Prices

December 3, 2015

November Imports Lowest Since December 2013

Written by John Packard

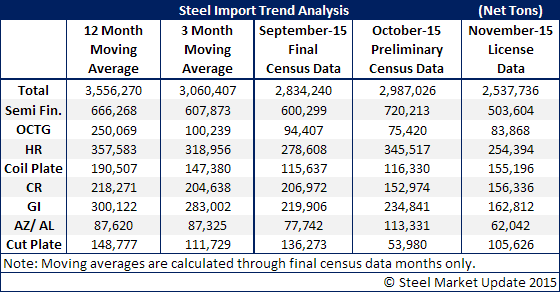

The U.S. Department of Commerce released license data collected through December 1st for the month of November. Based on license data (which can vary from the final census numbers) November foreign steel imports should be approximately 2.5 million net tons. If correct, this would be the lowest level seen since December 2013 which was the last time imports were 2.5 million tons.

As you can see by the table provided above, we saw hefty decreases in semi-finished (slabs/billets but mostly slabs), oil country tubular goods (OCTG), galvanized and Galvalume (other metallic). Other products followed by SMU also saw minor reductions and we anticipate further decreases in cold rolled and hot rolled as we move closer to Preliminary Determination announcements on antidumping and countervailing duties (AD/CVD).

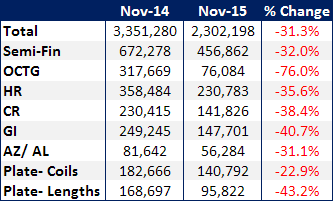

When comparing November 2015 against the final census data for November 2014 we find there are some fairly hefty differences with every product being lower this year than last:

Are the trade suits having an impact on those countries hit by AD/CVD?

Galvanized

Three of the five countries hit by AD/CVD have essentially ceased shipments to the U.S. They are: China, India and Taiwan.The two who have not are: Korea, which has continued to ship throughout the process and Italy which did slow down in October but it looks like they are back to the monthly rate they have been averaging for the prior 12 months.

Cold Rolled

Chinese tonnage essentially dropped to zero during the month of November as have the United Kingdom and India. Other countries continue to ship into the U.S.: Brazil, Japan (about half of what they were doing previously), South Korea, Russia (about one quarter of what they were shipping previously), the Netherlands and the United Kingdom.

Hot Rolled

China is not allowed to ship HR into the U.S. so they are not part of the hot rolled trade suit. Australia has essentially stopped shipments. Korea, Turkey and Brazil which are part of the AD/CVD trade suit have reduced shipments to the United States. The other countries continue to ship: Japan (increased shipments), the Netherlands and the United Kingdom.