Prices

November 10, 2015

First Look at November Import Licenses

Written by John Packard

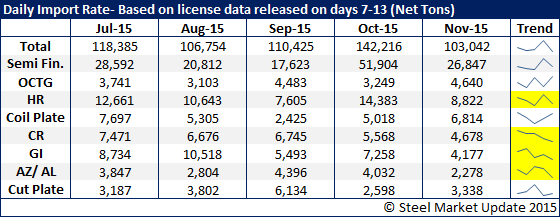

The U.S. Department of Commerce released import license data this afternoon. Steel Market Update reviews the data and compares it against previous months’ data at the same point in time during the month. What we are concentrating on are the four flat rolled items involved in the ongoing trade cases (AD/CVD).

We are seeing a downward trend in cold rolled which has been slowing over the past few months. Galvanized (which just had preliminary determination and critical circumstances announcements) is also seeing license requests slowing. When looking at hot rolled, license requests have tapered off so far this month after surging last month. It is too early to call the lower numbers as the beginning of a longer term trend but, that is the expectation as CVD and AD announcements (along with critical circumstances) are coming for HR over the next couple of months.

Other metallic (most being Galvalume) import licenses drop off dramatically as you can see in the table below. As with HR, it is too early to call this a trend and it may just be normal seasonal factors that take imports of Galvalume lower toward the end of the year.

It is too early to try to forecast what total imports will be for the month of November. It is anticipated November imports will be much lower than what we saw in October where we got a surprise spurt in imports. We will have a much better feel for the November trend by next Tuesday.

If you wish to explore this data in more detail, visit the Imports History page on the Steel Market Update website here. If you have any questions you may reach us at info@SteelMarketUpdate.com or at (800) 432 3475.