Prices

November 24, 2015

Hot Rolled Futures: Bottom of the Barrel?

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets

The S+P 500 remains strong despite world economic headwinds. We are last 2088 zone on the Dec future. We are on our way back up to test the highs, and look likely to have a chance to set new highs. However, the chart has posted a couple of lower highs in this last rally and it’s also possible the market may be starting to put in a top. We all know that the stock market is inextricably linked to what the Fed does on interest rates and if we start seeing tightening in earnest the stock market will start to become more volatile as it forms a potential top. In the meantime however, there are no other viable risk returns that compare and so in the meantime the stock market is still the investment of choice.

Copper and Crude remain depressed as do most commodities. We are last $2.06/lb. zone in the Dec. future after setting a new recent low of $2.00 yesterday. We probably rebound off this psychological level, but almost certainly will try to test it again at least once before any earnest rebound can commence. In crude we are at that $43/bbl level just above the $40/bbl psychological level, which tested about a week back. We looked like we were headed to retest it here any day and today all of a sudden we rallied. Same story as Copper, an important level we probably need to hold to avoid considerably lower levels.

Steel

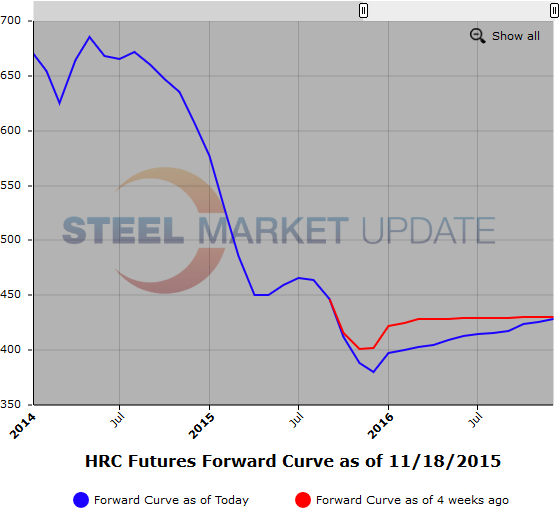

We have had a busy last 7 days in HRC. Interests in the futures have shifted further out the forward curve into Cal’17. In the last week 61,300ST of HRC has traded, 40,800ST of the total represented new open interest. In Cal’17 new open interest increased by 29,300ST. The trades in Cal’17 generated an increase in inquiries for Cal’17.

Selling interest pressure on the near end of the futures curve has pushed Q1’16 from $400/ST[$20cwt] to $396/ST[$19.80cwt]. The curve has shifted lower with HRC Q4’16 value dropping about $3/ST to $421/ST [$21.05cwt]. We have seen a bit of position adjusting as market shorts rolled some of their positions further out the forward curve.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

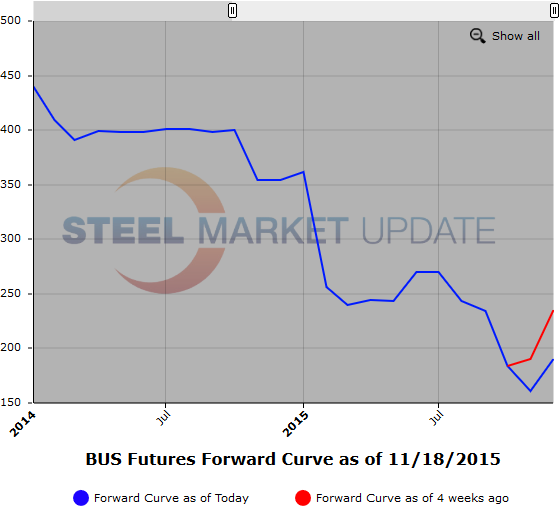

Scrap

Continued talk of weak mill demand for scrap in the Midwest leaves prices for Midwest Busheling sideways to down. Early indications suggest maybe off $10. Concern resurfacing as last East Coast shipments of scrap to Turkey traded at $195/MT which is a $5 drop from recent shipments. Also talk of slumping demand from Turkey following recent surge could impact future pricing. Current BUS interests we have seen are Dec’15 offered @ $190/GT, Jan’16 offered @ $210/GT and 1H’16 offered @ $225/GT. Inquiries for CAL’16 are also on the rise.

Iron Ore

Iron Ore continues to be depressed with overcapacity in Ore and a continuing reduction in steel production in China and the World over. We had a blip small rally the other day but we gave all that back and then some. The trend here is definitely down. The index is last $43.40/MT down almost 2% overnight and the forward curve is almost tracking it downward. The forwards remain backwardated and the most recent curve puts Dec15 at $42.50 and Q1 the last period slightly above $40/MT. Q2 is either side of $38.50/MT, Q3 is either side of $37.50/MT and Q4 is either side of $36.50. Cal16 is on either side of $38.25 with Cal17 and Cal18 Bid as low as $36/MT.

Another graphic is below, to use it’s interactive features you must visit this page on our website.