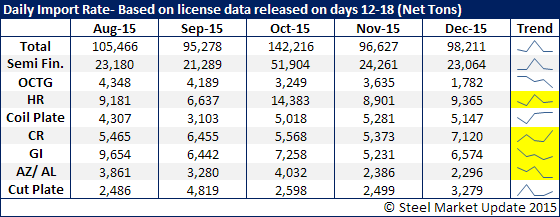

We are seeing a sharp drop in OCTG (oil country tubular goods) which was anticipated due to the weakness in the energy markets where OCTG is used.

At the moment, hot rolled is trending higher than each of the past four months with the exception of October. We noticed that is a large shipment expected from Australia which we anticipate is going to Steelscape in Washington.

Cold rolled is also beginning to trend above all four of the previous months with the biggest change being the number of tons coming from Vietnam.

The data below is based on license data released between the 12th and 18th days of each month, for that respective month (i.e. August figures are from data released August 12-18, 2015). Figures have been broken down into daily import levels for each product.

The table below shows the last three months of import data for all products along with the twelve and three month moving averages. SMU believes the 3 million ton trend for December is over-stated as we expect the final tally to be closer to the November total of 2.7 million net tons.

If you wish to explore this data in more detail, visit the Imports History page on the Steel Market Update website here. If you have any questions you may reach us at info@SteelMarketUpdate.com or at (800) 432 3475. If you would like to become a Steel Market Update subscriber you can do so by clicking here and if you would like to trial our newsletter/website you can do so by clicking here.