Market Segment

November 17, 2015

Canadian Distributor Flat Rolled Inventories

Written by Brett Linton

Canadian shipments for all steel products in the month of October were 422,400 net tons, a decrease of 6.5 percent from the month before and decrease of 18.3 percent from October 2014. Inventories at the end of the month stood at 1,355,300 tons, down 7.3 percent from last month and down 12.3 percent from the same month one year ago. The daily average receipt rate for October was 15,033 tons per day (21 day month), down from 17,281 tons per day the month before (21 day month). Total October receipts were 47,200 tons lower than the September figure. According to the MSCI, total months on hand stood at 3.4 months on a seasonally adjust basis or 3.2 months unadjusted.

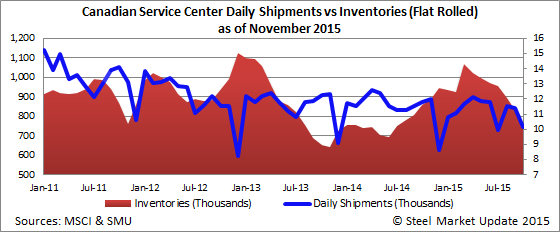

Flat Rolled

Canadian shipments of flat rolled products for the month of October were 213,500 tons, a decrease of 10.6 percent from the month before and a decrease of 17.6 percent from the same month one year ago. Inventories at the end of the month were 738,200 tons, down 11.4 percent from last month and down 14.1 percent from the same month one year ago. The daily receipt rate for October was 5,624 tons per day, down significantly from 8,533 tons per day the month before. Total tonnage received was 118,100 tons, down from 179,200 tons the month before. Flat rolled inventories stood at 3.6 months on a seasonally adjust basis or 3.5 months on an unadjusted basis at the end of October.

Plate

Canadian shipments for plate products in the month of October were 73,700 tons, an increase of 6.0 percent from the month before but a decrease of 20.8 percent from October 2014. Inventories at the end of the month were 202,000 tons, a decrease of 7.0 percent from last month and a decrease of 24.8 percent from the same month one year ago. The daily average receipt rate for October was 2,790 tons per day, down from 2,881 tons per day the month before. Plate inventories ended the month at 2.9 months on a seasonally adjust basis or 2.7 months unadjusted.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of October were 47,400 tons, a decrease of 6.0 percent from the month before and a decrease of 20.8 percent from the same month last year. Inventories at the end of the month were 134,700 tons, up 3.2 percent from last month but down 2.1 percent from the same month one year ago. The daily average receipt rate for October was 2,457 tons per day, up from 2,195 tons per day the month before. Total months on hand for pipe and tube inventories stood at 3.0 months on a seasonally adjust basis or 2.8 months on an unadjusted basis.