Market Data

November 30, 2015

Currency Update for Steel Trading Nations

Written by Peter Wright

We have two data sources for this report. These are the Federal Reserve and the Oanda forex trading platform. An explanation of these sources is given at the end of this report. Oanda is current every day but the Federal Reserve Daily Broad Index (BI) is normally about eight days in arrears. As of November 29th the Fed’s latest daily update was November 20th, therefore, nine days behind the individual steel trading currency data that we are presenting here.

![]()

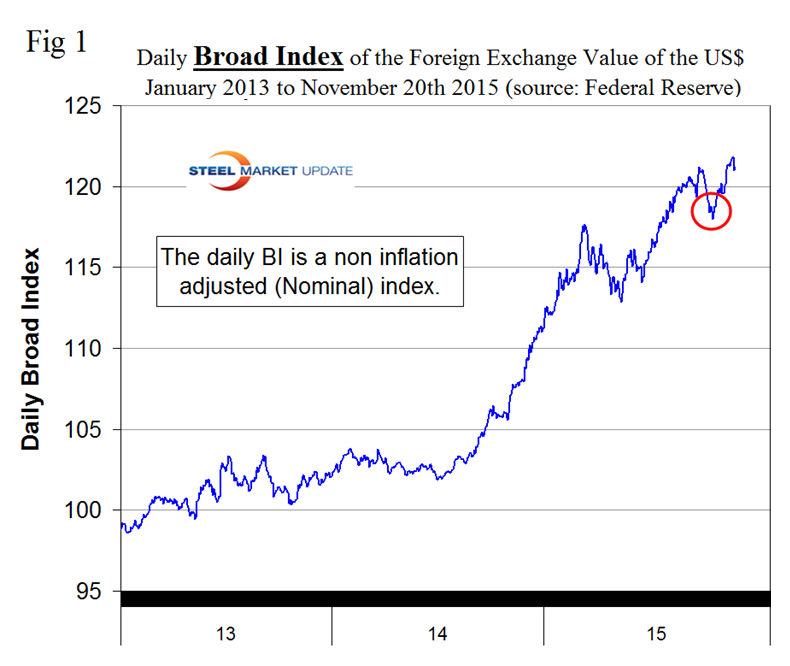

The betting that the Federal Reserve System will raise its short-term policy rate in mid-December continues to increase while the expectation that the European Central Bank will “expand and extend” its current round of quantitative easing is also increasing. Currency traders make bets on their assumptions of what central banks will do. Approaching the last FOMC meeting in September the dollar strengthened in anticipation of a rate increase. Then about six days ahead of the September 17th announcement, the smart money correctly concluded they would not act and the dollar gave back some gains. Figure 1 clearly shows this gyration, circled in red.

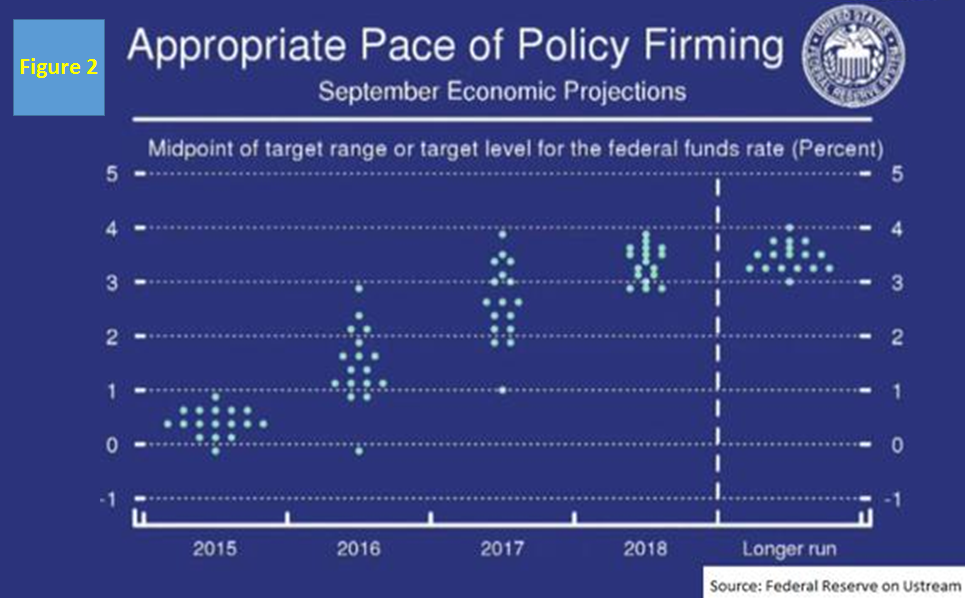

We have the same situation today as the next Fed decision date approaches. The dollar weakened on November 19th and 20th but this data is so old (9 days!) that we don’t know if this was the start of another anticipatory down trend. When (not if) the Fed raises rates, it will drive the value of the dollar higher. Figure 2 shows schematically when the 17 individual members of the board of the Federal Reserve expect interest rates to increase and by how much.

We first published this in early November and will stick with it until we come across newer information to challenge its assumptions. There is a wide spread between zero and 3 percent for next year but the members’ thoughts are much more closely aligned for 2018. According to Bloomberg Business, efforts are being made by the Federal Reserve officials “to focus on the pace of tightening” and not just on a December increase. Fed officials hope that if financial markets believe that there will only be “a gradual liftoff” of interest rates that this belief will “curtail the appreciation of the currency.”

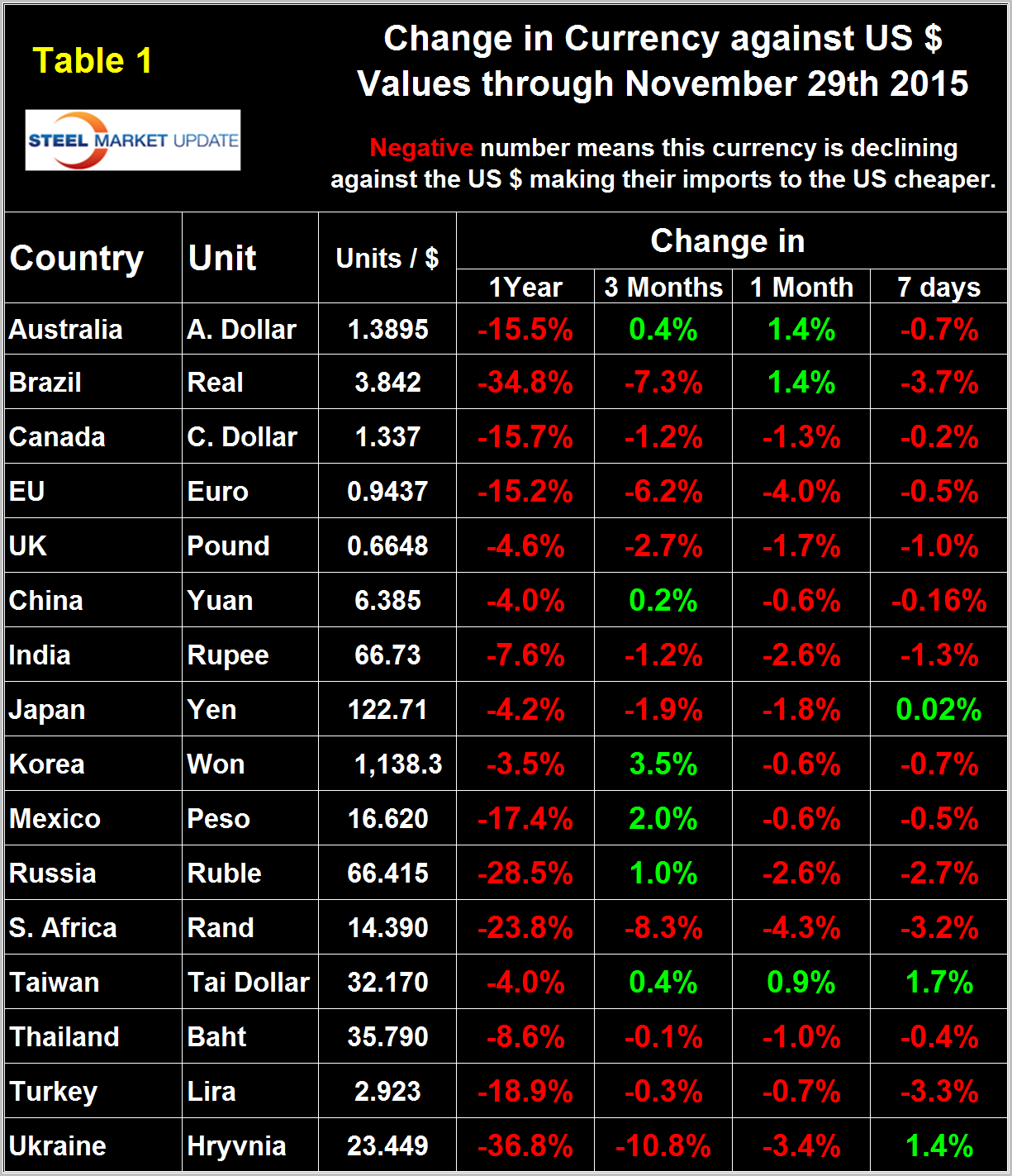

It does not necessarily follow that the steel trading currencies follow the BI but through the 29th they were on a rampage. Table 1 shows the number of currency units of steel trading nations that it takes to buy one US dollar and the change in one year, three months, one month and seven days. The table is color coded to indicate strengthening of the dollar in red and weakening in green. We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports.

In 2014, 25 percent of the U.S. economy was related to international trade, therefore, currency swings can have a huge effects on the economy in general and of the steel industry in particular. At the 12 month level the dollar has strengthened against every one of the steel trading currencies. In the last 7 days it strengthened against thirteen. The seven day trend based on our reports from the recent past has been as follows: September 21st (just after the last Fed announcement) the dollar weakened against 12/16, on October 15th the dollar weakened against 13/16. On November 5th the market began to turn with the dollar weakening against 10/16. On November 29th as we approach the next Fed announcement the dollar strengthened against 13/16, a complete reversal.

In each of these reports we comment on a few of the 16 steel trading currencies listed in Table 1 but charts for each are available through November 29th for any reader who requests them.

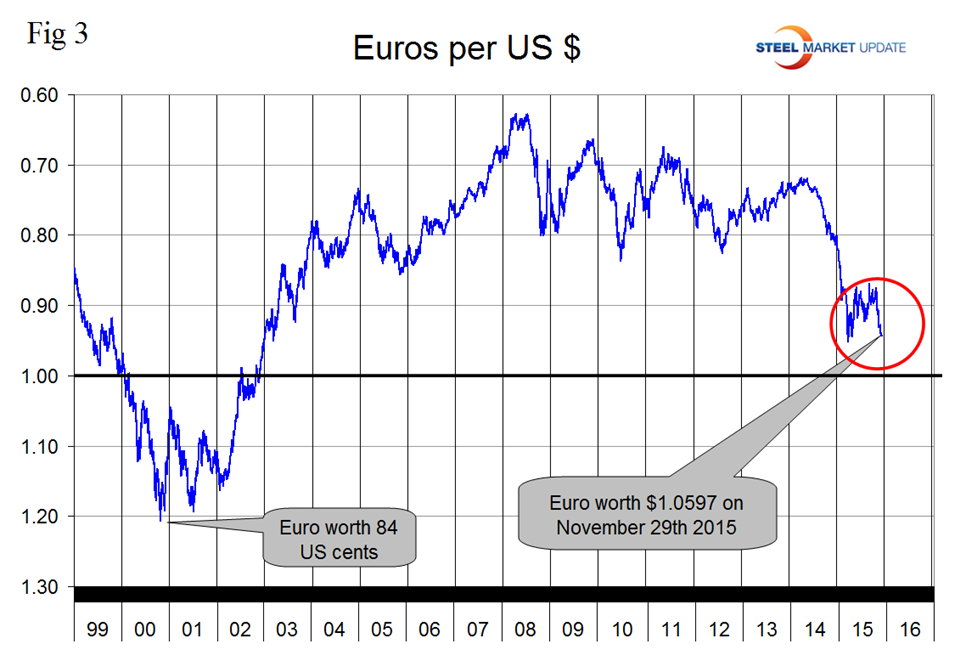

The Euro. On November 29th it took 1.0597 US dollars to buy one Euro (Figure 3).

Through that date the Euro had weakened by 15.2 percent in one year and by 4.0 percent in the last month. The euro has been under pressure because of the monetary policy divergence between the Fed and the ECB. Mario Draghi, ECB President, famously said in 2012 that he would do “whatever it takes” and investors are now getting ready for another round of stimulus to be announced on December 3. A failure to convince the market of the commitment of the central bank could result in further punishment of the Euro. With the ECB expected to further increase quantitative easing, the question becomes, what other central banks will do to avoid their currencies from appreciating against the Euro. The answer, according to Bloomberg, is that other central banks will intervene to reverse the trend.

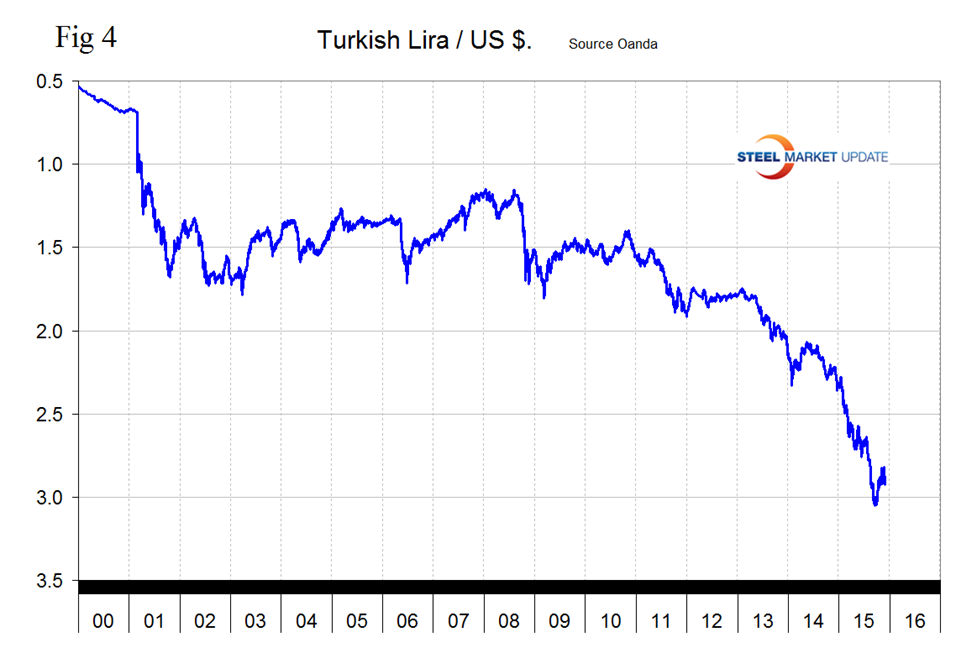

The Turkish Lira has weakened by 18.9 percent against the US dollar in the last year and by 3.3 percent in the last 7 days (Figure 4).

On November 29th its exchange rate was 2.923 liras/US dollar.

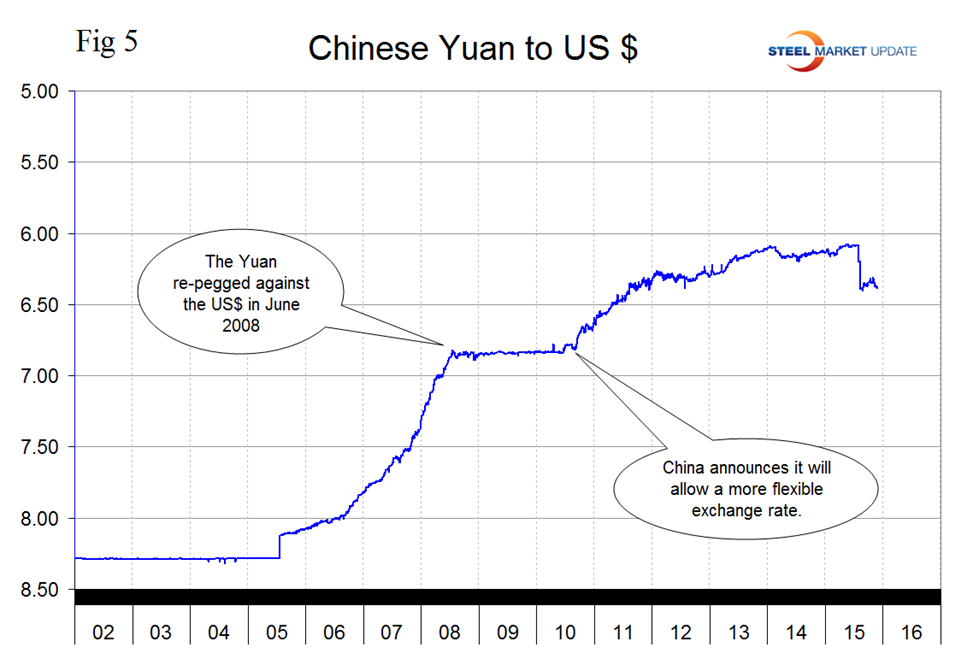

The Chinese Yuan. Following the devaluation in August the Yuan bottomed out at 6.4028 on August 27th. Since then the Yuan has recovered slightly to 6.385 on November 29th. In the last year the Yuan is down by 4.0 percent and by 0.2 percent in the last 7 days (Figure 5).

On November 30th the IMF released its decision on inclusion of the Yuan, also known as the Renminbi, in the basket of currencies that underwrite the SDR (Special Drawing Rights). The currency fell ahead of the announcement as its lack of convertibility could affect the final weighting it has on the SDR. The IMF statement was as follows: “The Executive Board of the International Monetary Fund (IMF) today completed the regular five-yearly review of the basket of currencies that make up the Special Drawing Right (SDR). A key focus of the Board review was whether the Chinese renminbi (RMB) met the existing criteria to be included in the basket. The Board today decided that the RMB met all existing criteria and, effective October 1, 2016 the RMB is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency, along with the U.S. dollar, the euro, the Japanese yen and the British pound. Launching the new SDR basket on October 1, 2016 will provide sufficient lead time for the Fund, its members and other SDR users to adjust to these changes.

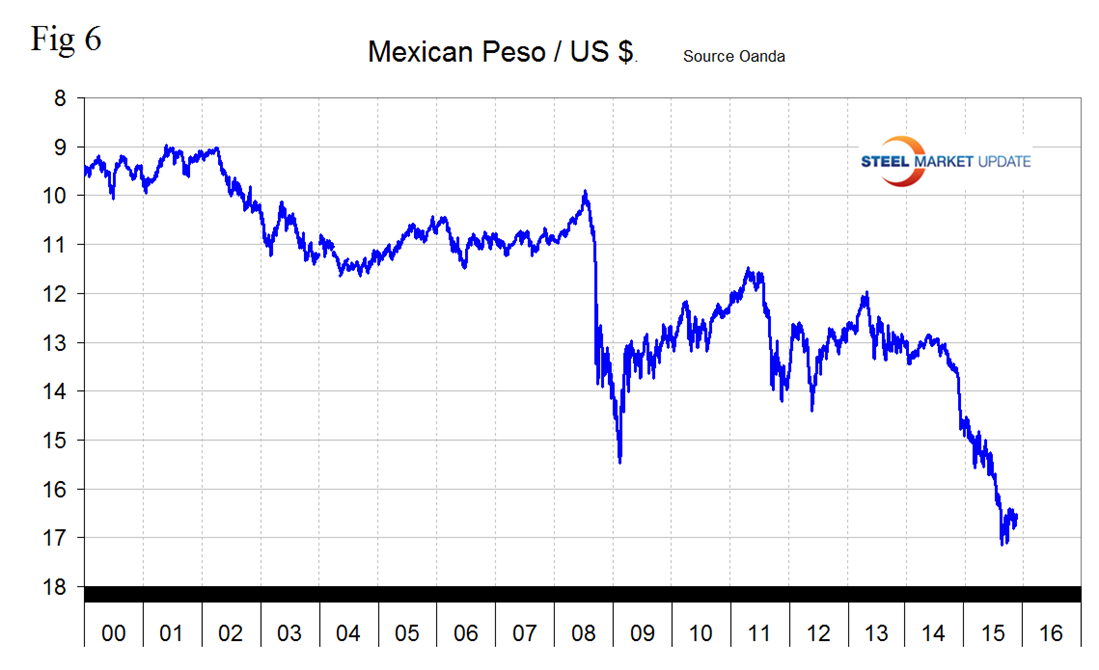

The Mexican Peso has depreciated by 17.4 percent in the last year and by 0.5 percent in the last 7 days (Figure 6).

On November 29th its exchange rate was 16.620 pesos to one dollar. On November 24th the IMF reported, “Mexico’s economy has shown resilience over the last year in a complex external environment characterized by falling commodity prices and heightened global financial market volatility. Moderate growth continues, inflation is close to target, and the external current account deficit is contained. Despite the increased volatility, foreign exchange and sovereign debt markets have continued to function well. This resilience reflects Mexico’s track record of prudent macroeconomic policies in the context of a strong policy framework. Looking ahead, the authorities have reaffirmed their commitment to proceed with fiscal consolidation to lower the public debt-to-GDP ratio, and to rebuild foreign exchange reserves. The implementation of a broad range of structural reforms is expected to raise medium-term growth.”

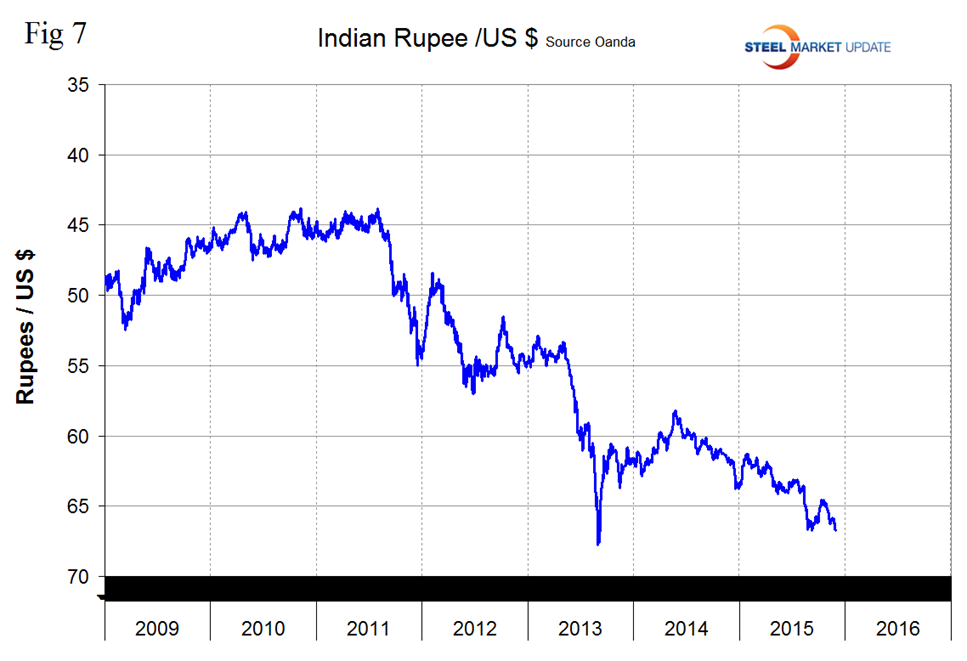

The Indian Rupee stands at 66.73 to the dollar and has depreciated by 7.6 percent in 12 months and by 1.3 percent in 7 days (Figure 7).

Explanation of Data Sources: The Broad Index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US dollar against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US dollar are traded every day on foreign exchange markets.