Prices

December 3, 2015

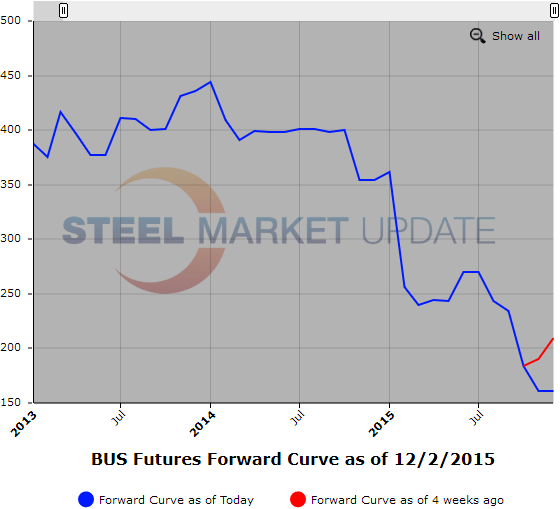

Hot Rolled Futures: Where is the next Support Level for HRC?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

Since we began our articles for Steel Market Update back in July of this year, HRC prices have continued to sink to lower in each of our updates, with no rebounding activity to speak of. It has really been something amazing to behold, but we are just recording the pain many of our readers are dealing with (assuming they have unhedged inventory!). The month of November managed to keep the losing streak intact and then some, with major declines seen across all forward months.

In fact, if anything looks wrong with the below table, it is that the exchange doesn’t seem to have been properly valuing the December contract low enough given the first index print…so expect that $384/ton number to be revised sharply lower in the days ahead. With that said, here is how it stands basis last night’s settlement:

Last time we were writing here we saw the descent in HRC prices beginning to slow, which certainly instilled some minor confidence in a market that was settling for whatever it could get in the way of positive news. The optimism was largely dashed when it became clear that imports were starting to pick up yet again, and that the global overcapacity issue was still not being held at bay by the various trade cases in the works.

The sharp declines have prompted renewed questions about where this market will find support, as previous calls for support at $400 and then $375 and then $365/ton all proved to be short pit-stops on the road lower, as we are now thoroughly below all these levels on a spot index basis. That prompted additional Q1 selling yesterday at $392/ton, well below the previously expected $400/ton level which was the expected rebound level in early 2016 up until recently.

That means contango levels have remained relatively healthy, as carries out to Q1 of over $30/ton will likely continue to entice some selling interest. That is because as much as we would like to say that we see a rally right around the corner, there isn’t much fundamental justification for that given the world is awash with excess steel while domestic demand is not breaking out in any meaningful way. It seems likely we will limp around in the current spot range through year-end, and perhaps we could see some modest increases on the back of restocking in the New Year. Of course seasonal restocking rallies were something that was fairly dependable, until this year of course, when the period offered zero additional support…

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.